Roadbuilding Odyssey

How a Greek Motorway Program Survived Upheavals

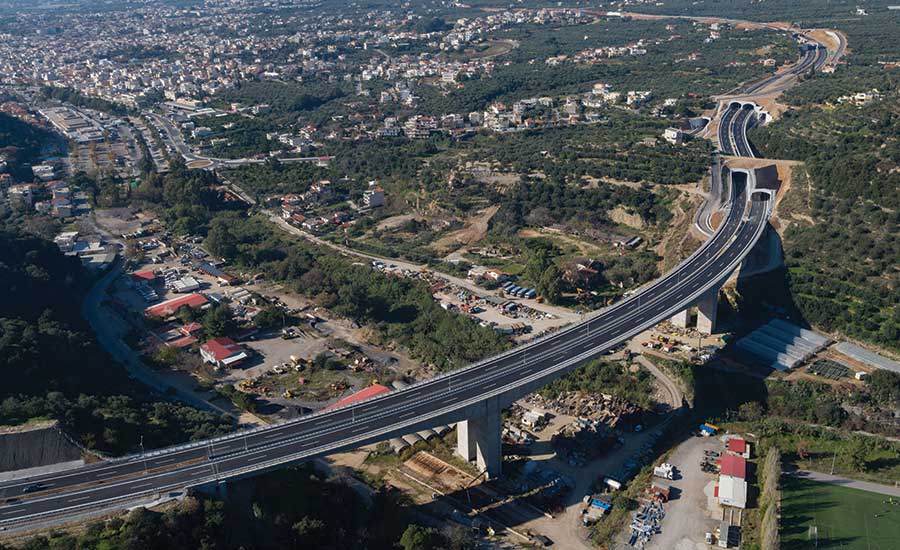

The $1.4-billion Olympia Odos motorway project is one of five that crisscross Greece.

PHOTO COURTESY OF OLYMPIA ODOS

Second-Generation Concessionaires Shape New National System

ORIGINAL GREECE MAP COURTESY OF ISTOCKPHOTO.COM

Aegean tunnels have advanced-warning detection systems that can divert traffic and identify potential violators.

PHOTO COURTESY OF AEGEAN MOTORWAY

For all five projects, including Olympia Odos, rights-of-way acquisitions took far longer than expected.

PHOTO COURTESY OF OLYMPIA ODOS

Toll stations, as on the Moreas motorway, are new and modern, but the near-term revenue remains to be seen in light of the ongoing economic troubles.

PHOTO COURTESY OF MOREAS MOTORWAY

Passing near Mt. Olympus and through the Tempe Valley, the Aegean project faced complex conditions and a fatal landslide.

PHOTO COURTESY OF AEGEAN MOTORWAY

The Moreas roadway was built by an all-Greek team that kept construction going even during the crises.

PHOTO COURTESY OF MOREAS MOTORWAY

In the classic Greek saga by Homer, Odysseus spends 10 years fighting the Trojan War and takes 10 more to get home. Facing a relentless stream of obstacles both human and fantastic, he succeeds in the end against seemingly impossible odds.

Odysseus could be the inspiration for the new, comprehensive national motorway system that, after two decades of overcoming a seemingly Sisyphean cycle of economic and social upheavals, is finally wrapping up.

In the mid-1990s, the Greek government began planning a mission to build more than 1,300 kilometers of new roads to link key destinations throughout the country, providing an alternative to the old national highway and serving as a key piece of the European Union highway network. The original $10.8-billion program included $3 billion from private investors and $7.8 billion split between Greece and the EU, says Yannis Karnesis, director of design and construction with the Greek Ministry of Public Works.

Initial projects completed included the 63.4-km airport-Athens link (ENR 8/16/99 p. 36); the 680-km northern motorway, delivered by state-owned Egnatia Odos (ENR 1/22/01 p. 36); and the signature Rion-Antirion Bridge (ENR 1/01/01, p.30). Those projects are considered the “first generation” of public-private road concessions in Greece.

