Infrastructure Finance

The 2016 U.S. Election: Beyond Trump and Clinton

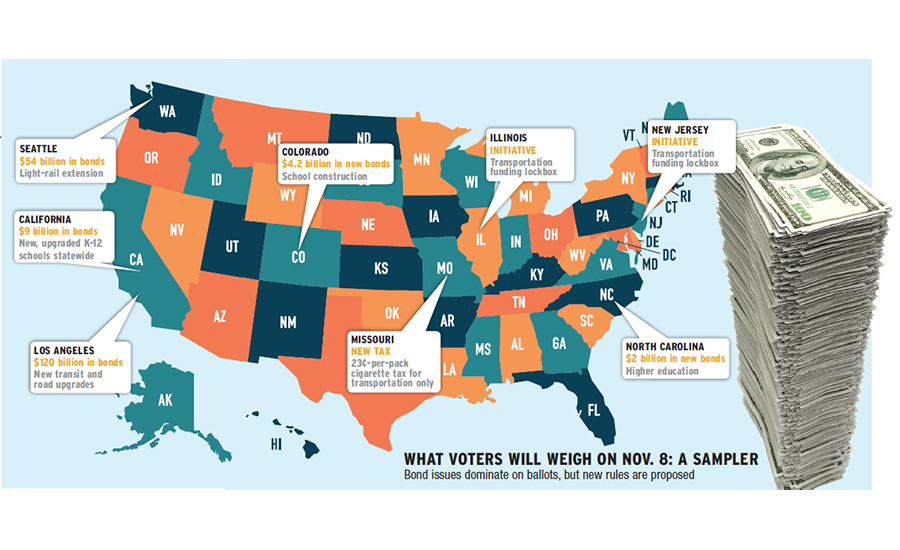

Voters face hundreds of decisions on bonds to pay for vital improvements

Map and money images courtesy of istockphoto.com, Graphic by Scott Hilling/ENR

Voters will have plenty to think about on Nov. 8, with a more contentious than usual presidential race between Hillary Clinton and Donald Trump that could influence down-ballot congressional, state and local political races. But the electorate also will decide a number of big-ticket business questions— including hundreds of state and local public infrastructure finance measures, new marijuana legalization initiatives, transportation fund lockboxes and a proposal to create the nation’s first direct carbon tax on the burning of fossil fuels.

The American Public Transit Association says the dollar tally for transit and related transportation bond issues on U.S. ballots totals $200 billion this year. According to the American Road and Transportation Builders Association, there are 87 state and local ballot measures that will finance transportation projects, including four that will affect work statewide.

Bloomberg reports that so-called megameasures are more prominent on ballots for the first time since 2008, with multibillion-dollar funding initiative for school upgrades as well as transit, that range from a $54-billion transit funding measure in Seattle to a $2-billion push for higher education and development in North Carolina.

Voters in 34 states also will decide 157 ballot propositions, up from 144 in 2014, says the Initiatives and Referendums Institute. Minimum-wage hikes are proposed in Colorado, Maine, Arizona and Washington, with the latter two states also requiring employers to provide guaranteed minimum amounts of paid sick leave.

Pioneered by Colorado and Washington in 2012, legalized private marijuana-use laws are also on this year’s ballots in Arizona, California, Maine, Massachusetts and Nevada, with four other states set to allow expanded medical use.

With growing employer concern over workplace impacts, Associated Builders and Contractors has been monitoring the legalization initiatives, says spokesman Jeff Leieritz. “State courts in legalized marijuana states have generally upheld the continuing right of employers not to tolerate use of marijuana affecting the workplace due to safety and performance reasons,” he says.

Not surprisingly, California voters could spend the most time in the voting booth next month. There are 17 state propositions on ballots there—the most in the U.S. but historically normal for The Golden State, says the institute.

Los Angeles-area voters will consider whether to approve major debt in Measure M, which is set to raise $120 billion over 40 years, with no sunset clause, for transportation projects. Notable among them are a rail tunnel through the Sepulveda Pass and a subway extension to Santa Monica, plus road and bikeway improvements. Polls show enough support for the initiative to reach the 67% supermajority needed in California to pass tax measures.

