New Projects

March Construction Starts Ease Back 1% Nationwide

Electric utilities and gas plants retreat, nonresidential building climbs sharply

The public works categories as a group witnessed a reduced level of construction starts in March, sliding 24% from February.

Image courtesy of Pixabay

At a seasonally adjusted annual rate of $660.5 billion, new construction starts in March receded 1% from February’s pace, according to Dodge Data & Analytics.

Total construction starts had jumped 13% in February, led by a huge gain for the electric utility and gas plant category. While the dollar amount of electric utility and gas plant starts fell considerably in March, accompanied by a pullback for public works, the latest month featured a substantial increase for nonresidential building, as this sector is providing more evidence that it’s regaining upward momentum.

In addition, residential building in March registered moderate growth, helped by the continued strength for multifamily housing. During the first three months of 2016, total construction starts on an unadjusted basis were $141.7 billion, down 10% from the same period a year ago, which included the start of several massive power plants and liquefied natural gas (LNG) export terminals.

If the volatile electric utility and gas plant category is excluded, total construction starts on a seasonally adjusted basis in March would be up 4% from February, while the year-to-date comparison on an unadjusted basis would show just a modest 4% decline.

The March data produced a reading of 140 for the Dodge Index (2000=100), compared to a revised 142 for February. Both February and March came in higher than the sluggish 126 average for the Dodge Index during the previous seven months.

“While March construction activity was down slightly from February, it stayed above the lackluster performance witnessed during the second half of last year that continued through January,” said Robert A. Murray, chief economist for Dodge Data & Analytics.

“What’s noteworthy about the March report is the renewed strength shown by nonresidential building, and in particular, its institutional building segment.

Nonresidential building had settled back 5% in 2015 after its 24% surge in 2014, reflecting not only a steep 36% plunge for manufacturing plant construction but also a slight 1% decline for institutional building.

“The strength shown by institutional building in March provides some indication that it’s beginning to shift back into expansion mode, helped by growth for educational facilities, as well as by the start of several large transportation terminal projects. Assuming this pattern gets repeated over the course of 2016, it would be an important factor behind nonresidential building reestablishing an upward trend,” Murray said.

Nonresidential Building

Nonresidential building in March climbed 23% to $228.1 billion (annual rate), strengthening for the second month in a row after February’s 5% gain. The institutional building group in March soared 44%, with most of the structure types reporting growth.

Leading the way was the transportation terminal category, up 339%, as it was lifted by the start of two large projects—$663 million for work on the rail terminal caverns at Grand Central Station in New York City and $537 million for the new North Terminal building at Louis Armstrong International Airport in New Orleans.

Other large transportation terminals included as March starts were the $132-million Andrews Federal Center bus garage in the Washington, D.C. area and the $112-million Terminal 4 expansion at Fort Lauderdale-Hollywood, Fla. International Airport.

Educational facilities, the largest nonresidential building category by dollar volume, advanced 20% in March. Several large university buildings reached groundbreaking, including a $131-million research building at the University of Kentucky in Lexington and the $110-million seismic replacement of Tolman Hall at the University of California Berkeley.

The amusement and recreational category had a strong March, rising 38%, with the boost coming from the $284-million casino portion of the $630-million Montreign Resort and Casino in Kiamesha Lake, N.Y., and the $192-million casino portion of the $500-million MGM Resort and Casino in Springfield, Mass.

The public buildings category and health care facilities rebounded from weak February amounts, rising 55% and 53%, respectively. Church construction, sliding 54% in March, ran counter to the general upward trend for institutional building.

The commercial categories as a group increased 5% in March, reflecting a mixed pattern by project type. Hotel construction rose 47%, lifted by the $332-million hotel portion of the Montreign Resort and Casino, and support was also provided by the $78-million hotel portion of the Springfield, Mass., MGM Resort and Casino.

Other large hotel projects included as March starts were the $285-million expansion of the Pechanga Resort and Casino in Temecula, Calif., and the $217-million Turnberry JW Marriott Hotel in Nashville.

Store construction in March increased 19%, reflecting the $140-million renovation of the Fashion Outlets of Philadelphia mall in Philadelphia, and the $116-million retail space expansion at TD Boston Garden in Boston.

On the negative side, office construction retreated 27% in March after its 26% hike in February. Despite the decline, several large office projects were included as March starts, such as $293 million for work at the Toyota Corporate Campus project underway in Plano, Texas, and a $131-million office building in Atlanta.

