It looks like things couldn’t be better for the Top 200 Environmental Firms, based on 2023 list financials and commentary. Total revenue accelerated last year to a new peak, as did optimism about boosted funds to support environmental and climate priorities, with owners and governments moving faster to address immediate and longer-term challenges.

But economic and execution headwinds still loom for firms seeking to turn projects, even if well-intentioned and fully capitalized, into doable and profitable realities.

Carlson Environmental Consultants revenue is up by 40% so far this year, says Kristofer L. Carlson, president of the solid waste and renewable energy specialist. “But market instability and high prices and wages make it hard to predict profit," he says, noting efforts "to ensure we are targeting the most critical work in the most efficient ways we can.”

Related Links:

ENR 2023 Top 200 Environmental Firms Rankings

ENR 2023 Top 200 Environmental Firms (PDF)

*Requires Subscription

Pushed by the enactment last year of the $369-billion Inflation Reduction Act and further market penetration of funding from the year-earlier infrastructure investment law—as well as added U.S. private sector commitment to energy transition and climate sustainability and similar global actions—total Top 200-criteria revenue reached $138.9 billion in 2022, with the non-U.S. component climbing again, to $65.6 billion.

“The economics of climate change and energy transition are creating significant opportunities,” says Kurt Beil, Americas environment market leader for Australia-based design firm GHD. “As markets influence the decarbonization agenda and the insurance industry rethinks its model to support areas that are prone to climate risk, [we] must respond with solutions that rise to these significant global challenges.”

Consultant RJN Group Inc.“is focused almost entirely on the environmental services market and 2022 was a strong year,” says CEO Paul Costa. Despite the firm's move up the list, he says “the largest challenges continue to be a very competitive labor market and a very small available talent pool.”

‘Volume Dynamics’

France-based Veolia Group widened its list dominance, reporting $45.2 billion in revenue from global water and waste sector work that includes gains from its purchase last year of most of water management rival Suez Environment. Veolia revenue “grew by 50% in 2022, driven by good volume dynamics, low sensitivity to economic conditions and effective implementation” of synergies from Suez, says CEO Estelle Brachlianoff. She says the integration added $10 billion to the firm’s global revenue.

Growth by acquisition also worked for consultant Tetra Tech, the winner last year in a bidding shootout with WSP Global to buy formerly Top 200-ranked U.K. consultant RPS Group. The perseverance helped boost Tetra Tech revenue to $4.2 billion on the 2023 list, from $3.3 billion last year. That strategy was easier for WSP Global in its $1.9-billion purchase of the environmental unit of energy consultant Wood Group, without competing buyers and completed in December. The new parent moved up to No. 6 on the Top 200 this year.

AECOM retains its number two spot on the list with reported environmental services revenue making up 66% of its 2022 gross total. “We’ve had solid growth in environmental consulting across all client sectors,” says Frank Sweet, head of its global environmental business. “For example, by carbon modeling transportation projects, we could take carbon out of a bridge design. This is a period of unprecedented growth. Last time I saw growth like this was after Superfund passed.” The federal toxic waste cleanup program law took effect in 1980.

Top 200 Newcomer | By Mary B. Powers

Solar is SOLV Energy Bright Spot

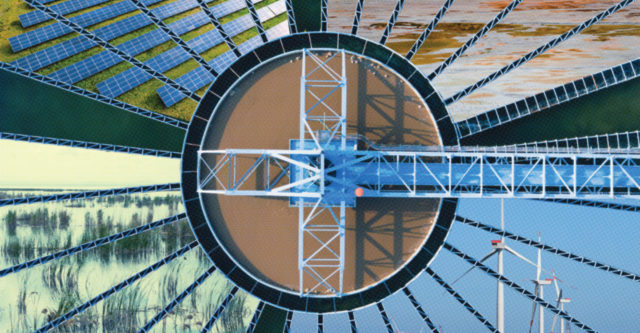

Photo courtesy of SOLV Energy

SOLV Energy, which began as the renewable energy unit of California contractor Swinerton, is this year’s highest-ranking Top 200 newcomer at No. 12 and has grown to become the largest U.S. builder of utility-scale solar power projects. It became a standalone firm in a 2021 merger with SOLV Inc. to form a full service design, construction, operations and maintenance provider.

