New Projects

August Construction Starts Jump 21% Nationwide

The August rise for total construction starts featured an especially elevated amount for nonresidential building.

Image courtesy of Pixabay

New construction starts in August soared 21% to a seasonally adjusted annual rate of $711.2 billion following lackluster activity in July, says Dodge Data & Analytics.

The August rise for total construction starts featured an especially elevated amount for nonresidential building, which was helped by the start of a $3-billion petrochemical plant in Louisiana, the $1.7-billion Wynn Casino in the Boston area, and a $508-million terminal upgrade at Seattle-Tacoma International Airport.

The nonbuilding construction sector also experienced strong growth, with its public works segment lifted by the start of a $3-billion natural gas pipeline project in Alabama, Georgia and Florida.

In addition, residential building contributed with a moderate August gain, reflecting another advance for multifamily housing that included groundbreaking for the $900-million Wanda Vista Tower in Chicago.

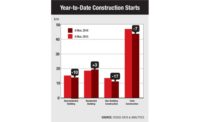

Through the first eight months of 2016, total construction starts on an unadjusted basis were $439.3 billion, down 7% from a year ago.

As 2016 is proceeding, the year-to-date decline for total construction is becoming smaller, affected to a lesser extent by the comparison to the massive projects reported during the first half of 2015 and now benefitting from the start of several massive projects in the year’s second half.

If projects valued at $1 billion or more are excluded, total construction starts during the first eight months of 2016 would be down a slight 1%, or essentially even, with a year ago.

The August data raised the Dodge Index to 150 (2000=100), up from 124 in July. The quarterly averages for the Dodge Index show that construction activity increased 11% in this year’s first quarter to 146, followed by a 10% decline in the second quarter to 131. The July and August average for the Dodge Index comes to 137, a 4% gain relative to the second quarter.

“The sharp rise in August makes it likely when September data becomes available that construction starts for the third quarter will be able to register moderate growth, supporting the belief that the construction industry still has room for further expansion despite some recent deceleration,” said Robert A. Murray, chief economist for Dodge Data & Analytics.

“The presence or absence of very large projects, of course, has played a considerable role in the month-to-month pattern for construction starts,” Murray added. “While July did not receive much of a boost from very large projects, such a boost was clearly present in the August statistics.

“Furthermore,” he said, “the year-to-date readings for the first half of 2016 were skewed by the comparison to the heightened first half of 2015, which included 13 projects valued at $1 billion or more, such as a $9-billion liquefied natural gas terminal in Texas, the $2.5-billion 30 Hudson Yards office-retail tower in New York City, and the $2.3-billion Interstate 4 highway project in the Orlando area.

“The number of $1 billion-plus projects entered as construction starts decreased substantially in the second half of 2015, when only three such projects were reported, and another low amount took place in this year’s first half when only four such projects were reported,” Murray said.

“In August, three projects valued each in excess of $1 billion were entered as construction starts, along with four projects in the $500 million to $1 billion range. This ‘grouping’ of very large projects in August can be attributed to timing issues specific to each project, yet it may also be part of a more general trend reflecting a less hesitant stance by firms towards investment than what was present over the past 12 months,” he said.

Nonresidential Building

Nonresidential building in August surged 42% to $267.4 billion (annual rate), rising from the subdued activity reported during the previous four months and reaching the highest amount since April 2015.

A substantial boost came from the manufacturing plant category, which climbed 291% in August with the start of a $3.0-billion ethane cracker chemical plant in Lake Charles, La. If this massive petrochemical plant is excluded from the August data, the manufacturing plant category would have retreated 44%, but nonresidential building would still have been able to register a 23% gain.

The commercial categories together advanced 31%, supported in particular by the August groundbreaking for the $1.7-billion Wynn Casino in Everett, Mass.

Hotel construction climbed 71%, reflecting the $465 million estimated for the hotel portion of the Wynn Casino, with additional support coming from other noteworthy projects such as the $180-million Lane Field Intercontinental Hotel in San Diego and the $127-million CityCenterDC Conrad Hotel in Washington, D.C.

The commercial garage category advanced 64%, helped by the $210 million estimated for the garage portion of the Wynn Casino, as well as by a $128-million parking facility at San Diego International Airport.

Warehouse construction strengthened 75%, due to the start of a $340-million trade and logistics center as part of the redevelopment of the Oakland Army Base in Oakland.

