When the Trump administration finally reveals the details and timing of its much-touted infrastructure investment program, the American Society of Civil Engineers has a good idea of what needs to be done.

The ASCE’s latest “report card” of U.S. fixed assets rated the nation’s roads, bridges, water systems and other infrastructure as a D+ overall, a grade no better than its last evaluation, in 2013.

|

| Click to view chart |

Transit is at the bottom of the group, falling to a D- score (see chart), said Greg DiLoreto, chair of ASCE’s committee on America’s infrastructure, at the report’s March 9 release in Washington, D.C. He said public transit systems have been “chronically underfunded” and have a $90-billion maintenance backlog.

Freight appears to be having a more comfortable ride than people, scoring a B—the highest grade among infrastructure categories—thanks to private-sector railroads’ strong capital investment.

ASCE says more funding and other investment is key to raising the scores. It estimates there is a $2.06-trillion gap over 10 years between current infrastructure spending levels and what is needed to pay for upgrades.

The 2013 report card pegged the shortfall at $1.6 trillion, measured over eight years. The largest gap is in surface transportation, with an estimated $1.1 trillion, more than half the total shortfall.

The report calls for increased infrastructure funding—to 3.5% of the gross domestic product by 2025, up from 2.5% currently—from federal, state and local government and the private sector.

In a key recommendation, ASCE calls for a 25¢-per-gallon boost in the federal motor-fuels tax, said DiLoreto, retired CEO of the Tualatin Valley Water District, in Oregon.

Norma Jean Mattei, ASCE’s 2017 president and a University of New Orleans professor in the department of civil and environmental engineering, added that the recommendation also includes indexing the fuels tax for inflation. Referring to the overall infrastructure investment gap, she said, “There’s no magic wand to address this, no infrastructure money tree, no infrastructure private-sector angel.”

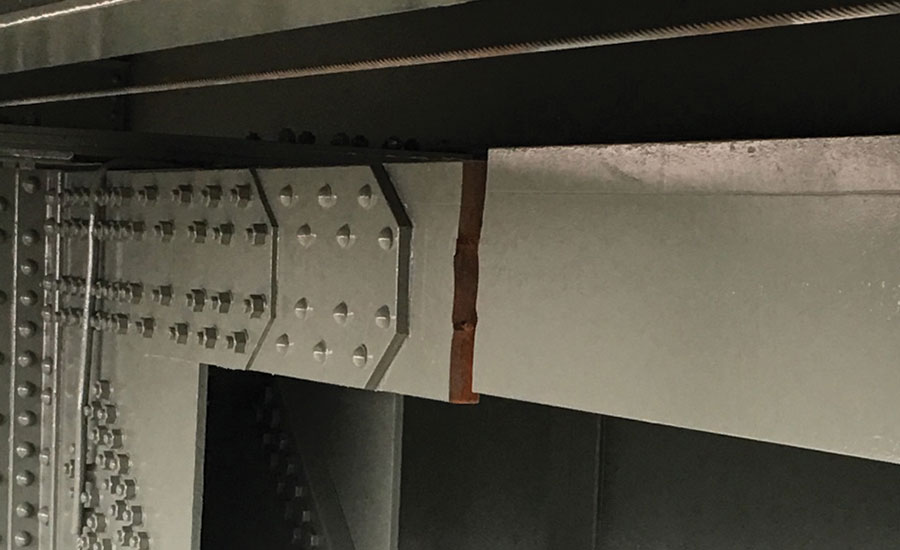

Other transportation grades include D grades for aviation and roads and C+ scores for bridges and ports. Among environmental and flood-control infrastructure assets, dams, drinking-water facilities and levees each rated a D.

“From Flint, Michigan, to Los Angeles and hundreds, possibly thousands, of other communities, the cascading effects of the nation’s crumbling water infrastructure is a clear and present threat,” said Michael Deane, executive director of the National Association of Water Companies. “The water challenges facing this nation and affirmed by ASCE’s 2017 report make it clear that communities need to consider multiple solutions.”

Media reports have speculated that the administration’s potential $1-trillion investment takes a backseat to other priorities, such as the Obamacare health-plan replacement and tax reform, and may not be unveiled until 2018.

In a March 14 report, The Hill newspaper says states "have submitted hundreds of transportation proposals for the administration to start vetting, and Congress held a hearing to explore potential funding options. Yet a timeline for considering the plan remains up in the air, and it is unclear how the infrastructure projects would be paid for.”

DJ Gribbin, a former Federal Highway Adminisration chief counsel who also worked for engineer HDR and project investor Macquarie Capital, was named in late February as a special assistant to Trump for infrastructure policy.

Trump also has named two supporters, New York City developers Richard LeFrak and Steven Roth, to lead what the Wall Street Journal termed a “council of builders and engineers to oversee his infrastructure spending plans and vet potential projects.” However, neither the projects nor the council’s members could be confirmed.

At a March 14 hearing of the Senate Energy and Natural Resources Committee, Chairman Lisa Murkowski (R-Alaska) emphasized that “energy infrastructure … belongs in any conversation we have about roads, bridges and airports.” She added, “Hundreds of projects representing billions of dollars of investment are currently navigating the federal labyrinth of permitting … layered on top of state and local permitting processes, with little to no apparent coordination.”

Senate Appropriations Committee Vice Chair Patrick Leahy (D-Vt.) said "we have not seen a plan for real investment from the Trump administration. We have only [heard] vague talk about tax breaks to corporations, imposing more toll roads on the middle class and leaving rural America behind.” But congressional officials and private-sector experts say private investors are more enthused about new projects with a better return than repairing existing infrastructure.

Leahy said the ASCE report card “serves as a timely wake-up call” to the administration and Congress. “Regrettably, President Trump’s proposal to cut $54 billion from non-defense programs next year [as outlined in the fiscal 2018 budget released on March 16,] is a giant step in the wrong direction,” he added.