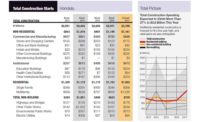

New construction starts in December improved 5% to a seasonally adjusted annual rate of $425.8 billion, according to McGraw-Hill Construction.

While nonresidential building and housing were essentially steady with the prior month, the nonbuilding construction sector (public works and electric utilities) strengthened in December, providing the lift to total construction. For the full year 2009, total construction starts plunged 26% to $411.6 billion, marking the third straight year of diminished contracting after declines of 7% in 2007 and 13% in 2008.

The December statistics produced a reading of 90 for the Dodge Index (2000=100), up from November�s 86. The Dodge Index for all of 2009 was 87, so December�s pace of construction starts came in slightly above the full year average.

�The construction industry went through a particularly tough year in 2009, as the 26% annual decline for construction starts was the steepest in at least the past forty years,� says Robert A. Murray, vice president of economic affairs for McGraw-Hill Construction. �At the same time, the bottom for construction starts was reached in February, to be followed by an up-and-down pattern during 2009 which suggests that the transition has been made from steady decline to at least low-level stability.

Single family housing, while still remaining at a very low volume, began to show some improvement as 2009 progressed. Funding from the federal stimulus bill helped to produce gains for highways and bridges, as well as a pickup for a few project types such as courthouses.

However, commercial building and multifamily housing registered particularly severe declines in 2009, and even the previously resilient institutional building sector lost momentum. Going into 2010, more improvement is expected for housing and public works, but commercial and institutional building will continue to be adversely affected by weak employment, tight bank lending, and the eroding fiscal health of states and localities.�

Nonresidential building in December was reported at $145.2 billion (annual rate), unchanged from the previous month, which reflected a mixed performance across the various structure types. On the commercial side, gains were registered by stores and warehouses, up 52% and 15% respectively, compared to very weak activity in November. This was countered by a 32% slide for hotels as well as a 15% drop for offices, which retreated even with groundbreaking for a $91 million office building in Washington DC. The manufacturing plant category in December jumped 143% from a depressed November. On the institutional side, healthcare facilities in December advanced 8%, lifted by groundbreaking for a $140 million hospital in New Mexico and a $135 million medical center in Ohio.

Amusement-related projects climbed 56% in December with groundbreaking for a $107 million casino in Pennsylvania and a $95 million indoor arena in Indiana. Reduced activity in December was reported for educational buildings, down 3%; transportation terminals, down 14%; and public buildings, down 60% from an elevated November.

For 2009 as a whole, nonresidential building dropped 33% to $162.4 billion. The commercial sector plunged 47%, much steeper than the 16% drop that took place in 2008. The retail categories were hard hit in 2009, with stores and shopping centers falling 42% while warehouse construction plummeted 62%.

An even larger decline was reported for hotels, down 66%, which included a sharply reduced amount of hotel/casino projects. The office building category in 2009 dropped 37%, less severe than the other commercial categories yet still a substantial downturn.

The office decline in 2009 was cushioned to some extent by the start of several large government-related projects, such as the $922 million U.S. Army headquarters complex in Alexandria VA and the $747 million renovation of the United Nations Secretariat Building in New York NY, as well as groundbreaking for several large data centers.

On the plus side, the public buildings category grew 10% in 2009, lifted by a large increase for courthouse projects, which in numerous cases were able to reach groundbreaking as a result of funding provided by the federal stimulus bill. Transportation terminal work in 2009 also advanced, rising 37%, with the boost coming from several large airport terminal projects in California and Nevada, as well as rail terminal work in New York.