Staff-level construction employees continue to see salary raises on the upswing.

Staff-level construction employees continue to see salary raises on the upswing.

Firms that gave raises to employees in 2015 offered a 3.7% increase on average, according to the 2016 Construction/Construction Management Staff Salary Survey compiled by Personnel Administration Services, Saline, Mich. The latest data continues a steady upward trend in salary increases, which PAS reported at 3.46% in 2014, 3.24% in 2013 and 3.16% in 2012.

Jeff Robinson, president of PAS, says he expects the trend to continue this year and possibly through 2017. Survey respondents reported anticipated increases of 3.41% this year, but Robinson says those estimates are typically 0.5% lower than actual increases. “Everyone remains optimistic about the construction market,” he says. “Clients don’t see things slowing down. [The percentage of increase in 2016] will be at least where it was last year. I think it will be higher.”

In fact, he says some economists have suggested that the Bureau of Labor Statistics’ employment cost index could rise to as much as 4%. “Generally, construction salary increases stay ahead of the employment cost index,” he notes. “If we get above 4%, that means salaries will keep going up.”

Robinson says the increases are happening even as many employers have slowed down in terms of hiring. “That speaks to availability of talent,” he says. “I’m not sure there are enough people around for the work that’s out there, and that will continue to push wages up.”

|

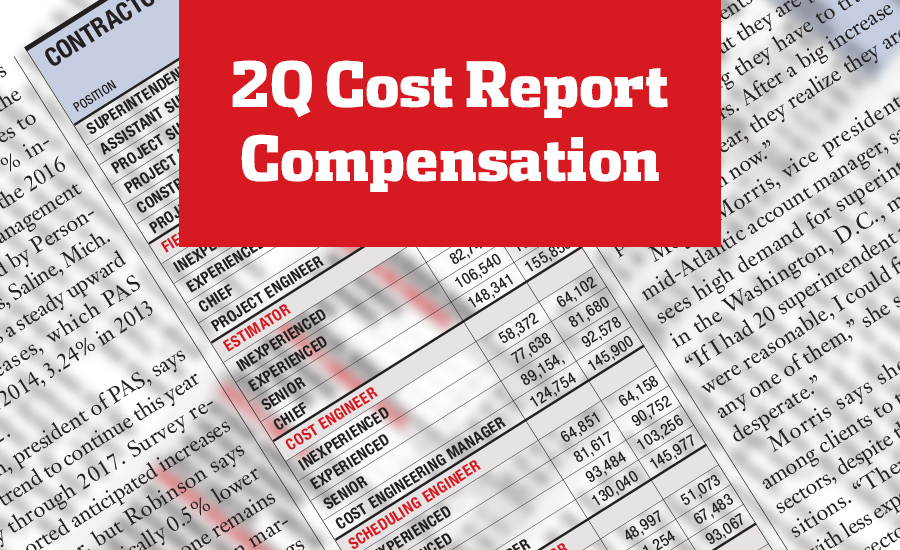

Click Here to Read the Cost Report (subscription required) |

Bonuses are showing signs of improvement. Although bonus levels remained roughly the same from 2014 to 2015, the number of companies offering bonuses has risen, Robinson points out. He notes that more companies are able to pay bonuses because margins have improved on projects.

New York and New Jersey saw the biggest average increase in salaries last year, jumping to 4.2% in 2015 from 2.9% in 2014, according to PAS data. Rob Herndon, president of HCC Consulting & Recruiting Services, Roswell, Ga., says he sees strong demand throughout the South and Southeast, particularly in Florida, the Carolinas and Texas.

Demand is high for project managers in the commercial sector and superintendents in the multi-family residential sector. In light of the recent jumps in salaries, Herndon says many companies are trying to hire younger employees and train them across sectors, if necessary. “Demand has gotten to the point where people were getting a big jump in salaries and then contractors decided, ‘That’s it—it’s too high, and we’re not going to do anymore,’ ” he says. “My clients still demand the best of the best, but they are [hiring]people and realizing they have to train them across sectors. After a big increase in salaries last year, they realize they are paying enough now.”

Megan Morris, vice president and mid-Atlantic account manager, says she sees high demand for superintendents in the Washington, D.C., metro area. “If I had 20 superintendent résumés that were reasonable, I could find a home for any one of them,” she says. “People are desperate.”

Morris says she sees less interest among clients to train employees across sectors, despite the urgent need to fill positions. “They might look at someone with less experience, but it has to be in the same sector,” she adds.

To lure talent away from companies, Morris says her clients are typically willing to offer a 10% to 15% bump in pay. “That’s such a small dollar amount compared to what they lose if they don’t have someone in the spot and they lose a job,” she observes.

Bob Honour, principal at H&H Consultants, Charlotte, N.C., says contractors are still cautious about new hires, despite the need. “Companies used to hire knowing they would have a job in 60 days. Now, they can’t be sure the projects will come, and they are not willing to hire based on a future project.”