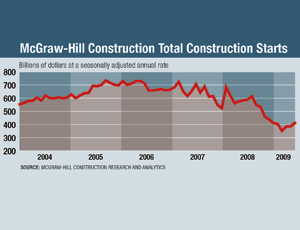

What a difference a year makes. In the second quarter of 2008, construction starts had moved slightly off the record-run rate of the previous three years. The economic bloodletting set off by the subprime meltdown did not really spill over into construction until the second half of the year.

Now, by any measurement in any place, we are in a deep recession. Unemployment tops 10% in many regions, with construction joblessness pushing California’s overall rate to 11.2%— the highest level ever recorded. Construction starts in the nonbuilding sector were off 19% for April, according to McGraw-Hill Construction Research & Analytics, like ENR a unit of The McGraw-Hill Cos.

As the first public-works projects begin to flow through the American Recovery and Reinvestment Act (ARRA) pipeline, bidding is fierce. Gone are the days when contractors, content with fat margins and burgeoning backlogs, decided to chase only the most profitable jobs and those they were most likely to win.

These days, no job is too small, no margin is too thin. The St. George Airport terminal replacement project in Washington County, Utah, drew more than 50 general contractors, says Owen Olsen, the Associated General Contractors’ district manager for southern Utah. “It’s crazy,” he says.

Fire stations have been generating fire-sale environments: a project in Utah drew 30 competitors. In Arizona, the apparent winner submitted a $2.2-million bid for a fire-station job; a similar project two years ago went for $3.8 million, says Mark Minter, executive director of the Arizona Builders’ Alliance.

The number of bidders for school projects in Los Angeles has nearly doubled, from an average of 5.4 bidders two years ago to 9.6 in the current fiscal year. Colorado’s Dept. of Transportation reports the number of bidders in June is up 38% over a year ago, and the number in May was up 62% compared with May 2008. In the Southeast, jobs that would have attracted six or seven bidders now routinely draw 35 bidders, says Phil Roy, regional vice president in contractor Barton Malow’s Atlanta office.

Landing Work

Contractors that previously specialized in certain markets now are looking to land work wherever they can find it. Going out of state or bidding in new sectors is commonplace. “We are seeing a lot of subs that we have never heard of before,” says Doug Savage, director of marketing for KK Mechanical, Roy, Utah.

Conditions are “making for a more competitive market than we have seen in a long time,” says John Reyhan, area general manager for Skanska USA Building in Atlanta.

Contractors are cutting their bids to the bone. “We have not dropped our margins, but we definitely are being more aggressive in our direct costs for self-performed work,” says Grant Moorhead, chief estimator in PCL Constructors’ Seattle office.

From highway jobsand school construction and rehabilitation to water and sewer work, bids are coming in well below engineers’ estimates all across the nation. Bids also are clustered much more tightly. Sharon Greenburger, president and CEO of the New York City School Construction Authority, says jobs that might have attracted a pair of bidders before can now draw a dozen, with costs and escalation rates dropping and bid ranges contracting. In the past “the price range might have been 20%,” she says. “Now it is more like 5%.”

In Connecticut, Stamford-based W&M Construction won a Milford school contract, edging out the next of 22 competitors by a tenth of a percentage point. W&M CEO Tom Durels says lower bids are helped by three factors: price drops on finished goods, tighter profit margins and subcontractors trying to increase labor productivity. Subs are dropping prices by about 20% from their peak about 12 months ago, he says. What is a challenge to contractors is proving to be a boon to public-sector owners. North Carolina has been aggressive in...