Neither Jacobs Engineering nor CH2M would confirm acquisition talks between the two U.S. design-construction giants, as reported on July 19 by the Times of London.

"We do not comment on rumors or speculation,” said Mendi D. Head, Jacobs vice president of global communications.

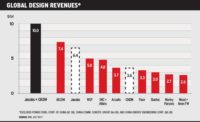

If it is negotiated and closed, the combination of the companies may be the biggest construction and engineering deal of the year. Jacobs reported about $11 billion in 2016 revenue.

In a July 19 research report, Andrew Wittmann, chief industry analyst at Baird Equity Research, cites "chronically low margins" at the $5.2-billion revenue CH2M despite a $300-million investment from private equity firm Apollo Global Management LLC in 2015.

But he says the terms of that investment "practically necessitates a transaction for CH2M over a fairly compressed time period, lending credibility to the Times' report."

Jamie Cook, who leads construction industry coverage at Credit Suisse says "there is probably some truth to this deal," as she notes was reported by Bloomberg. "This would be large deal for [Jacobs], and in our view, provide greater exposure to government/state customers vs. private as well as the nuclear and water end markets, consistent with where JEC wants greater exposure," she says in a July 19 research note.

She notes CH2M's current $8.2 billion in backog, but also points to project "execution issues" related to an EPC power project in Australia and a toll road expansion in Texas.

Adds Wittmann: "While today's equity market typically rewards deals on cash-[earnings per share] accretion and cost synergies, the disruption created from large-scale integration of people businesses remains a process few have mastered. Accordingly, for longer term investors. our first blush on the deal is negative, particularly with improving revenue and margin trends in [Jacobs]' legacy business setting a more positive organic path forward."