Inflation Reverses Course As Recession Floors Prices

Over the last six months, the deepening recession its accompanying credit crisis have dramatically changed the construction industry’s cost picture. Construction inflation has gone from the double-digit realm just last summer to between 2% and 6% this quarter. Ten of the 14 major industry cost indexes collected by ENR for this report posted declines during the first quarter, ranging from 0.5% to 8.4%.

The reversal of inflation was led by the price collapse in crude oil and steel. “Structural steel and rebar prices are about half of what they were at their peak last year,” says John Anton, steel analyst for IHS Global Insight, Washington, D.C. Prices already are approaching production costs and cannot fall much further, he says. “However, prices can’t rise much either because there is so much idle capacity,” Anton notes.

Most construction materials fit this model, with prices having been pushed to their lower limits, and economists say the prices are likely to remain there well into 2010. “Materials prices have already taken the major hit, and we expect further declines to be quite modest,” says Karl Almstead, a vice president with Turner Construction Co., New York City.

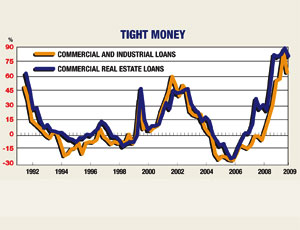

With materials prices bottoming out, the credit crunch is becoming the biggest cost headache for contractors. “Tight credit is affecting everyone from owners down to subs and material suppliers,” says Julian Anderson, president of construction cost-management firm Rider Levett Bucknall Ltd., Phoenix. “When financers pull the plug on a project it leaves a whole lot of unpaid people.”

Bonding also is an issue. “Bonding is also becoming a problem as bonding companies start evaluating a firm’s assets and business strength a lot differently than they use to,” says Anderson.

The potential for tightening bank credit is a serious concern for some subcontractors. Many say banks are more closely scrutinizing a sub’s financial condition and backlog, which could lead to tighter credit later this year.

“It’s definitely a concern,” says Chris Zaucha, vice president of Innovative Glazing Systems Inc., Lansdale, Pa., and a member of the executive committee of the Construction Financial Management Association, Princeton, N.J.

“Banks are asking for a lot more information,” says Anne Bigane Wilson, president of Bigane Paving Co., Chicago, and a former president of the American Subcontractors Association. Given that the economy will likely continue to deteriorate this summer, she says, “I think bank credit is going to be a big issue for subcontractors this year.”

Zaucha says banks typically review financial information annually when determining lines of credit, but many now are asking for interim financial statements, even on a quarterly basis. “They are particularly interested in backlogs and work-in-progress statements,” he says.

Another part of the equation is that many owners are delaying payments due to their own cash-flow problems. “Payment cycles have definitely slowed,” says Wilson. And suppliers are asking for payment on their materials faster. “It makes for a difficult situation—we’re getting squeezed on both ends,” Wilson says.

Fudging Definitions

With all parties trying to hold onto money as long as possible, the definition of monthly work put-in-place will become a larger source of dispute on jobsites, predicts Don Short, president of independent estimating consultant Tempest Co., Omaha. “An owner that is tight on money can fudge their definition of ‘work put-in-place,’ to their advantage,” he says. The subcontractor does not have a lot of control over that.”

That slowing of payments is why the potential for tightening credit is a major concern. “For subcontractors, credit is our lifeline,” says Wilson. “We end up acting as the bank on many projects. If banks constrict our credit, we’re in uncharted territory.”

“It’s been a double whammy in both directions for subcontractors,” says Don Gregory, general counsel for Alexandria, Va.-based American Subcontractors Association. “Banks are turning subcontractors away for financing, and payments are being delayed because owners cannot get financing either.” Gregory say the number of liens filed this year by subcontractors seeking overdue payments has increased dramatically throughout the industry. “Everyone is wringing their hands,” he adds.

Economists say the unavailability of credit is subcontractors’ most dire threat, dimming hopes that the federal stimulus and a reprieve in materials costs will soften the general economic blows. “There is welcomed downward pressure on costs for materials and wages,” says Ken Simonson, chief economist at Associated General Contractors, Arlington, Va. “But it’s a much tougher market with the lack of credit.”

“A line of credit is crucial, and ours is still in place, but the lending terms are changing and banks are being very strict about what they lend and who they lend to,” says David Bradbury, president of Alpharetta, Ga.-based Precision Concrete Inc., an approximately 400-employee subcontractor that has watched revenue slump by 30% in recent months. In the Southeast, where Precision does most of its work, “local and national banks are tightening credit more than the regional banks, which seem to be better off,” Bradbury says. “Banks are looking for minimal risk, and so credit is available but only to those who don’t need it.”

Hungry lenders are hunting for low-risk borrowers, Bradbury notes. “If you can demonstrate you are stable and have a good balance sheet, there is lending out there,” he adds. “We have actually had lenders coming to us.”

For Dutton, Mich.-based interiors subcontractor Soibe Co. Inc., a solid balance sheet and a several-decades-long history with its main lender was not enough to obtain financing for one of its current projects. “We needed $400,000 to start a project but could not get financing through our bank where we have been doing business since the 1950s,” says Jack Austhof, president of Soibe and president of ASA Michigan. Austhof says the bank balked because...

.png?height=200&t=1720641768&width=200)