CH2M Hill's Formula for Success: Fly High but Stay Grounded

...and on time. “From a client standpoint, the contractor met its commitments,” says Jim Harlan, Eastman’s vice president of worldwide polymer operations. “We feel good about the plant we got and are doing additional business with the firm.”

London 2012 Managing London 2012 construction is a challenge, with cost in flux and schedule tight.

|

The broadened focus also has turned CH2M Hill into a market force in the federal arena, particularly nuclear waste services. The firm’s technical and financial success in expediting the $7-billion Rocky Flats cleanup in Colorado for the U.S. Energy Dept. was a key market catalyst (ENR 10/24/05 p. 10). “It was a watershed project that has to be on any list that defines the firm,” says Senior Vice President Robert G. Card, who developed CH2M Hill’s joint venture approach there and is a key executive running its newly awarded program management contract for the 2012 London Olympics.

Rocky Flats turned CH2M Hill into a major DOE player, rivaling stalwarts Bechtel Group, Fluor Corp. and Washington Group and leading to new work at DOE’s Hanford site in Washington state and at locations in Idaho and South Carolina. At Hanford, the firm beefed up early safety management problems to become “one of the best in the DOE complex,” says Shirley Olinger, acting manager of DOE’s Office of River Protection.

|

Nancy Tuor, an economist who managed Rocky Flats through closing, is now CH2M Hill’s vice chair and, more recently, took over the firm’s federal sector group, including its post-Hurricane Katrina relief and cleanup efforts last year. Group revenue rose last year by 20.7%. She is positioning the group to manage billions of dollars more in new work, including large management contracts at DOE’s Hanford, Savannah River and Oak Ridge sites. “We are looking at where the procurements are, what the competitive strategies need to be and where we can put the best teams together,” she says. “Do we have talent available?”

Kaiser-Hill LLC Rocky Flats cleanup, now complete, put CH2M Hill into nuclear waste remediation.

|

Even more challenging will be still-developing multibillion-dollar procurements for nuclear waste services in the U.K., and U.S. military redeployment construction in Korea and elsewhere. “Those kind of challenges are hard but personally rewarding,” Tuor says.

Integrators

Integrating a construction and EPC culture has fallen on new shoulders. Former Granite Construction executive Garry Higdem joined in 2005 as EPC group president and CEO. “They started the group before I arrived, but it didn’t have that ‘construction guy’ lead,” he says. “I interviewed the firm to make sure it was really serious about EPC.”

|

Higdem acknowledges the Eastman Chemical problems. “Was it a success for us? Absolutely not,” he says. “Was it a financial success for Eastman? Look at the stock price the day they announced the plant was ready. The best business development is always project delivery.”

Higdem emphasizes CH2M Hill’s engineering prowess as an asset to the growing construction culture. He now leads a corporate “center of excellence” for EPC that includes consulting capabilities and carrying best practices across all the firm’s business lines. “Opportunities far outweigh little speed bumps that get in the way of pushing the business,” says Higdem. “We have a good list of lessons learned.”

CH2M Hill CH2M Hill finished EPC work at Las Vegas powerplant last year, won another job nearby last month and sees big growth in energy markets.

|

Also adding management depth is Lee A. McIntire, a former Bechtel executive named president and COO a year ago. Recognizing CH2M Hill’s “depth of consulting talent” as a competitive advantage, he says, “I met with 4,000 people in a few months to let them know I was not here to change the culture. We have a true full-service company, and there aren’t many of them.” After spending his first year strengthening risk analysis and procurement processes, McIntire is turning to business development. “We’re quite good at sales, but we can be more efficient in this area,” he says.

Michael Goodman/ENR

|

|

"The depth of our consulting — that’s the difference.." — Lee A. McIntire,

President and COO |

CH2M Hill will need plenty of efficiency in managing the international market. The firm has a lead role in a program management joint venture for the estimated $6-billion 2012 London Olympics, a coveted prize won last year in a unique procurement approach. “We are particularly proud and pleased,” says Card. “The process was very good.” Executives are contractually bound to keep mum on the firm’s work, but press reports hint that a long-awaited cost proposal is imminent. The Games also are planned to be a model of environmental sustainability.

There is remaining work in Iraq and new opportunities on the $6-billion Panama Canal expansion, in Asia’s electronics industry and in pharmaceutical work in Ireland and Singapore, but with caveats, says McIntire. “The market is so big, and we’re constrained by people,” he says. Like other industry firms, it is boosting its profile to young people. Senior Vice President Bud Ahearn leads a new talent management effort. “We have to build a leadership culture,” he says. Continued investment in training is key.

|

"We have to build a leadership culture in this firm." — Bud Ahearn, Senior Vice President

|

As the pool of available U.S. engineering talent shrinks, “global sourcing” will be critical, Peterson says. “We have a supply-side component that demands interconnectivity of labor forces.”

A cornerstone of CH2M Hill’s draw is its employee stock ownership program. Once restricted to top managers, it was opened in 1999 to all employees directly and through 401k plans. Some 11,000 employees are now involved in stock ownership, with 6,454 listed as direct owners. “Having the providers of intellectual and human capital and the providers of financial capital the same is a competitive advantage in a services firm,” says Peterson. “They get to eat what they kill.”

| + click to enlarge |

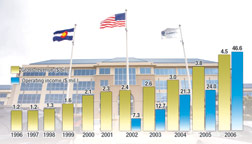

CH2M Hill’s self-designed corporate campus is LEED-rated and built for new ventures.

|

The stock program’s size subjects it to federal scrutiny and Sarbanes-Oxley compliance, but CH2M Hill wants to avoid preoccupation “with short-term financials,” says Peterson. “Our model allows us to take a longer view.” The firm plays down industry speculation that it may have to go public to finance future growth. “I don’t see the need based on the trajectory we’re on now,” Peterson says.

Having survived stomach cancer treatment last year, Peterson is ready to tackle what’s ahead. He expects to retire in three years but hints he might want to become a project manager. Rumors abound that McIntire is the heir apparent, but other top executives may not be out of the running. Peterson won’t speculate.

The still energetic chief prefers to plan for CH2M Hill’s decade ahead, noting challenges in project finance, energy “security” for clients and natural resource stewardship. “We will be a larger firm because there are big needs out there,” says Peterson. “The world needs our help to be sustainable, and we’re gonna get it done. ”