San Diego-based SOLV Energy is extending beyond its traditional southwest focus. “We’re starting to see much more work in the Midwest,” says CEO George Hershman, the former Swinerton unit president who also chairs trade group Solar Energy Industries Association. The region makes up about 30% of the U.S. solar market despite more weather condition risks that builders are learning to control. “We believe in those markets and want to operate successfully,” Hershman says.

Most projects are 200 MW to 500 MW, but demand and new federal tax incentives have pushed some above 1 GW, he says. Developers also are adding energy storage. SOLV Energy now is building the first 400-MW phase of a 1.3-GW solar project in northwest Indiana (above) but also offers consulting for building smaller projects, a niche that it says is 22% of its business. Hershman sees federal credits and the energy transition propelling both short- and long-term growth. For more customers, “climate does matter,” he says.

But with most U.S. solar project components imported from Asia, deliveries can be uncertain and there is still confusion over domestic content for a project to qualify for federal tax credits. While tariffs on some Asian imports are waived until June 2024, the waivers will not be extended past that date.

U.S. solar manufacturing is growing but it is “not there yet,” Hershman says. “It’s our hope and the industry’s hope that it will be there in a few years,” he adds.

Rising Tides

AECOM also is among listed firms reporting more work in air quality and clean energy niches—boosting that segment revenue to $24.2 billion, or 17.4% of the 2023 Top 200 total—from $18.3 billion, or 16.3% last year. SCS Engineers CEO James J. Walsh says its renewable natural gas engineer-procure-construct projects “grew substantially” in 2022.

“The challenge of energy transition creates an interesting opportunity,” says GHD’s Beil. “Whether [environmental firms] do front-end planning and assessment or remediation of transitioning assets, they will play a critical role in the transition.”

For Sundt Construction, which rose 11 places on this year’s list, environmental project revenue “grew as a result of the high demand for responsible water use and reuse as well as the push and initiatives for clean energy sources,” says G. Michael Hoover, its CEO. Opportunities for firm services in those areas “will increase significantly in 2024,” he says.

Frank Renda, CEO of water infrastructure contractor Southland Holdings, which launched a company growth strategy last year by going public on the Nasdaq stock exchange, says, “Demand for environmental design, engineering and construction is at a record high, and we do not see a change in this for the foreseeable future.” For Michael Baker International, “larger capital projects that had been delayed pending funding are moving forward along with the environmental services they require, including permitting, studies and review,” says CEO Brian Lutes. “While still limited, we see this as an area of growing interest” to investors.

Woodard & Curran CEO Alyson Watson also notes movement of projects “previously on the back burner,” as well as “significant growth in our contract operations business, as both public and private-sector clients continue to be plagued by difficulties finding staff and meeting regulations.” She sees “all of this continuing over the next 12 months.”

Even as Top 200 firms watch market trends, opportunities and risks ahead, this year’s ten highest ranking companies all managed to clear $2 billion in environmental services revenue for the first time. In addition, the number of participants reporting revenue of $1 billion or more now extends to the top 25, up from 20 last year. Burns & McDonnell, which reports $1.9 billion in 2022 Top 200 revenue that elevates it to No. 11 from No. 21 last year, points to design and construction growth in both its renewables and remediation niches.

Top 200 Firm in Focus | By Mary B. Powers

Phillips & Jordan Goes With Flows

Photo: Phillips & Jordan

Water supply projects have been part of the Phillips & Jordan (No. 79) portfolio since its founding in the early 1950s, but growing needs drove its revenue and backlog up last year, says Gerry Arvidson, president of the contractor’s civil division. “We had a strong growth objective in water in the Southeast and have been able to capitalize on our strategy,” he says.