In the 2006-08 second generation, another five concessionaires signed a total of about $10 billion in 30-year agreements with the government to build the rest of the new network.

Olympia Odos is building new and improved sections of the 365-km Athens-Patras-Tsakona route to the Peloponnese (see sidebar, p. 28).

The Aegean Motorway consortium upgraded the 210-km highway between Kleidi and Maliakos Bay, plus 30 km of new construction near Mt. Olympus. Hochtief leads the consortium with 35%, while Vinci has 13.4% and Greek firms own the balance.

The Nea Odos project involves Spanish firms Cintra and ACS Group building a new 196-km, Antirio-to-Ioannina section, plus upgrading 172 km from Athens to Maliakos.

Related Articles

Traffic Management Where Old Greek Road Met the New

Greek Motorway: A Mountain Full of Faults and Limestone

The Central Motorway project covers a new 174-km link between the existing Athens-Thessaloniki motorway, near Lamia, and Egnatia Odos, the long east-west highway crossing northern Greece. The project company includes Spain’s Ferrovial and Cintra and Greece’s GEK Terna.

Moreas S.A., a group of Greek companies that includes Aktor Concessions, built and is operating a 205-km motorway to connect Corinth and Kalamata.

But then came the global economic crisis. It drastically reduced existing and projected toll revenues.

Public sentiment was turning against paying tolls at all. A year later, Greece plunged into its own depression. The compilation of events threatened to stop all projects in their tracks.

A lenders’ meeting was scheduled for Dec. 3, 2010, recalls George Leventis, managing director of Langan International, the technical adviser to Olympia Odos. “Two days before, I had told the secretary general that we’re going to have problems.”

Sure enough, the lenders turned off the flow of cash, grinding work to a halt in 2011—with the exception of the Moreas project, says Marilena Nitsopoulou, CFO at Moreas SA, the project’s concessionaire.

Speaking of the factors that allowed the job to advance, she notes that Moreas was a relatively smaller project well underway and run completely by Greek firms, which were individually invested in continuing work. “We were one entity, speaking one language,” she says.

Two years of negotiations modified each project’s scope of work and deadlines. The changes included reduced bank loans and claim compensations, a government agreement to cede expected toll revenues and cover inflation for extended deadlines, and increased EU contributions.

“We kept it going.”

– George Leventis, Managing Director of Langan International, on Collaboration to Keep Roadwork Moving During Crisis

Work resumed, but it was still rough going because of austerity measures, national riots, constantly changing government leaders in eight elections and uneasy lenders. But the group of consortia, overlapping in major players such as Vinci, Hochtief and GEK Terna, “collaborated to keep enough money trickling in” to continue construction, recalls Leventis. “What should have been about $30 million per month in work was about $3 million. But we kept it going.”

Then, in 2015, the government changed hands, causing almost a year’s hiatus. The EU agreed that the overall 2015 program completion would push back to spring 2017, with exemptions for a few sections to summer. “In the event these deadlines were not met, we would be fined by the EU to the tune of $5 billion,” says Georgios Dedes, Greece general secretary.

But the periodic stoppages had a silver lining in that they gave the state time to address the substantial issues of archeological finds and rights-of-way acquisitions, Dedes adds. Ministers agreed to an “express” ROW process, used before for the Olympics, and adjusted laws to streamline both that and the archeological process by giving the state, rather than local authorities, responsibility for handling significant findings, he says.

Mountainous Moreas

The Moreas project, completed in December, is a poster child for the archeology and ROW challenges. A total of 37 out of 120 km in greenfield construction had archaeological potential and required 430 km of investigation trenches (the concessionaire had anticipated building only 250 km of trench). Artifacts were found just two weeks before the March 2017 contract deadline.

ROW acquisitions cost $160 million and included 2.4 million sq m of private property. The road between Tripoli and Kalamata, an emerging tourist destination, “had been a nightmare,” says Vegiri Vily, operations and maintenance manager for Moreas. The upgrades reduced a 2.2-hour travel time to under an hour and improves safety, especially along the mountainous winding roads between Tripoli and Sparta, he adds.