Office construction improved 3% following its 21% increase in July, supported by the $194-million office portion of a $300-million bank operations center in Plano, Texas, and a $96-million office building in Herndon, Va.

Store construction was the one commercial project type that did not report an August gain, as it held steady with its July pace.

The institutional side of the nonresidential building market increased 24% in August. The amusement and recreational category jumped 118%, reflecting the $975 million estimated for the casino portion of the Wynn Casino.

Transportation terminal work climbed 30%, pushed upward by the start of a $508-million upgrade to the North Satellite Terminal at Seattle-Tacoma International Airport.

Educational facilities, which is the largest institutional category, grew 18% in August with the lift coming from the start of a $124-million life sciences building at the University of Washington in Seattle and a $118-million high school in the Dallas area.

Health care facilities increased 15%, featuring five projects valued at $100 million or more, led by a $300-million medical center expansion in St. George, Utah, and a $271-million hospital in Rockford, Ill.

The religious buildings category managed to grow 16% in August from a subdued July, while the public buildings category (courthouses and detention facilities) fell 11%.

Nonbuilding Construction

Nonbuilding construction, at $152.7 billion (annual rate), increased 25% in August. The public works categories together rose 36%, with most of the gain coming from a 326% hike for the miscellaneous public works category, which includes pipeline work.

August featured the start of the $3.0-billion Sabal Trail and Florida Southeast Connection natural gas pipeline upgrade project, which will transport natural gas from Alabama through Georgia and into central Florida. If this massive project is excluded from the August data, the gains for the miscellaneous public works category and the public works group would have been 64% and 1%, respectively, while nonbuilding construction would have been down 4%.

Highway and bridge construction in August rose 5%, with major construction starts led by a $163-million tolled express lanes project in Denver, and a $110-million realignment of State Route 99 in Fresno, Calif.

River/harbor development work in August grew 8%, but considerable declines were reported for water supply systems, down 35%; and sewer construction, down 43%. The electric utility and gas plant category fell 31% in August, weakening for the third straight month, although August did include the start of a $573-million power transmission line in Illinois and a $156-million wind farm in upstate New York.

Residential Building

Residential building in August advanced 5% to $291.1 billion (annual rate). Multifamily housing strengthened for the second month in a row, rising 25% after its 10% gain in July.

August featured 13 multifamily projects valued at $100 million or more, led by the $780-million multifamily portion of the $900-million Wanda Vista Tower in Chicago, a condominium-hotel-retail project, which at 93 stories, will be the third-highest building in Chicago when completed.

Other large multifamily projects that reached groundbreaking in August were the $465-million Transbay Block 8 building in San Francisco, the $344-million multifamily portion of a $375-million mixed-use building at 1120 South Grand Avenue in Los Angeles and the $266-million multifamily portion of the $300-million Miami Worldcenter 7th Street development in Miami.

Through the first eight months of 2016, the top five metropolitan areas ranked by the dollar amount of multifamily starts were New York, Chicago, Los Angeles, Miami and Boston.

While New York City was able to hold onto to its number one ranking, its dollar amount of multifamily construction starts was down 30% in this year’s January-August period from a year ago. In contrast, large year-to-date gains for multifamily housing were reported for Chicago, up 153%; and Los Angeles, up 24%.

Single-family housing in August eased back 2%, essentially maintaining the plateau that’s been present so far in 2016. The regional pattern for single-family housing in August showed gains in the South Atlantic and the Northeast, each up 2%, while declines were reported in the Midwest, down 1%; the South Central, down 5%; and the West, down 7%.

The 7% drop for total construction starts on an unadjusted basis during the first eight months of 2016 was the result of declines for both nonbuilding construction and nonresidential building compared to a year ago.

Nonbuilding construction fell 17% year-to-date, with public works down 8% and electric utilities/gas plants down 34%. Nonresidential building decreased 10% year-to-date, with commercial building down 1%, institutional building down 8%, and manufacturing building down 45%.

Residential building continued to be the one major sector reporting a year-to-date gain, increasing 3% with single-family housing up 7%, while multifamily housing receded 4%.

By major region, total construction starts during the first eight months of 2016 showed this performance compared to a year ago—the Midwest, up 5%; the South Atlantic, up 4%; the West, unchanged; the Northeast, down 12%; and the South Central, down 25%.