AGC of California CEO Tom Holsman predicts that high voter turnout for the presidential election will benefit state revenue measures, including Proposition 51, which would allow the state to sell $9 billion in general obligation bonds for new and modernized K–12 and community-college facilities. Prop 51 is the first school- construction bond measure on the ballot since 2006. Construction-industry and education proponents raised some $9 million for the cause and say it would create 221,000 construction jobs.

But a likely construction roadblock could come with Proposition 53, which would require statewide voter approval for a local project’s revenue bonds that are above $2 billion. AGC spokeswoman Sofia Taft says the measure “would stop or delay vital public-works construction projects and erode local control.” The measure was launched by a Central Valley landowner opposed to a proposed $15-billion delta tunnel, known as the California Water Fix.

Opponents worry Prop 53 could impact funding for the state’s high-speed-rail project. It also would bar subdividing projects into smaller chunks to avoid the statewide approval mandate. The state Building and Construction Trades Council is one of numerous groups fighting the proposition.

Also on the ballot in California are local transportation improvements, totaling more than $162 billion. Most are half-cent sales-tax measures to deliver steady revenue streams over the next three or four decades.

Maine wants voters to approve debt for $100 million in transportation upgrades; polls show support from 66% of voters but with key partisan differences. About 87% of Democratic nominee Hillary Clinton supporters said they would vote yes for the bonds, but only 46% of those backing Republican nominee Donald Trump would do likewise.

Illinois and New Jersey ballots will include “lockbox” amendments to state constitutions to earmark fuel-tax revenue for transportation spending, with both states enduring bruising budget and project funding battles this year. New Jersey’s political standoff resulted in a three-month summer shutdown of all state-funded road and rail upgrades that only now is being resolved, with a political deal late in September for a 23¢-per-gallon gas tax increase.

Without the reform, “any effort to renew and replenish the [Transportation Trust Fund] would be rendered inadequate,” says Joe Fiordaliso, president of the American Council of Engineering Companies of New Jersey. Voters are likely to approve the measure, with state roads in bad shape, but another ballot measure to expand casino gambling beyond Atlantic City appears to be already dead on arrival, according to media reports.

Voters in Colorado in November will decide up to $4.2 billion in school bond issues, the biggest tally in any single election in the state’s history and well ahead of the $2.7 billion sought in 2008. Districts in Denver and nearby Jefferson County, with a total of 177,000 students, account for the biggest pieces of the tab: $572 million and $535 million, respectively. School officials cite Colorado’s record in-migration—the Census Bureau ranks it as the second fastest-growing state since 2014—and many years of deferred maintenance and capital needs.

Energy-related initiatives on ballots include a constitutional change in Florida that would allow consumers to own or lease installed solar equipment on their properties to generate power for their own use, but that would also protect non-installers from forced subsidy of backup power and electric grid access costs the users could incur.

Nevadans will decide a constitutional amendment to end the monopoly of NV Energy as the state's power provider, in a measure that media say is backed by billionaire hotel owner-business mogul Sheldon Adelson. An AFL-CIO-backed lawsuit filed earlier this month seeks to prevent the initiative from placement on 2018 ballots since it needs two votes by state residents to be enacted.

In Washington state, there is controversy over a measure that would impose a carbon emission tax on the sale or use of certain fossil fuels and fossil-fuel-generated power. Supporters say the revenue would reduce other taxes, but business interests claim higher fuel and energy costs would competitively disadvantage state-based firms.

The initiative has split the industry: the Seattle chapter of the American Institute of Architects supports it, noting that the measure "may be the only opportunity to implement carbon pricing for many years." AIA says that while it "has some weaknesses which the legislature may wish to address after it passes, it represents a big step forward in our efforts to arrest climate change."

But the local building trades and contractors oppose it, contending the measure will boost fuel and energy costs, and leave state companies at a competitive disadvantage.

Concern over costs and competition has also sparked opposition to Colorado's Amendment 69, which would create the first state-run, single-payer health-care system in the U.S. Funded largely through payroll and income taxes, proponents say it would provide universal care for residents and save on costs. But opponents, including many in the construction sector, cite its cost—between $25 billion and $36 billion. “If it passes, it’s likely to shut off business relocations and force other businesses to move out of the state,” says Michael Gifford, CEO of AGC of Colorado. “We don’t want to see our economy go backwards.”