Warehouse construction also retreated in March, slipping 13%. The manufacturing plant category showed improvement after its weak February amount, rising 20%, with the push coming from such projects as a $335-million carbon fiber production plant in Moore, S.C., and the first phase of the $220-million Volvo auto assembly plant in Ridgeville, S.C.

Residential Building

Residential building, at $292.0 billion (annual rate), grew 3% in March. Multifamily housing increased 15%, bouncing back following a 6% decline in February, as it continues to proceed at a brisk pace.

There were 12 multifamily projects valued at $100 million or more that reached groundbreaking in March, led by two projects in New York City valued at $404 million and $308 million respectively.

Other large multifamily projects that reached groundbreaking were a $305-million condominium tower in Sunny Isles Beach, Fla., a $243-million condominium tower in Miami; and the $229-million Transbay Block 9 multifamily development in San Francisco.

During the first three months of 2016, the leading metropolitan areas in terms of the dollar amount of multifamily starts were: New York City, Miami, Boston, San Francisco and Los Angeles.

The New York City metropolitan area comprised 25% of the national multifamily dollar amount during the January-March period, staying close for now to the 27% share reported for full year 2015.

Single-family housing in March slipped 2%, essentially remaining close to its February pace. By major region, March showed this pattern for single family housing relative to February—the Northeast, up 6%; the South Atlantic, up 2%; the West, down 2%; the South Central, down 4%; and the Midwest, down 10%.

Nonbuilding Construction

Nonbuilding construction in March fell 30% to $140.4 billion (annual rate), after surging 50% in February. The electric utility and gas plant category retreated 38% from its exceptional February amount, which included the $3-billion third segment (or train) of an LNG export terminal in Freeport, Texas, as well as the start of several large power plants.

Even with the decline, the level of activity for the electric utility and gas plant category was still fairly high in March, coming in only 3% below the average monthly pace reported during 2015.

The latest month included the start of six large solar power projects, located in California (two projects valued at $850 million and $418 million respectively), Utah ($450 million), Texas ($298 million), Idaho ($200 million), and Alabama ($200 million).

Other large power-related projects included as March starts were a $382-million transmission line in Wisconsin, a $275-million natural gas-fired power plant in North Carolina, and a $250-million retrofit of three coal-fired power plants in Alabama.

The public works categories as a group witnessed a reduced level of construction starts in March, sliding 24% from February and down from the generally improved activity reported during the closing months of 2015.

Highway and bridge construction experienced a comparatively mild 8% pullback while steeper declines were reported for the environmental public works categories—water supply systems, down 27%; sewers, down 31%; and river/harbor development, down 52%.

The miscellaneous public works category, which includes such diverse project types as pipelines and rail-related work, fell 40% in March following its 16% gain in February.

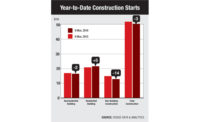

The 10% decline for total construction starts on an unadjusted basis during the first three months of 2016 compared to last year was due to a varied pattern by major sector.

Nonresidential building dropped 9% year-to-date, with manufacturing plant construction down 53%, the institutional building segment down 9%, while the commercial building segment ran counter with a 5% gain.

Residential building grew 12% year-to- date, with similar growth for single family housing, up 11%; and multifamily housing, up 13%. Nonbuilding construction plummeted 34% year-to-date, with public works down 28% and electric utilities/gas plants down 42%.

The reduced amounts for public works and electric utilities/gas plants so far in 2016 are relative to particularly strong activity during the first three months of 2015, with respective gains of 18% and 439% compared to the same period of 2014.

By geography, total construction starts for the January-March period of 2016 showed a 37% drop for the South Central region, which last year included the start of several massive LNG terminal projects. The other four regions registered this year-to-date pattern for total construction starts—the South Atlantic, no change; the Midwest, up 1%; the Northeast, up 7%; and the West, up 9%.

Further perspective comes from looking at 12-month moving totals, in this case the 12 months ending March 2016 versus the 12 months ending March 2015. On this basis, total construction starts were up a slight 0.4%, as the result of this behavior by major sector—nonresidential building, down 10%; residential building, up 14%; and nonbuilding construction, down 5%.

By geography, the 12 months ending March 2016 revealed this pattern for total construction starts—the Northeast, up 14%; the Midwest and West, each up 4%; the South Atlantic, up 1%; and the South Central, down 14%.