Subcontractors say late and delayed payments are becoming an ever more pressing issue, even as the construction market and the overall economy show strong signs of improvement.

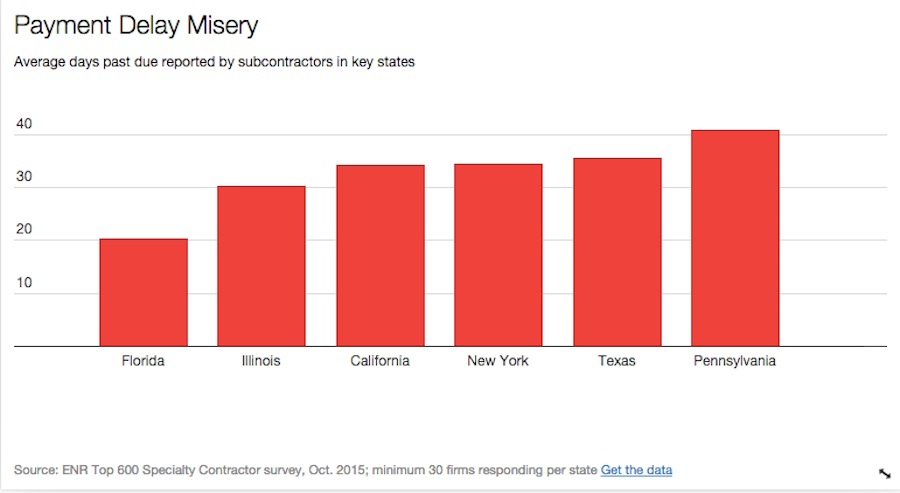

An ENR survey of 640 subcontractors found that more than 30% of payments from general contractors are coming in late, with an average delay of 36.4 days.

The problem, if anything, has gotten worse over the past few years, say subcontractors, with some owners and prime contractors standardizing less-than-prompt payment on many projects as a general business practice.

“It’s terrible,” says C. Carroll Heyward, Sr., chief executive of W. B. Guimarin and Co., an HVAC and plumbing contractor based in Columbia, S.C. That company’s payments now roll in nearly 90 days late.

On average only about one out of three payments is late, the survey shows.

But for 83 subcontractors who responded to the ENR survey, the problem is far worse, with more than six out of10 payments delayed or late.

A total of 168 subcontractors reported to ENR that at least 40% of their payments are late now. (Click on bars to see values in interactive graphic below; text continues beneath graphic).

How much state prompt-pay statutes help prevent even further deterioration in pay practices isn’t clear. All 50 states have prompt-pay laws, and some cover private construction as well as public works. Terms and interest penalties vary. So do the relationships on the payment chain that is covered: owner to prime, prime to sub and sub to lower tiers.

Difficulties in collecting final payments sometimes drag out for years, some subcontractors have said.

The Alexandria, Va.-based American Subcontractors Association, which regularly fights the battle for improved payment practices, has had its own payment surveys.

ASA’s most recent data cited “slow final payment” as a very serious issue, with another 27% calling it “somewhat serious.”

“Certainly there are owners and prime contractors who are good payers or generally good payers,” says Colette Nelson, the ASA’s chief advocacy officer. “There are also owners and prime contractors who are simply predators. It is really easy to be the lowest bidder if you are not going to pay your subs.”

For W. B. Guimarin and Co., the problem of late payments has escalated dramatically over the past couple of years, Heyward says.

Back in 2013, payments were coming in, on average, 49 days late. That jumped up to 82 days in 2014 and 120 days last year.

The delays have puzzled Heyward, who says that with interest rates still at rock-bottom levels, there is not a lot to be gained by someone else holding onto the money owed to his company.

“I am just confounded by it all,” he says.

86 Days Past Due

Jim Slack Jr., president of Slack & Co. Contracting, Inc. in Houston, notes his average payment is now 86 days past due.

He’s convinced that the delays are part of a conscious and growing technique by general contractors and owners to improve their own cash-flow situation at the expense of their subs.

Project owners can certainly collect interest on subcontractors’ payments money while it sits in their bank accounts, notes Slack, whose company performs excavation and grading.

But if the owner or general contractor is borrowing money themselves, it can delay the point at which they have to take out money and start paying interest on it.

“We are farther down the food chain,” Slack says. “In my opinion it is a conscious effort by those parties to improve their cash flow.”

“It’s getting worse,” he says of the late payment trend.

An executive at a Pennsylvania specialty contractor offered a similar assessment.

Not long ago, a large percentage of her firm’s work was paid within 30 days. Now that has ballooned to 60 days.

Some of the delays may be due to the local economy, which has taken a hit with the decline in oil and gas prices, which have made shale oil extraction less economical.

“Lately in the past two years, things have gotten progressively worse in terms of getting paid,” says the Pennsylvania executive, who preferred not to be identified. “If I had all the money that was owed me right now, I would be walking tall.”

When it comes to ensuring they are paid what they are owed, subcontractors have developed different strategies.

Heyward has tried to weed out the bad apples while adding a percentage or two to his bid if he has reason to believe that payments will be delayed.

“We have actually quit quoting some customers who in our opinion have been abusive in how they have paid their subcontractors,” he says.

By contrast, Slack takes full of Texas’ mechanics lien laws to make sure his company gets paid what it is due.

Slack starts with an initial notice signaling his intent to file a lien, sending it to contractors and project owners. If that doesn’t shake the payment loose, he follows that up in 45 days by filing a mechanics lien on the property.

“I don’t care if it’s my mother, I will file a lien on the project,” he says.