2015 Intermountain Legacy Award Honoree Sam Clark Creates a Legacy of Trust

Salt Lake City insurance and surety leader emphasizes fairness and builds a reputation for trust across the construction industry

Contractors’ Advocate

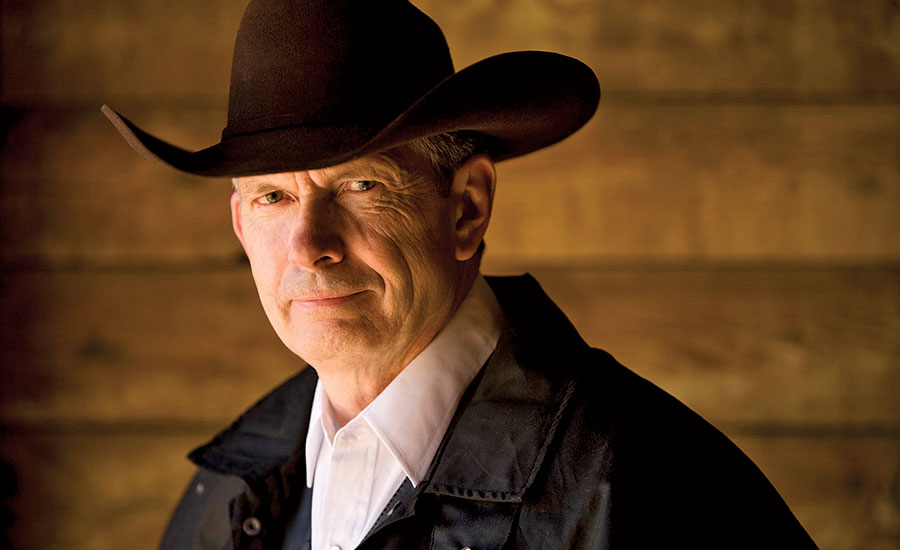

Sam Clark, head of the Dale Barton Agency, has won this year’s Legacy Award in Utah.

PHOTO COURTESY OF THE DALE BARTON AGENCY

Take a quick tour across the greater Salt Lake City area, and you will see the influence of the Dale Barton Agency all over town—from the light-rail system, the City Creek Center and the 21,000-seat conference complex for the Church of Jesus Christ of Latter Day Saints to the venues for the 2002 Winter Olympics, the University of Utah’s Rice-Eccles Stadium, along with more than 120 other campus buildings.

Those projects and many more were built with the backing of construction surety bonds and other insurance services provided by the 67-year-old agency, now run by Sam Clark, the son-in-law of the late Dale Barton. The 22-person surety business has long been regarded as a principal go-to firm for general and trade contractors throughout Utah and the Intermountain region. It also is known for its ethical dealing and vigilance about customers’ interests.

Jim Gramoll, president of Gramoll Construction Co. in North Salt Lake, Utah, says of Clark, “He’s well known and well respected in our industry for his character. He’s very honest and good to do business with.” The nature of the insurance and surety business requires contractors to reveal confidential information to their agents, and Gramoll says, “Because of the way Sam acts, I always feel comfortable that it’s well taken care of.”

“My philosophy has always been that if you take care of others and take care of their business, then they’ll take care of you,” says Clark, who holds several business degrees from the University of Utah. As an example, the agency not only scrutinizes contracts for its surety bonds but also watches for terms that may place its clients at a disadvantage, should something go wrong.

“Everyone knows that we aren’t lawyers, and we don’t practice law,” Clark says. “However, as you have contracts come across your desk every day, we see those contracts that may be firm but are also fair. We also see those that are quite onerous and quite difficult, and see the problems and the challenges that can come from bad contracts. So we will look at those, and we will counsel with our customers and tell them the things we see that may not be insurable, that may be detrimental to them, that may be extremely harmful, as well as those things that are acceptable. And then we encourage them to talk with their legal counsel to get what is proper and appropriate for that particular situation.

“In effect, when you look at the major law firms in our area, we might see more contracts than they might, from a variety of owners and for the trade contractors from the general contractors and so forth. And we see those that have worked successfully and those that haven’t, those that have the kinds of clauses that can be deal killers,” Clark says.

Even though Clark can quickly spot a bad agreement, it’s his talent for getting to a yes that has helped build both his agency’s success and that of its clients. Faced with potentially losing a longtime customer over a price ssue, Clark sat down with the client on a Saturday morning and spent two hours going through the numbers. Eventually, he spotted a flawed assumption that, once corrected, persuaded the customer to stay.

Keeping the business was certainly satisfying, but for Clark the greater pleasure was in meeting an unexpected challenge and seeing the client well served.

“Every day is different,” he says, “so what you have to learn to do, in my opinion, is anticipate the unanticipated. You come early, you work hard, and at the end of the day, you’re tired but you’re satisfied because you’ve made a difference. You’ve helped somebody accomplish the goals they have, you’ve been able to provide services in terms of surety or insurance services, consulting services and risk-management services, and helping them to do things.”

In that vein, Clark resembles his mentor Barton, who frequently said, “If you love your work, you’ll never work a day in your life.” Clark’s son, Chris, who has worked in the agency for a decade, says, “He definitely has a passion for the business. He’s always been the same, whether it’s been in his ecclesiastical roles (the elder Clark is a regional leader in the LDS Church) or in business or as a father. What you see is what you get. He’s above board across the different hats he wears, and he treats his clients as family as well.”

The role of son in a family business can be difficult, but Chris Clark says he and his father have never had a serious disagreement at the office. In fact, just as Barton did with Sam Clark, Sam did with his son—recruiting him from another planned career (for Sam, it was law; for Chris, broadcasting) to join the agency.

Rob Bauman, a 23-year Dale Barton Agency executive, echoes Chris Clark’s comments about Sam’s rapport with clients.

“Sam has a real compassion and empathy for the client, and he’s well known for this,” Bauman says. “He moves beyond a product or a service to a relationship. Sam regularly supports individuals, their families and children. He almost becomes a counselor or a confidante. He’ll go to bat for small and large contractors.”

“Sam always makes you feel like you’re his most important customer,” says Gramoll. He also considers Clark a strong advocate for contractors. Gramoll’s company has done business with other agencies over the years, and sometimes, he says, “They maybe forget who the customer is. Sam does a good job representing us.”