Infrastructure Propels Bullish Design Market

The five-lane Genesee Avenue bridge over I-5 in San Diego is being replaced with a new 10-lane overcrossing.

PHOTO COURTESY OF KIMLEY-HORN

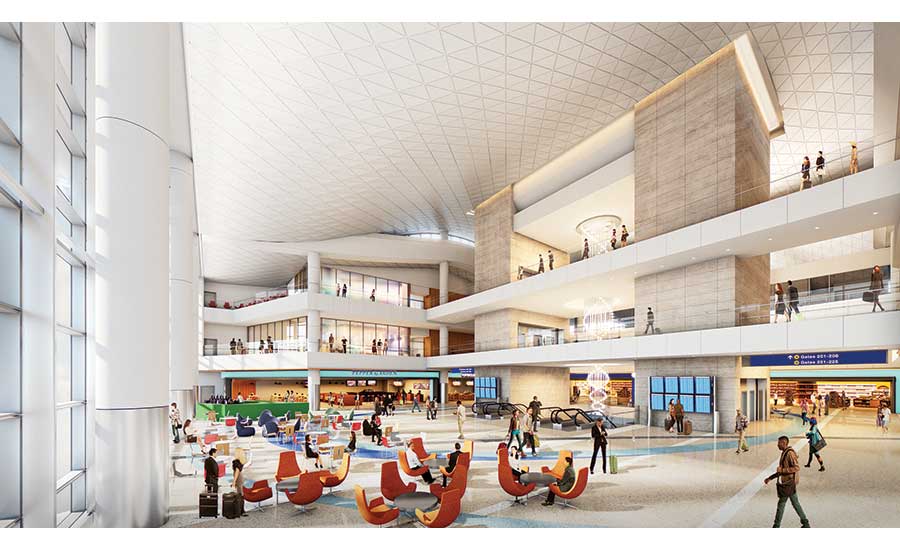

Several firms in the ranking worked on the design for the $1.6-billion Midfield Satellite Concourse at LAX, which broke ground in February.

IMAGE COURTESY OF CORGAN

Design firms continue to ride a strong wave of success in California. The 95 firms that participated in this year’s Top Design Firms survey reported $4.87 billion of combined revenue in California during 2016—a 14% increase from the previous year. In the three most recent surveys, combined revenue in the state has grown by 33%.

Firms with practices in transportation and other infrastructure are particularly bullish on the market. Don Sepulveda, deputy national market lead, rail and transit for West Coast operations at Michael Baker International, notes that several significant tax measures have passed to provide funding for transportation projects in the region. In Los Angeles, for example, passage of Measure M in November will provide $120 billion to advance the Los Angeles Metropolitan Transportation Authority’s long-range transit plan for the next four decades.

|

ENR California Top Design Firms 2017 |

“The Western United States is riding on a transportation boom,” he says. Michael Baker saw annual revenue rise 24% in California—to $120.1 million in 2016 from $96.8 million in 2015. Transportation work accounts for 19% of the firm’s total revenue.

Kip Field, Southern California area manager for HDR, says his firm is also optimistic about Measure M projects, which will leverage funds from a half-cent sales tax increase that takes effect on July 1. “Funds will be immediately allocated toward larger infrastructure projects, including Link [Union Station], regional rail projects such as the Crenshaw Line, Regional Connector, Purple Line Extension, bus rapid transit projects and developments that are widely supported by the local community such as the LA River Bike Path and Rail to River Trails projects.”

HDR, which saw annual revenue rise 7% in California last year, is currently working on the Link Union Station project for the Los Angeles County Metropolitan Transportation Authority.

WSP USA is banking heavily on rail work in the state. Last year, it broke ground on the $2-billion Mid-Coast Corridor Transit Project in San Diego. And, WSP USA and partner Network Rail Consulting are responsible for program management, integration, delivery and operations and maintenance planning on the California High-Speed Rail Project, which is now under construction in the Central Valley. In Los Angeles, the firm is at work on the Regional Connector and the Purple Line Extension.

Some firms are also eying significant opportunities in aviation. “We anticipate demand. The need to upgrade aging infrastructure will drive opportunities in our market sectors to continue over the next five to 10 years, especially in the aviation sector,” says Brent Kelley, principal at Corgan.

Corgan, in association with Gensler, is leading design of the $1.6-billion Midfield Satellite Concourse at Los Angeles International Airport. The new 12-gate facility, which will serve as an addition to Tom Bradley International Terminal, broke ground on Feb. 27.

Kimley-Horn, which is the lead civil engineering consultant on the LAX Midfield Satellite Concourse project, expects to see a steady stream of work as well. “We continue to be optimistic about the next several years ahead, based on the robust funding environment through recent local and state funding commitments to transportation and other areas of infrastructure within our areas of expertise,” says Jason Matson, Kimley-Horn’s California regional leader.

Stantec has positioned itself to capitalize on a wide range of opportunities in the water sector. Last year, the firm acquired MWH, which helped boost its annual revenue by 62% to $340.3 million. “We see a continued interest and investment in water infrastructure throughout California,” says Alfonso Rodriguez, Stantec’s Pacific Region vice president. “Rains from the past year have transitioned many client discussions from conservation and efficiency to storage and flood planning. Stantec’s 2016 acquisition and consequential integration of MWH has been a good pairing with these marketplace trends, with the combined companies successfully winning project work.”

Woodard & Curran also firmed up its position in the water sector through acquisition, adding RMC Water and Environment in late 2016. RMC had seven offices throughout California with expertise in integrated water resource management and potable reuse. Alyson Watson, municipal west business unit leader at Woodard & Curran, says the acquisition of RMC rounds out the firm’s water resources management portfolio.

In the building sectors, some firms are also seeing big bumps in revenue. Bonnie Khang-Keating, Los Angeles office director for SmithGroupJJR, says that although some small to midsize offices are experiencing a slowdown in limited sectors, “the design and construction industry seems to be strong and resilient in Southern California.”

SmithGroupJJR saw revenue jump to $82.06 million in 2016 from $59.29 million in 2015. “The economy will certainly slow down at some point, bringing with it the challenge of growth and recruitment in a competitive market,” she adds.

Joyce Polhamus, San Francisco office director for SmithGroupJJR, says capital spending remains strong for both institutional and private developers in the Bay Area. “As new projects are completed in the city, we expect to see an uptick in office tenant improvement and retrofit projects,” she says. “Health care activity will likely remain steady as well, with a wave of backfill projects and continued growth in ambulatory, specialty care, urgent care and cancer centers. The seismic upgrade deadline of 2030 continues to drive the need for replacement hospitals in the Bay Area, Sacramento and Central Valley.”

Amy Williams, managing principal at HDR in Pasadena, also sees seismic work keeping the health care market steady for years to come. “The future of health care in America continues to be unsure,” she says. “Nonetheless, California Senate Bills 1953 and 90 are mandating facilities be compliant with state seismic requirements by 2020/2030. The level of national insecurity related to health care spending has caused a number of organizations to delay upgrades. At this point, time is the critical factor for compliance and a number of entities are moving forward with the necessary upgrades.”