P&J has six active restoration projects in the Florida Everglades and is completing phase one of the state C-51 reservoir project (above), an alternative south Florida water supply project designed to capture excess stormwater that will replenish aquifers—allowing withdrawal of 35 million gallons per day by eight municipal water utilities.

Phase one, which includes engineered levees and concrete spillways, will provide 14,000 acre-ft of storage that also could combat saltwater intrusion. Phase two, which is set to provide 46,000 acre-ft more storage capacity, gained a $65-million state budget boost last year. “We’ve been adding reservoirs in the area since 2004,” Arvidson says.

The firm had an $80-million Everglades canal project win blocked by a federal judge last year in a losing bidder’s protest against its U.S. Army Corps of Engineers evaluation. Arvidson did not elaborate but said “the issue was ultimately resolved and we began work again in late 2022.” P&J also is building water treatment plants for reshored energy transition manufacturing facilities—such as Ford Motor’s Blue Oval City electric vehicle and battery campus in Tennessee.

With 20 years of disaster response experience—including restoration work after the 2010 BP oil platform collapse spill, and after Hurricanes Katrina, Rita and Andrew—P&J is pursuing coastal resilience projects in Texas and Louisiana and working with southeast utilities such as Southern Co. to close ash impoundments at retired coal-fired power plants.

Arvidson sees more work as a result of weather pattern changes. “We’ve been upgrading spillways and dams to withstand a maximum probability flood,” he says.

Legacy Cleanup

Expanded efforts by the Biden administration to remediate legacy Superfund waste sites under the new infrastructure law, and stronger federal and state funding and cleanup mandates for emerging contaminants such as PFAS chemicals are among catalysts that maintained hazardous waste work as the Top 200’s largest revenue category, at 24.7% of the total, with more work expected ahead.

Remediation contractor ECC saw funding to address PFAS contamination at some 100 Superfund sites contribute to a 20% rise in 2022 environmental services revenue, says CEO Manjiv Vohra, “and we expect even higher gains in 2023 through 2025,” fueled by nearly $1 billion in second-round cleanup funding. “This is leading to a massive amount of investigation on new sites and reopening closed sites, [with] groundwater and soil remediation over the next decade,” he says. Cascade Environmental “booked more than $3.3 million of PFAS-related work this year and expects the trend to continue,” says CEO Ron Thalacker. “But it requires creativity and innovation to remain competitive as the market becomes more cost-conscious.”

Waste management giant Clean Harbors Inc., the fourth-ranked Top 200 company, has “multiple PFAS treatment systems now across the country for the U.S. Navy and private clients,” says Senior Vice President Paul Bratti. “It’s a growing market, but there is still a lot of hesitation because it is not regulated yet. We focus on industrial water but can treat drinking water as well to non-detectable levels.” Clean Harbors announced last year results of a comprehensive third-party study that said its commercial facilities can safely and thoroughly destroy PFAS in multiple forms, he adds.

While many municipal drinking water systems have completed or started treatment-related construction, the scope of the PFAS problem in the U.S. remains huge. Just-announced multibillion-dollar utility settlements with 3M, DuPont and other chemicals producers will boost treatment design and execution, with concentrated work over the next four to five years, says AECOM’s Sweet. Noting that developing effort and overall water-wastewater infrastructure needs, “our revenue should increase significantly in the next 12 months,” says Tim Smith, CEO of sector contractor Wharton Smith.

Consultant Garver’s water and wastewater practice finished 2022 up 33.2% in revenue over 2021, with growth set to continue, says CEO Brock Hoskins, citing PFAS work, more collaborative project delivery and new environmental services in other infrastructure areas.

Stretched

Even with inflation impacts easing somewhat, market economics are far from perfect. In its real estate environmental due diligence business, NV5 Global Inc. “saw a sharp decrease in demand in the second half of 2022 due to rising interest rates impacting transactions,” says Chairman and CEO Dickerson Wright. While he hopes for a pickup later this year, others see market retraction continuing well into next year.

