Shikun & Binui Group, Israel’s largest contractor, expects to take a loss of up to $30 million on debts owed since last year for infrastructure by its key overseas client, oil-sector-ravaged Nigeria. But the setback has not stopped S&B from staying in Africa or new expansion into the Americas as the $1.3-billion company seeks to grow its global footprint for contracting, project finance and real estate development.

The current quarter has helped to boost the ambitions and bottom line of the firm, traded on the Tel Aviv stock exchange. Nigeria on June 20 announced a $65-million payment to S&B owed for a year, following a move to devalue the local currency. The firm has worked in Nigeria for years on BOT road and bridge projects but was forced to slow operations last year as the oil-price falloff hurt Nigeria’s economy and its ability to fund work.

The Nigerian payment rallied S&B shares, which fell sharply earlier this year on news of the devaluation. Israeli financial analysts had mixed reviews. The Israel arm of S&P Global put the company on its watch list, saying the Nigeria situation’s impact could lead to a debt downgrade. But Apex Capital said the impact has been vastly overstated. Even so, global revenue and profit both declined in the first quarter, compared to the same period in 2015, the firm said on May 31.

The risks have not impeded S&B’s global strategy. Last year, foreign operations made up 50% of revenue and accounted for $2.1 billion in backlog as of March 31. That total does not include another $800 million for BOT projects in the U.S. and Colombia for which the firm just announced completed financing. S&B has partnered with Spain’s ACS Infrastructure Development and international investors for a $1-billion, 10.3-mile-long toll highway in Houston, the first of its kind in the area. In Bogota, it won the $640-million, 154-kilometer Cundinamarca toll road, which includes financing, construction, and operation and maintenance. With the new projects, S&B’s foreign backlog is nearly $3 billion.

“These two projects are major milestones and will make it easier in the future to win new projects,” S&B Chairman Moshe Lahmani said in an interview last month. In the U.S., “our focus is on BOT projects in Texas, Florida, Virginia and California, where we believe we have a better chance of competing as a foreign company.” He said S&B’s global unit also may acquire a local U.S. contracting firm. In South America, the company is eyeing Peru. S&B’s long-term strategy is a 50-50 split between Africa and the Americas by 2020, when it expects foreign work to make up 65% of revenue.

Nigeria also is key to the global mix, for now. “We are involved in several highway and bridge projects that have been given national priority,” said Lahmani. S&B also is active in Togo, the Ivory Coast, Uganda, Tanzania and Kenya.

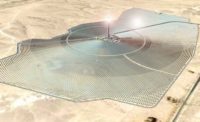

But Israel remains S&B’s single largest market. Teamed with China Tunnel Railway Group, it last year won a $750-million award to construct tunnels and underground stations on a key leg of the Tel Aviv regional light-rail network. In the Negev Desert, it has a major role in building the 121-MW Ashalim thermo-solar power plant, which the government on June 26 said would continue, says Israel’s Globes newspaper. Officials had considered halting the project or replacing its technology after the bankruptcy of S&B’s former partner, Spain’s Abengoa, and with changes in photovoltaic energy costs.