|

| Steve Demetriou, Jacobs |

Jacobs Engineering confirmed a deal to purchase Denver-based CH2M, announcing the acquisition agreement on Aug. 2.

Under the deal, which had been reported widely prior to its official announcement, Dallas-based Jacobs would acquire CH2M in a cash and stock purchase for about $3.27 billion, including about $416 million of debt. The deal, which still needs a CH2M shareholder vote and government approvals, is set to close by year-end, says Jacobs.

When completed, the transaction would create a $15.1-billion revenue company, according to Jacobs.

On its website, CH2M says the $88.08 per share price would be a premium over the firm's share price on Aug. 2 of $50.69. It said shareholders could choose any combination of cash and stock (see announcement details here).

In follow-up comments to ENR, Jacobs Chairman and CEO Steve Demetriou said "the industry is resource constrained. This is what we needed at Jacobs, CH2M's great talent." He is set to maintain those roles in a combined company, which would include 20,000 CH2M employees added to Jacobs' 54,000.

He said Jacobs was "invited by CH2M" to consider the deal. "We have partnered with the right strategic firm." said Demetriou, who became Jacobs' CEO in August 2015.

"It's all about growth. We will create a company that doesn’t exist in the industry," he said. "We are excited about the new capabilities."

The deal price surprised some market analysts. It was "much higher than we expected," says Andrew Wittmann, construction sector analyst at Baird Equity Research, "with the industry track record on large M&A integration success mixed."

But he emphasized that "with CH2M checking boxes in water, nuclear/environmental remediation, and broader government services, these businesses reduce market cyclicality, are favorable to working capital, and lower risk" for Jacobs.

Wittmann cautioned that there could be more overlap between the two firms' transportation businesses that could be a risk for both firms.

|

| Jacqueline Hinman |

CH2M Chairman and CEO Jacqueline Hinman said recent restructurings by both firms reduced the overlap.

Jacobs predicted about $150 million in cost synergies focused on real estate consolidation, non-labor procurement efficiencies and IT. "Synergies appear reasonable, assuming revenue holds," said Wittmann in a research note.

Demetriou noted CH2M's "leadership" in the water sector, characterizing it as a $100-billion market.

Jacobs is set to report its third-quarter results on August 8, while CH2M will report for its second quarter on August 10.

In a presentation to investors, Jacobs CFO Kevin Berryman said that "legacy issues" related to CH2M projects in Texas and Australia are "winding down" and had involved "extreme due diligence. We believe we have covered ourselves. We are buying a fundamentally low risk project portfolio" (see chart below).

He said pension liabilities totaling about $300 million "have been evaluated."

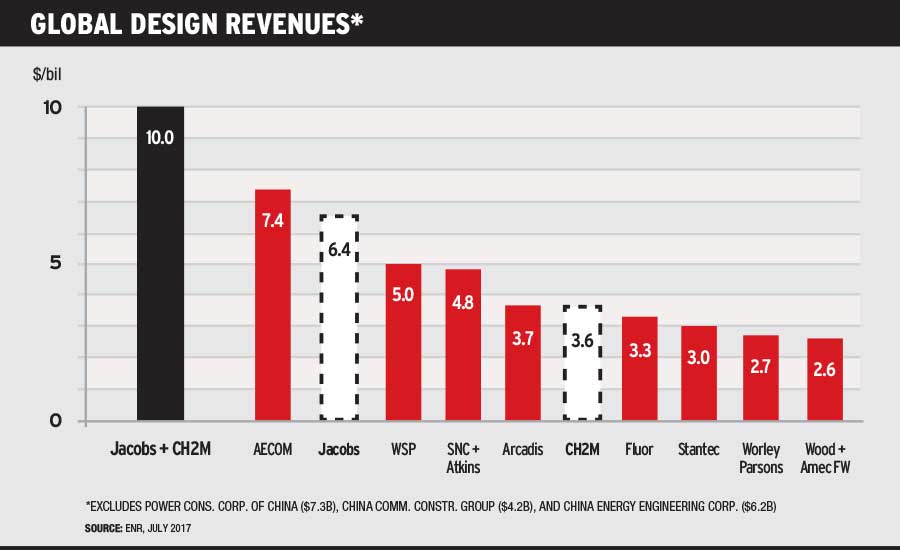

Demetriou added that "we're not going down the path of being a construction firm. Design is key and we will be the largest design firm in the world."

|

| Source: Jacobs presentation to media Aug. 2, 2017. |

That last point has special significance.

CH2M may have sealed its own fate several years ago with a shift into fixed-price contracts that exposed the company to new risks. The problem projects, together with the company's significant debt, drained cash for several years and forced CH2M to lay off employees, cut costs and exit fixed-price EPC work and design-build transportation infrastructure.

The cash drain exacerbated the problems inherent in the company's employee-ownership model, where each quarter the board set a price for the stock. Sellers sometimes outnumbered buyers, especially as the company's problems worsened.

In June, 2015 CH2M arranged to sell preferred shares equal to 20% of its equity to a private investment firm, but the deal terms further restricted CH2M's ability to buy back shares from current employees and retirees.

According to some former employees, they worried about the price they would receive when they could sell as many shares as they wanted to as the company's internal repricing of its share fell from $62 to $50.

Now presumably those shareholders will be repaid with cash and Jacobs stock.

No Future Role for Hinman

Jacobs did not disclose a future role for Hinman in the pending combined firm, and in a statement to ENR, she alluded to a future elsewhere.

Hinman said: “Between now and transaction closing, I continue to proudly serve as Chairman and CEO of CH2M .... because we accomplished all of the goals established when I became CEO in January 2014, reflected in the excellent premium we’re commanding in this combination. Once completed, I’ll take that experience and pride in all we achieved at CH2M on to my next opportunity, to transform another company.”

Jacobs says it has formed an "Integration Management Office" to oversee the link of the two companies. It will be led by senior executives from both companies: Gary Mandel, most recently Jacobs president of petroleum & chemicals, who was named executive vice president of integration for the firm, and Lisa Glatch, executive vice president for gowth and sales at CH2M.

New roles for other senior executives were not disclosed.

Hinman also said the use of the CH2M name in post-deal completion branding has "not been decided."

Demetriou added that CH2M would benefit from Jacobs' "global industrial platform" and "a culture of accountability, improved project delivery and more efficient receivables capability," as well as "a well capitalized balance sheet."

_ENRready.jpg?height=200&t=1732204916&width=200)