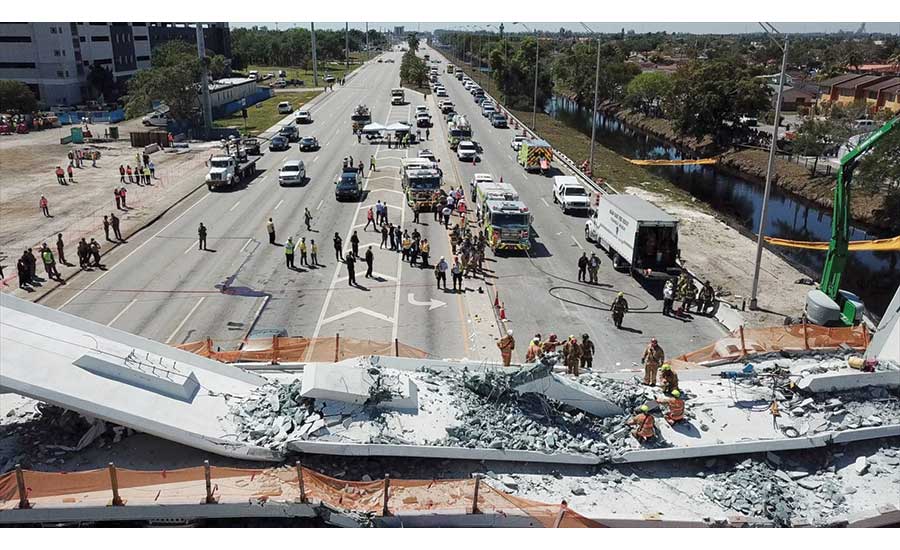

The prime contractor in last year’s Florida International University bridge collapse ran into financial trouble and piled up losses in the two years before the accident. The March 15, 2018, accident killed six motorists and has now sent Munilla Construction Management (MCM) into federal bankruptcy court in Miami to file for protection from its creditors. The company’s main surety, Travelers, has provided debtor-in-possession financing of about $17 million, according to court records.

The company was already under financial stress from unsuccessful attempts at geographic expansion and had operated at a loss since 2016.

While the company—now known as Magnum Construction Management—cites the bridge project’s catastrophic collapse in its March 1 filings to the U.S. Bankruptcy Court in Miami, the contractor was already under financial stress from unsuccessful attempts at geographic expansion and had operated at a loss since 2016.

The fallout from the bridge collapse is weighing heavy, though, according to the filings. The contractor reports it has been named as a defendant in 18 lawsuits relating to the tragedy. Further adding to its troubles is its de-certification by the Florida Dept. of Transportation, along with an estimated “$200 million in potential revenue from future projects,” the company claims.

“The culmination of these tragic events materially constrained MCM’s liquidity and its ability to generate revenue such that the company cannot meet its ongoing obligations,” the contractor states in its bankruptcy filings. At the same time, the company states that it is attempting to be responsible for its role in the accident.

The Chapter 11 filing “is not the end-result of a strategy, or an attempt, to avoid any responsibility that might be assigned to the debtor for the heartbreaking and tragic loss of life following the catastrophic collapse of the Florida International University Pedestrian Bridge,” the company states to the court.

MCM’s reorganization plan includes setting up a trust fund to cover all claims relating to the March 15 bridge collapse at FIU. According to its filings, MCM is negotiating with its insurers “to establish a settlement trust or fund” to resolve all related claims. The contractor estimates that “completely exhausting the policy limits and extinguishing each Insurer’s obligations under the insurance policies” would result in a fund totaling approximately $42 million. Last year, ENR reported that one personal injury attorney had estimated that based on past Florida settlements, the total for losses related to the six deaths and injuries sustained could be as high as $90 million.

The National Transportation Safety Board is still investigating the collapse, and MCM states that it is fully cooperating. Last November, in its most recent update on the investigation, the NTSB noted that a design review led by the Federal Highway Administration had determined that “errors were made in design” of the northernmost section of the bridge’s 174-foot-long span, where the collapse appears to have started.

Last September, the Occupational Safety and Health Administration cited MCM for two serious violations and proposed fines of $25,868. The violations involved improper use of lifelines, which resulted in a fall hazard for multiple employees.

Mistakes Piled Up

Financially, MCM was stressed in recent years, and last turned a profit in 2015—and just barely. That year, according to court documents, the firm earned a roughly $1.75-million profit on revenue of $221.2 million, for a less than 1 percent rate of return. Revenue grew in 2016 and 2017, to $265.1 million and $296.8 million, respectively, but not enough to cover expenses. In 2016, for instance, MCM’s filings state a $1.1-million loss, while losses piled up to more than $8 million for the following year.

Trouble with recent geographic expansions into Panama and Texas, both undertaken in 2010—amidst the Great Recession—would prove costly, delivering little work but plenty of frustration. In fact, the expansions mostly produced trouble, with the Panama operation ending up in a bankruptcy proceeding and MCM getting terminated from one of its few Texas contracts.

The Panama expansion required a significant investment up front, MCM reports, with increased compensation for the “expats” hired to lead the effort, along with housing and travel costs, all expected ahead of time. Less anticipated, or appreciated, were the pains of dealing with the Panamanian government’s delayed payment process, which required the contractor to “continuously capitalize the ongoing operations” by utilizing local banks in Panama to facilitate liquidity. Having not planned on these costs when it bid the Panama projects, MCM says “the profitability on all projects was reduced” and the MCM Global S.A. division “became liquidity constrained.” By late 2018, the unit was $22 million in the red.

As a result, “Global has discontinued substantially all of its operations and is currently the subject of an involuntary bankruptcy proceeding in the Republic of Panama,” according to the contractor’s bankruptcy filing.

The Texas expansion didn’t fare much better.

Around 2010, the Texas construction market appeared stronger than that of many other states, which were still struggling to recover from the historic economic downturn. MCM struggled greatly to land work, though, according to its bankruptcy documents.

“Unfortunately, much time, effort and resources were spent pursuing general construction work and not one project was landed,” according to the contractor. Here, a tight labor market in Texas added to the company’s expenses, as MCM had to increase compensation for key employees leading the expansion. The contractor says that these labor cost increases “were not originally anticipated.”

Making matters worse was the inexperience of the Texas leadership, which ended up requiring support from Florida. However, the company says: “Because of the problems in Panama and the resurgence in the Florida market, MCM did not have sufficient resources to provide the Texas market the attention it required."

One project win has ended up in a legal skirmish between MCM and the Texas DOT.

In 2017, the contractor started work on a $35-million contract to widen a two-lane road in Denton into a six-lane divided highway. However, a dispute erupted over the project’s underground utility work, and improvements requested by the city of Denton. The dispute failed to be resolved, and on Jan. 25, 2019, TxDOT terminated MCM. The contractor is fighting the termination, contending that the agency failed to communicate critical information about the project.