After more than two decades of cataloguing its vast stock of rundown neighborhoods, the U.S. may be starting to get serious about cleaning up after itself. When President George W. Bush signed the Small Business Liability Relief and Brownfields Revitalization Act on Jan. 11, he implemented a long overdue change in the way the federal Environmental Protection Agency looks at depressed properties.

|

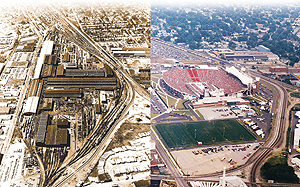

| IT'S GOOD University of Louisville converted CSX rail yard into football stadium with EPA Project XL assistance (Photos courtesy of Law Environmental) |

The measure enjoyed broad support, combining House and Senate versions that sailed through their respective chambers last year by unanimous votes. Briefly, the law codifies EPA's program and doubles funding levels, from $98 million this year to $200 million yearly, starting in fiscal 2003. Federal money can now be spent for cleanup as well as for site assessment. Underground storage tank work is now eligible. There is liability relief for minimally polluting small businesses, contiguous property owners, prospective purchasers and innocent landowners, if they can demonstrate due diligence. Property owners who voluntarily enter qualified state cleanup programs are exempt from further federal enforcement.

EPA defines brownfields as "abandoned, idled or under-used industrial and commercial facilities where expansion or redevelopment is complicated by real or perceived environmental contamination." They come in all shapes and sizes, from orphaned country landfills and gas stations, to small-town dry cleaners, to castoff inner- and edge-city rail yards, factories, chemical plants and refineries. Their exact number is unknown; the consensus is about 450,000 U.S. brownfield sites. The worst industrial practices pushed Congress to pass the 1980 Superfund law, the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). "The new law puts distance between most brownfields and the more seriously polluted sites that make up the Superfund National Priorities List," says Larry Schnapf, a New York City-based environmental attorney.

Unfortunately, many lightly polluted properties were lumped in with the most toxic properties. The result: over-regulation and flight by lenders, insurers and developers. Blight spread as eyesore properties drained resources. Many of the brownfields "are not pollution-driven, at all," says Salah Abdelhamid, an industrial site specialist and vice president in the Philadelphia office of the CH2M Hill Cos. "The program has been bottlenecked by other issues. The biggest is site transfer." Liability issues have driven most developers to greenfields sites instead, he says.

But the tide may be turning. Anti-sprawl measures continue to gain ground and cash-strapped states and localities are desperate to clean up abandoned properties, often in desirable locations, and return them to the tax rolls. "We have a study that shows that for every single acre of brownfields reclaimed, we preserve 4.5 acres of green space," says Charles Bartsch, senior policy analyst for economic development and brownfields at the Northeast Midwest Institute, a nonpartisan Washington, D.C.-based think tank.

Still, skepticism abounds. A 2001 General Accounting Office report faulted EPA for poor tracking of its brownfields inventory and inflated project claims. A consulting engineer who requested anonymity says, "We've made plenty of money from site characterizations, but the program has been more of a feel-good photo-op for politicians than a real clean-up program. Not that many sites are really getting done."

"There is a pork-barrel element to [the federal program], but on the whole the new law takes a pro-business, common-sense approach," admits Barry Hersch, associate director of the Steven L. Newman Real Estate Institute at Baruch College in New York City. Hersch was formerly with brownfields developer Dames-Moore/Brookhill's New York office. "The new law aligns the federal program with what EPA had been moving toward in the last few years and also pushes it toward some of the more progressive state programs," he says.

There was no state program in Kentucky a decade ago when the University of Louisville approached Richmond-based CSX Transportation about buying an abandoned 92-acre site south of the campus for a football stadium. Buildings, railroad track and pavement covered 85% of the site and uncertainty about contamination and attendant liability was holding up the deal. "The buyer and seller weren't going to invest in the project without knowing if it was a go," says Nicholas Schmidt, assistant vice president of Law Engineering and Environmental Services, Atlanta.

Site characterization proceeded hand-in-hand with fundraising. "Unfortunately, it was perceived to be highly contaminated even before it was assessed," says Schmidt. The majority of the $68-million project came from private donations. Locally based Papa John's Pizza claimed the biggest slice, at $5 million, for naming rights. Seat sales brought in $15 million, and bond sales raised another $18.5 million.

Law identified 47 soil contaminants. More than 1 million gal of diesel fuel was making its way to groundwater. Asbestos was found in 20 acres of existing structures. Preliminary cleanup estimates ranged from $10 million to $40 million. "At that price the project would never have happened,'' says Schmidt.