“We were one entity, speaking one language.”

– Marilena Nitsopoulou, Moreas CFO, Regarding the Moreas Team

Construction on 24 interchanges, 5 km of tunnels, 251 bridges and six mainline toll plazas took place through mountain ranges as high as 785 meters, allowing for design speeds of 130 km an hour, with two lanes in each direction and a median barrier. The Tsakona Bridge, the longest at 390 m, is a steel-arch bridge designed to avoid landslide conditions.

Vily says Moreas was the first of the concessionaires to complete new tunnels that adhere to the heightened, 2004-established EU safety standards, including ventilation shafts that draw smoke into containment areas and an increased number of evacuation portals. As with all the projects, Moreas included a state-of-the-art maintenance-and-operations facility, traffic management center, rigorous road maintenance procedures and inspections, and dedicated first-responder facilities.

Road maintenance during the 30-year concession will be tougher in the Pelopponese due to its more extreme weather conditions, which will require greater use of salt in the winter, Vily adds. “Tripoli has a 650-meter elevation. We will be monitoring the pavement” in collaboration with Greek university students, he says.

Aegean Ambition

Traveling along the country’s eastern border, the Aegean Motorway includes 205 km of existing motorway and 25 km of the one-lane national road that only recently was converted to motorway standards, says Dimitri Gatsonis, CEO for the project’s concessionaire, led by Hochtief and Aktor, with Vinci, J&P-Abae, Aegek and Athena Technical.

The approximately $1-billion project also includes 25 km of new motorway, extending north to Mt. Olympus. Already affected by the same economic and political factors as the other projects—for example, ROW acquisition took eight years instead of one—the Aegean Motorway team faced an almost mythical array of negative events, especially the tragedy of its technical director being killed in a 2009 rockslide in the Tempe Valley during inspection of the cliff after a small rockfall the day before. The section was shut down for five months.

In 2011, EU specs for the guardrail changed, forcing the construction team to start all over again with installation. Additionally, the local governor announced an increase in the fuel tax, and traffic dropped by 50%, Gatsonis adds. Between 2011 and 2013, construction ceased. “It took three years, and finally a new governor brought in advisers to restructure our deal,” he says. Moreover, for a few months the concessionaire lost revenue due to a movement of citizens refusing to pay tolls. “There was a 35% loss in revenue,” he adds.

Poor-quality earth also caused a collapse during construction of the Platamonas tunnel. The project delay induced design changes to the bridges and interchanges, including going to prefabrication.

“It would have cost more not to continue.”

– Dimistri Gatsonis, Aegean Motorway CEO

The alignment runs very close to a railroad, and it took the team two years to negotiate with the railway company to relocate the rail utilities and alter the design to avoid a big gas pipeline.

But the project boasts several firsts for Greek road construction, the team says. For example, tunnel-washing outflows are routed to a processing facility, consisting of sedimentation units and filters that sanitize and recycle the water. Noting another first for Greece, the concessionaire says deflectometers were used to measure pavement conditions during the 30-year maintenance period. And the use of an array of tunnel-safety cameras, called AVID, is one of a few in the world, claims Gatsonis. (The system sends out alarms if it detects something unusual, diverts traffic to the old national road if needed, and uses a PA system to identify potential toll violators.)

Gatsonis tries to find the silver lining in the procession of delays, including time for one meter’s worth of soil settlement, installation of a pilot project replacing 10,000 old road lights with LED lights, and time to handle ROW and archeological issues. “It would have cost more not to continue” with the concession, he says.

On a macroeconomic level, the first- and second-generation concessionaires formed Hellestron in late 2014 to facilitate interoperability and knowledge-sharing among all entities; represent the country in international forums and closely follow the fundamental changes that the road transportation industry is facing, says Bill Halkias, Hellastron president.

Dedes says these experiences will improve the third generation of concessionaire projects, including an underwater Piraeus-Salomina link, a new Crete motorway and a new metro line. Considering the ups and downs of the most recent program, Dedes says, “This was a crash test.”