Risk Management

End Bias in Big Construction Project Predictions

Could game theory provide a better result than Bayes Theorem?

Infrastructure planners and builders need to rethink how they approach and compute uncertainty and risk, especially on complex projects such as Seattle’s state Route 99, a tunnel to replace the old Alaskan Way Viaduct. “Bertha,” the tunnel-boring machine, recently resumed work on the project after a long, costly interruption.

Infrastructure planners and builders need to rethink how they approach and compute uncertainty and risk, especially on complex projects such as Seattle’s state Route 99, a tunnel to replace the old Alaskan Way Viaduct. “Bertha,” the tunnel-boring machine, recently resumed work on the project after a long, costly interruption.

Game theory, a branch of social science, may have been a better approach than probability theory to guiding the project team on risks and risk management.

These days, project members on almost any medium-to-large infrastructure project create a risk register during planning and design to identify and better manage uncertainty during the construction and operation phases. Generally, that approach relies on conventional probability theory to select the probability of some uncertain event happening and then assigning a probable cost, or time delay, to that event. The process works well when applied properly, and most of its shortcomings involve a failure to recognize biases or update data that could change the picture.

Before the S.R. 99 project began, I was concerned that there was not enough “data” on the performance of 57-ft-long, 4-in.-dia TBMs to accurately predict the project outcome. Then, Bertha encountered problems in late 2013, boring only 1,000 ft of its planned 9,270-ft drive. After a two-plus-year delay to repair and rebuild the big machine, she has bored about 3,088 ft of tunnel and made it to a planned maintenance stop. Project supporters are now feeling good, but they should be revising their predictions based on what has happened so far.

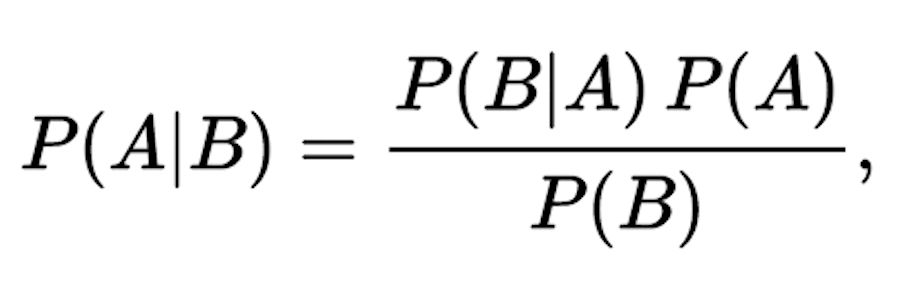

Bayes’ theorem is widely employed in many areas in which conventional probability appears to apply. It describes the “truth” of a belief or probability of an event occurring, based on conditions that might relate to the belief or event. Bayes’ theorem requires that you have an initial “prior probability” estimate—that is, you have a belief regarding the chances of something happening before that event actually happens. During the planning for S.R. 99, WSDOT used its complex, so-called cost estimate valuation procedure to assign a 2% probably of something bad happening to the TBM—that is, a low-probability event. However, they also assigned a high penalty if this event happened.

The mathematics can get complex, but, simply stated, one can have an opinion (belief) before an event transpires, but then one can update that opinion once new evidence becomes available that relates to the event. Bias plays a role, without a doubt. However, the important thing to realize is that, if you continually make predictions and update and evaluate them, you eventually will arrive at the “truth.”

Game theory is neither widely understood nor applied to complex infrastructure risk management or tunneling. It might be a superior method for evaluating the outcome of the S.R. 99 project. By focusing on strategic decision-making in situations in which there is often no clearly “correct” solution, game theory forces participants to recognize that actions aren’t taken in a vacuum and that an outcome depends upon the sum total of all actions taken by all the players involved.

For example, in the prisoner’s dilemma, the classic game-theory problem, two members of a criminal gang are arrested with insufficient evidence to be convicted. The prisoners are held in isolation, and each member must decide whether to confess and betray the other prisoner or remain silent, which has a different range of possible outcomes, from freedom to a long stay in jail. In the case of the S.R. 99 project, neither WSDOT nor the project’s prime contractor, Seattle Tunnel Partners (STP), will obtain the best outcome by working individually and looking out for only its own interests.

By working together—and with trust—they might avoid the “worst” outcome for both.

At this juncture, the worst outcome could be no tunnel, a very big bill and a long court battle.

Despite the good feeling about the project, an honest reevaluation of possible outcomes is needed. Also, the citizens of Seattle and Washington should be fully apprised of their potential financial liability at each stage of work. Success can be defined in many ways. A fresh approach to the project risk may avoid the equivalent of a surgery in which the operation was a success, but the patient died.