But by innovatively tailoring brownfield cleanup techniques to the site's end-use, engineers designed a remediation that came in at just $6.8 million. The largest portion was demolition, which cost the seller $5 million. The rest of the site was capped with 4 ft of clean soil. "It was designed so the university could plant a tree, or put up an event tent with 3-ft stakes without bringing out a special contractor," says Schmidt. A vapor collection system underlies the stadium and other buildings to make sure there is no methane exposure.

The contractor used contaminated soil to construct a horseshoe-shaped foundation berm under the first 25 rows of concrete-on-grade seats. Piles auger-cast to bedrock prevent contamination from migrating vertically. Because construction was, in fact, the cleanup, Law devised a safe way to operate. "Construction workers were effectively remediation workers," says Schmidt. A hardhat sticker system signified which of 1,500 trained workers could enter restricted areas.

The stadium opened in 1998 and the following year the project won an EPA award for brownfields innovation. Sen. Mitch McConnell (R-Ky) cited the project as a model for transforming "an overwhelming environmental problem into a regional asset."

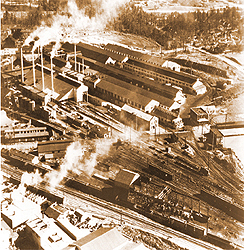

PROJECT XL. Another innovative approach to a big-ticket brownfields transformation is under way in central Atlanta, where local mall-master Jim Jacoby's Jacoby Development Inc. is turning the old Atlantic Steel Mill site in Midtown into Atlantic Station, a $200-million multi-use development.

The 138-acre site housed a recycle mill with open-hearth furnaces from the early days of the 20th Century. Electric arc furnaces came later. Slag was common, but the site was also contaminated with lead and other metals, PCBs, TCE and solvents.

|

| STEEL AWAY Former mill in Atlanta's Midtown area will be recast as a $200-million development. (Photos courtesy of Law Environmental) |

Cleanup was expensive, but the developers faced a bigger hurdle: a 1999 city requirement for a bridge over the Interstate highway to connect the development to other neighborhoods and to MARTA, Atlanta's public transit system. At the time Atlanta's highway funds had been frozen because the city was not able to meet Clean Air Act standards.

Ironically, it was EPA that offered a solution, through its brownfields program. "All state, federal and local agencies worked together to make sure the bridge would be built and the old steel mill redeveloped,'' says Jim Kutzman, EPA deputy regional administrator in Atlanta.

The Project XL (eXcellence in Leadership) designation gave the various agencies the authority to go forward with an environmental assessment, which weighed the new bridge against a similarly sized development on suburban green space. EPA ultimately determined the bridge would actually improve the region's air quality.

The project includes more than 3,000 apartments, 1.5 million sq ft of office space, and several million square feet of entertainment space. "It's a classic live, work and play environment, part of the new urbanism that reduces the impacts to greenfields," says Hilburn O. Hillestad, senior vice president of environmental affairs for Jacoby.

Georgia Dept. of Transportation funded the $38-million bridge, and contracts will be awarded this month. Another advantage the project offered the city was replacement of nearly a mile of 100-year-old combined sanitary and storm sewers. Adding an 8 x 8-ft box culvert storm sewer cost developers $25 million. Finally, the remediation team decided to cap the old, deep slag and contain pathways of contaminant exposure, says Leonard Ledbetter, vice president of the Law Group, which was the environmental consultant for both the owner and the seller. "We worked as a team under a three-party contract,'' he says.

Cleanup contractors removed some 200,000 cu yd of material. The site cap consists of 2 ft of clean soil or engineered barriers, such as sidewalks, streets and structures. Contaminated groundwater will be treated and discharged into the Atlanta sewers.

The project's skeptics included members of the Georgia Dept. of Environmental Protection. Bill Mundy, manager of the state's corrective action program, says, "We were always supportive, but we were not going to overlook our responsibility just because we were excited about the project.''

To ensure future protection, the state attached a conservation easement to the title of the property. "It doesn't restrict the sale or development of the property, but it does require that if any changes are made to parcels in the future, they must be restored to the condition required by the corrective action plan,'' says Mundy. The easement guarantees that all potential exposure will be cut off in perpetuity, he says. "New owners can't mess up the cleanup."

Critics say that prime locations in cities such as Louisville and Atlanta can easily attract private sector investors, especially if liability barriers are removed, but even doubling the federal brownfields pot will not go far toward reclaiming the vast inventory of less attractive properties. The Defense Dept.'s Base Realignment and Closure (BRAC) program, through four rounds dating from 1988, listed 152 major installations and 235 smaller bases to shut or scale down.

|

MILITARY MIGHT. The government's approach to military brownfields has advantages over its civilian counterpart, says James Kovalcik, CH2M Hill's vice president of BRAC programs. The program is fully funded, he says, and the sites have one owner (the military) and grant cleanup indemnity to the new property owner. "And, perhaps most important, we're under a directive from Congress to return these properties to the private sector as quickly as possible," he says.

