February Construction Starts Jump 16% Nationwide

At a seasonally adjusted annual rate of $724.3 billion, new construction starts in February advanced 16% compared to the previous month, according to Dodge Data & Analytics. Much of the lift came from three massive projects valued each in excess of $1 billion that were included as February construction starts.

The nonbuilding construction sector was boosted by an $8.4-billion liquefied natural gas export terminal in Louisiana and a $1.2-billion solar power facility in California, while nonresidential building registered a sharp gain partly as the result of a $3.0-billion petrochemical plant in Texas. Residential building also strengthened in February, as growth for multifamily housing outweighed a loss of momentum by single-family housing.

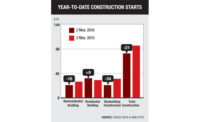

For the first two months of 2015, total construction starts on an unadjusted basis were up 34% from the same period a year ago. If projects in excess of $1 billion are excluded, the result would be more moderate gains for total construction—up 10% in February on a seasonally adjusted basis relative to January, and up 8% on an unadjusted basis during the first two months of 2015 relative to the same period a year ago.

The February statistics produced a reading of 153 for the Dodge Index (2000=100), compared to a revised 132 for January. For 2014 as whole, the Dodge Index averaged 123.

“Due to the presence of several unusually large projects, the first two months of 2015 witnessed an especially elevated level of activity that’s exceeded the underlying trend for construction starts,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “Some pullback can be expected in coming months, since there are only a limited number of LNG-related projects that may reach the construction start stage and petrochemical plants are not likely to match the exceptional amount that was reported last year, particularly with the recent decline in oil prices.

“At the same time, the first two months of 2015 have shown several noteworthy features that point towards the continued expansion for overall construction activity,” Murray continued.

“For commercial building, both office buildings and hotels are continuing to track upward, supported by the increasing amount of private financing directed at real estate development. For institutional building, school construction is now seeing the benefits of large school construction bond measures that were approved in recent years, while health care facilities registered an unexpectedly strong performance in February.

“For residential building, multifamily housing continues to show brisk development activity in major cities. One area of concern for overall construction activity in 2015 relates to single-family housing—will it be able to move beyond the extended plateau that took hold in 2014?

“Another area of concern relates to public works and, specifically, highway and bridge construction—will Congress be able to reach agreement on a new multiyear federal transportation bill by the end of May, or at the very least a continuing resolution that shores up the depleted Highway Trust Fund?”

Nonbuilding Construction

Nonbuilding construction in February increased 9% to $253.8 billion (annual rate), which followed its substantial 92% hike in January. The electric utility and gas plant category in February topped its heightened January amount by 17%, with the inclusion of the Sempra LNG export terminal in Hackberry, La., at an estimated construction start cost of $8.4 billion. (In January, two segments of an LNG export facility in Freeport, Texas, valued at $6.0 billion were included as construction starts.)

Other large projects that lifted the electric power and gas plant category in February were the $1.2-billion Stateline Solar Farm in California, a $675-million natural gas-fired power plant in Maryland and another solar power facility in California valued at $450 million.

Public works construction as a group improved 2% in February, with a substantial push coming from highways and bridges, which advanced 12%. Large highway and bridge projects in February were led by several in the New York City area—a $283-million tunnel rehabilitation in Brooklyn, a $213-million toll plaza rehabilitation at the RFK Bridge in the Bronx and a $96-million toll plaza improvement project on the New Jersey Turnpike in Bayonne, N.J.

The environmental public works categories in February were mixed, with river/harbor development up 29%, sewer construction up 4%, and water supply construction down 3%. The miscellaneous public works category, which had been boosted in January by the start of the $350-million Sun Life Stadium modernization in the Miami area, fell 33% in February.

Nonresidential Building

Nonresidential building, at $224.9 billion (annual rate), surged 42% in February after a relatively weak performance in January. The manufacturing building category was a major contributor, soaring 663% in February with $3.0 billion for the estimated construction start cost of the Formosa ethane cracker and propane dehydrogenation plant in Point Comfort, Texas.

The next largest manufacturing building starts in February were considerably smaller—a $169-million manufacturing research lab in California and a $43-million carpet manufacturing plant in Georgia. If the manufacturing building category is excluded, nonresidential building in February would still have registered a 19% gain.