Even so, Partner Engineering & Science Inc. CEO Joe Derhake says rising concerns by real estate and other investors about climate resilience and ESG is driving more interest in its energy/sustainability practice. The firm also is opening new non-U.S. offices, with investors “eager for a consistent approach to engineering, environmental and energy consulting throughout their global footprints,” he says

New list entrant EIS Holdings reports 30% organic revenue growth last year in addition to acquisitions, says CEO Kory Mitchell. But “we saw margin compression due to inflationary pressures” in labor, materials and other areas, he adds. “In short, our pricing didn’t keep up with cost increases." That course corrected in late 2022 with better margins now, Mitchell says. Frank Mangin, Haskell president of design and consulting operations, says the firm managed project supply chain issues by manufacturing concrete and having “our own steel fabrication shop.”

“The highly divided U.S. political

landscape could slow agreement on environmental regulation and project permitting.”

Yde van Hijum,

CEO, Antea Group N.V

Last year “was our best year to date in revenue, but it could have been a lot better,” says Joe Godin, president of water-wastewater contractor American Contracting & Environmental Services, which rose six list spots. With inflation “wreaking havoc on many bid prices,” he says, project schedules were disrupted as owners had to seek more funding. “We have multiple jobs that have taken over a year to receive a contract award,” he says.

Justin Cumby, president of water sector contractor J. Cumby Construction Inc., says he sees “more opportunities when budgets are brought more in line,” but also increased defaults from subcontractors that “are already stretched too thin.” Andrew McCune, president and CEO of Wade Trim, says competition for staff “to meet this heightened level of industry demand is creating challenges to firm growth and timely delivery of work.”

Technology Solutions

Top 200 firms looked to technology to meet emerging needs. “Our focus on being an innovation leader had the most significant impact on our environmental services practice in 2022,” says Susan Taylor Martin, CEO of BSI America Professional Services Inc. Clean Harbors has long invested in developing its own software because of the firm’s unique waste tracking and emergency response work, founder Alan McKim said in an interview. Now transitioning to be chief technical officer after several decades as CEO, he sees new hazards in disposing lithium-ion batteries and solar panels.

Investments by remediation firm ATI Restoration LLC in advanced software and other technology, including ultraviolet germicidal irradiation, 3D scanning, thermal imaging and weather monitoring platforms “have positively impacted environmental services revenue,” says CEO David Carpenter. Kleinfelder CEO Louis Armstrong points to its proprietary FieldNet reporting and data management software in delivering results “that led to an increase in repeat sole-source business.”

“Investors are eager for a consistent approach to engineering, environment and energy consulting throughout their global footprints.”

Joe Derhake, CEO, Partner Eng. & Science Inc.

Langan’s ESG team “works closely with our digital solutions group to understand the technical and regulatory aspects of projects as well as software necessary to support them,” says CEO David Gockel. Jan Walstrom, Jacobs climate response and ESG senior vice president, says the firm is exploring “how machine learning and artificial intelligence will influence work in the environmental market.”

Looking forward, Top 200 firms are monitoring global legal, economic and political landscapes for signs of changing market directions.

VHB CEO Michael Carragher notes potential sector impact from the U.S. Supreme Court’s Sackett v. EPA decision in May that altered the definition of federally protected wetlands. The firm “is watching how states and municipalities respond,” he says. Antea Group CEO Yde Van Hijum fears the “highly divided U.S. political landscape could slow agreement on environmental regulation and project permitting.” He adds that issues abroad such as the inflation-challenged European Union’s “tepid growth” outlook and U.S sanctions on China that pose a threat to trade will “temper our U.S. clients’ willingness to invest [there.]”

Says PPM Consultants Principal Todd Perry: “It has been said that progress is impossible without change. However, with change comes challenges, especially in areas such as environmental management with rapid advancements in science, technology, and public opinion. Our firm continued to grow in 2022 by expanding our services and facing those challenges head on.”

—Data management assistance by Jon Keller and Jack McMackin

Post a comment to this article

Report Abusive Comment