Last spring, at the Plant Vogtle construction site near Waynesboro, Ga., executives representing Georgia Power, its lead contractors and trades groups gathered to commit publicly to turning around the $16-billion nuclear power plant expansion. At least three years behind schedule and billions of dollars over its original budget, the massive effort—the first U.S. project of its kind in decades—is a closely watched bellwether of the country’s nuclear plans, which could fizzle if this project fails to deliver, many believe.

At the site ceremony, Georgia Power Chairman Paul Bowers noted as much when he said the utility’s construction plans for other Georgia nuclear sites “won’t materialize unless we get it right here.”

Executives with Westinghouse and Fluor, which represent the contracting team that took over on Jan. 1, publicly vowed to do what they already had contractually agreed to do: deliver the project according to schedule by achieving the in-service target dates of June 2019 and June 2020 for Vogtle Units 3 and 4, respectively.

Also on hand at the May ceremony was Sean McGarvey, president of North America’s Building Trades Union, who was fired up by the new contracting team’s promised employment opportunities. Clearly foreseeing the huge challenge ahead, McGarvey said, “There’s no better advertisement for the building trades … than for us to successfully complete this project.”

Now, nearly a year into Westinghouse and Fluor’s Vogtle project takeover from former contractor CB&I, the site’s workforce has swelled, but productivity and schedule have actually slipped, say state construction monitors.

Testimony submitted in November by Public Service Commission (PSC) staff monitors, while noting some productivity gains, provided this bottom-line assessment: “The Contractor completed less work than planned in the most recent months and has fallen further behind schedule.” The transcript marks the PSC staff’s first official analysis of Westinghouse and Fluor’s management of the project.

In joint testimony, PSC analyst Stephen Roetger and construction monitor William Jacobs noted, “The contractor has failed to achieve the project’s critical milestones in accordance with the January 2016 Integrated Project Schedule, which reconfirmed the June 2019 and June 2020 Commercial Operation Dates.” Jacobs, the state’s construction monitor, holds a doctorate in nuclear engineering and has more than 12 years of nuclear-plant construction and start-up experience.

Noting that construction completed between Jan. 1 and June 30, 2016—the period covered by their testimony—was “far below” forecast estimates, Roetger and Jacobs added, “This trend of not meeting construction forecast production continued through the … period of July 2016 to October 2016, and, since August, production actually declined.” As of Sept. 30 monitors pegged overall construction completion at roughly 36%.

Georgia Power, noting in its 15th Vogtle Construction Monitoring (VCM) report, filed in August, counters that it “has seen increased productivity and will continue to hold the contractor accountable.”

Also in the report, the utility, which owns 47.5% of the project, noted that Westinghouse and Fluor are implementing several schedule mitigation strategies, such as combining concrete placements to reduce concrete curing times and the amount of formwork construction required; increasing the use of modularized shield-building panel installation; resequencing vendor deliveries of Unit 4 components to optimize fabrication and on-site assembly scheduling; and adding craft and equipment to support two five-day, 12-hour shifts.

Georgia Power also reported that Westinghouse and Fluor have developed a plan that comprises 108 proposed actions to improve construction performance. Of those, 47 actions relate to project management and oversight, 17 to field supervisor performance and 14 to craft performance. Officials with Georgia Power, Westinghouse and Fluor declined to make themselves available to ENR for comment at this time, with the utility and contractor instead deferring until next year.

Earlier this year, Darrell Waters, Fluor’s senior vice president and project site director, told ENR that the contractor would seek to deliver a “step-change in performance … very quickly.”

One of the biggest moves Fluor and Westinghouse planned was a rapid workforce ramp-up. Since taking over the project in January, the contractor has added to the site an estimated 1,300 craft workers, for a total of more than 6,000.

Roetger and Jacobs say the action has not yet produced gains. Instead, they testified, “The addition of these craft personnel has not increased production … due to lower productivity of the craft workforce.”

North America’s Building Trades Union representatives, who also were present at the May ceremony, declined to comment for this story.

Meeting Milestones

Nevertheless, contractors are delivering a sizable amount of work. According to Georgia Power, Vogtle contractors performed 6.9 million work-hours from January to June 2016, installing or placing more than 1,480 tons of rebar, more than 2,451 tons of structural steel and more than 10,845 cu yards of concrete in the nuclear islands, turbine islands and annex building.

Also, contractors have hit several major milestones in recent months. In November, Westinghouse announced crews had placed the 278-metric-ton Unit 3 reactor vessel and the Unit 4 CA01 module, both achieved within a 48-hour span. Compared against the state PSC staff’s most recent estimates, both of these achievements came roughly one month behind schedule.

The Unit 3 reactor vessel’s placement marks the project’s transition from “strictly civil engineering and construction to assembly of the unit’s reactor system,” Jeff Benjamin, Westinghouse senior vice president, noted in a press statement. Workers now will begin to install piping, pumps and cabling.