Under a three-way contract, CH2M Hill is working with the Navy and local developer Lennar Mare Island llc to clean up 670 acres of the former Mare Island Naval Shipyard, develop it and turn it over to the City of Vallejo, Calif. The pilot program sliced the Navy's property transfer schedule from five years to four, says Kovalcik. An $80-million contract includes $70 million for remediation and the remainder for administration and oversight. The developer's part of the deal includes $120 million worth of mixed use development with an eight to 12-year buildout.

|

| MAKING GOOD Suozzi, above, toppled stacks and status quo. |

By contrast, civilian brownfields, without the BRAC program's billions of dollars in funding, force developers and communities to scramble to cobble together their programs. The new law should put more sites on the cleanup track, says Bartsch, but with the current level of funding, "the burden will fall even more to the states," he says. More than 40 states have brownfield programs in place, but some are better than others. Batsch puts Illinois, Pennsylvania, Connecticut and New Jersey in this category. All aim at signing off on minimally polluted sites as quickly as possible.

New York is a different story, apparently. An EPA staffer says the state's cleanup standards are "as rigorous as any in the country." This sounds good on the surface. But Schnapf sees it differently. "When a state assemblyman on a key economic development committee publicly states that he regards risk-based cleanups as morally reprehensible, you know right there that flexibility is not part of the game plan," he says.

Projects find many ways to fail. A neighborhood group wanted to bring 2,000 jobs to the South Bronx by converting the Harlem River rail yard into a paper recycling plant. Maya Lin, the designer of Washington, D.C.'s Vietnam veterans memorial, was to design the plant. The Natural Resources Defense Council joined the effort, investing some $2.5 million in the project, and New York state planned to kick in $75 million in bonds for financing.

But the project fell apart last year, apparently because of infighting between two local community groups and, according to NRDC's Allen Hershkowitz, loss of New York City support when former Mayor Rudolph Giuliani was considering a U.S. Senate run. The final nail in the coffin came when the Internal Revenue Service killed a tax break for recycled paper plants, Hershkowitz says.

REPLATING GOLD COAST. Outside the city, on Long Island's North Shore, Glen Cove is faring better. A century ago the city was a playground for the New York plutocracy, a summer refuge for members of the Morgan, Pratt and Woolworth clans. Long Island's Gold Coast heyday peaked around 1910, followed by subdivision and the advent of industrialization. Most of the city's 10 miles of waterfront remain pristine, but the one mile along Cove Creek, which empties into Long Island Sound via Hempstead Harbor, suffered from a century of industrialization.

Then-Mayor Thomas R. Suozzi unveiled his grand vision in 1995. "He wanted to reclaim the waterfront, to clean it up and provide public access, but we didn't want to simply turn the property over to a developer to build a high-rise," says Myra Lee Mackle, who manages city grant applications. Suozzi, who served four two-year terms as mayor before being elected Nassau County executive director last fall, "is one of the most visionary and forceful officials I've ever dealt with," says Mark Strauss, a New York City-based architect and urban planner brought on board to craft a master redevelopment plan. "The city leveraged a $200,000 EPA brownfields pilot grant into several million more in grants with New York state, the Corps of Engineers and other agencies. Tom just wouldn't take no for an answer."

|

|

| After cleaning site (bottom), plan calls for development of mixed-use waterfront complex (top). (Photos courtesy of the Glen Cover Community Development Agency) |

Strauss's master plan divided the 214-acre site into seven sectors, each with specific cleanup and end-use goals. Front-end work included creek dredging, bulkhead repairs, tungsten plant demolition and abandoned condo removal. Infill to date includes a pedestrian esplanade along the creek and harbor shoreline, a high-speed ferry terminal, town houses and a restaurant.

Edward M. Weinstein, an architect who worked on the marina district part of Glen Cove's master plan, hopes to transfer success from Long Island Sound to two Hudson River towns with brownfield characteristics: Hastings-on-Hudson and Haverstraw. Hastings-on-Hudson has a polluted 26-acre tract that once housed the Anaconda Wire and Cable Co. Owner Atlantic Richfield Co., Los Angeles, is ready to pay up to $50 million toward cleanup and development, but some residents want a "$200-million cleanup," to pristine conditions, he says. Upriver, Haverstraw, formerly the brickmaking capital of the world, is penned in by a railroad track, quarry and a powerplant. But a developer is ready to go, with plans for 850 new residential units and high-speed ferry service.

"We have to get the communities and the state and federal agencies on the same page," says Weinstein. A former New York City assistant ports commissioner, he sees potential where others see pollution. But he is also pragmatic. "New York needs to do more to match the federal effort and the private sector's funding," he says.