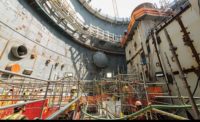

Over at Unit 4, just two days prior, contractors placed the 907-metric-ton CA01 module, a 21-meter-long, 29-m-wide and 24-m-high steel structure that will house the reactor vessel, steam generators and pressurizer.

Even more recently, in mid-December, Westinghouse announced the placement of Unit 3’s second containment vessel ring, weighing 1,119 metric tons; it is the third of five sections that comprise the plant’s 60-m-tall containment vessel, another steel structure housing the reactor vessel and other systems. Contractors previously had placed the containment vessel’s bottom head and first ring. Installation of a third ring and containment-vessel top head will follow. Fabricated from multiple courses of steel plates, the ring measures more than 15 m high and nearly 40 m in dia.

Westinghouse’s Benjamin described the containment vessel as “an integral safety component” that provides a “robust barrier and [serves] an important function in the plant’s passive containment cooling system.” The passive containment system uses natural forces, such as gravity, natural circulation and condensation, to shut down the reactor automatically for up to 72 hours, the company states.

For example, according to the firm’s website, “the AP1000 plant is designed to drain the high capacity in-containment refueling water storage tank water into the reactor cavity in the event that the core has overheated. This provides cooling on the outside of the reactor vessel preventing reactor vessel failure and subsequent spilling of molten core debris into the containment.”

Despite the recent progress, final completion milestones are beginning to loom large. The start of a process called hot functional testing (HFT) for Unit 3 is scheduled to begin in May 2018, just over a year before the June 2019 commercial operation date (COD). During HFT, the plant is heated to normal operating temperature and tested as an integrated unit.

To begin HFT for Unit 3 as scheduled—a key to achieving the COD on time—project monitors say nuclear island buildings (shield, auxiliary and annex buildings), nuclear steam supply components and the turbine building all must be “essentially complete.”

To date, none of those Unit 3 structures is more than 35% complete, which is the turbine building’s actual completion percentage, according to the PSC staff’s recent testimony. That compares to the structure’s forecast completion percentage of 43%, an 8% shortfall. The other structures in descending order of percentage completion, along with their corresponding forecast figures, are the auxiliary building, 31% (versus 39% forecast); the shield building, 29% (36%); and the annex, 13% (33%).

In their testimony, project monitors noted the schedule challenge facing the contracting team by asserting that productivity would have to reach “much higher monthly rates” than the team achieved in 2016.

To meet the current CODs, they added, “the amount of construction work required to be completed each month increases in each subsequent month through September 2017 to a rate over three times the amount that has ever been achieved to date on this project.”

A Major Stipulation

Originally, Plant Vogtle’s Unit 3 was supposed to be operational by 2016. Despite the PSC staff’s testimony of continuing schedule slippage since 2015, when Georgia Power announced an 18-month extension, those June 2019 and June 2020 CODs have stayed unchanged.

Federal nuclear production tax credits currently expire on December 31, 2020–the date by which plants must be operational to qualify for the subsidy—which reportedly equates to $18 per megawatt hour for a period of eight years. Unless some in Congress are able to extend the deadline, Georgia Power and its contractors have little leeway for Unit 4.

PSC staff are skeptical contractors can complete Unit 4 by the 2020 deadline, testifying, “This date can only be achieved if all mitigation is successfully implemented as planned and no additional delays occur to future activities, which we believe to be highly unlikely.”

Further, the long-simmering issue of the financial impact to ratepayers has escalated. In November, a group called the Concerned Ratepayers of Georgia (CRG) intervened in the Vogtle hearings. There, Executive Director Ben Stockton, another engineer with nuclear construction experience, derided Georgia Power’s assertions that the nuclear expansion was needed and that the project has been managed in a “prudent” manner.

In mid-December, PSC staff and Georgia Power filed briefs supporting an agreement, called the “Stipulation,” that caps impact to ratepayers. By reducing the maximum rate of return Georgia Power can earn and deferring the recovery of construction costs, the utility says the stipulation reduces the estimated amount customers will pay by $185 million while deferring $139 million until the units are on line.

The proposed stipulation generally classifies as “prudent” most costs to date. Under the agreement, the PSC would retain the right to review and disallow the previous capital costs associated with items that, for instance, do not perform as designed or else delay the schedule.

On Dec. 13, Stockton and CRG filed a protest in which he called the stipulation process a “complete sell-out for all Georgia Power customers.” Stockton also noted that previous prudency hearings regarding the construction of Vogtle Unit 1 and Unit 2 resulted in a $951-million disallowance of the utility’s rate-hike requests.

In testimony related to the stipulation, PSC staff argued that the effort likely would have resulted in years of hearings and appeals, with the potential that no capital costs would be disallowed and with only the possibility of reducing future costs to ratepayers.

Meanwhile, Georgia Power says the peak-rate impact on electricity costs for customers will be roughly 6% to 7%, which it claims is nearly half of the original rate-impact forecast. The utility expects the new nuclear units, once on line, to “deliver long-term savings for Georgia customers.”