Viewpoint

New Industry Study Says Firms Must Begin Management Succession Plans Early

As baby boomers continue to retire in large numbers, many are leaving leadership of their companies to the next generation.

ILLUSTRATION COURTESY OF ISTOCKPHOTO.COM

|

| Jake Appelman |

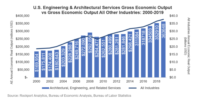

As baby boomers continue to retire in large numbers, many are leaving leadership of their companies to the next generation. More than 50% of engineering and construction firms are expected to change ownership in the next 10 to 12 years, according to a recent study by industry consultant FMI. However, with rampant talent shortages across the industry, firms must both acquire and develop talent while transferring ownership to a new generation, the study says.

FMI’s study focused on questions of ownership transfer and management succession (OTMS) to assess how companies find and develop next-generation leaders. The findings reveal several emerging trends:

- Fewer firms have family members active in their businesses today than in 2013 (45% in 2017 versus 73% in 2013, according to the FMI survey). Even fewer say the next generation will own and run the business in the future (32% in 2017 versus 52% in 2013).

- In 2013, 17% of respondents planned on a third-party sale. In 2017 that number has declined to 8%. Conversely, employee stock ownership plans (ESOPs), have gained in favor among respondents, increasing from 4% to 12% from 2013 to 2017, respectively.

- Firms with a clear strategy for the future are more likely to have a formal ownership transfer-and-succession management plan in place.

- Successions in the engineering and construction (E&C) industry require embracing nontraditional development plans and cultural shifts.

- Less than half (44%) of survey participants indicated that current leaders are held accountable for their own succession.

The survey also revealed that many next-generation leaders (47% of identified successors) are unprepared to lead the business for another three to five years. Worse still, options are dwindling for baby boomers who have delayed their transition planning. That’s due to the amount of time needed for effective ownership and leadership transition.

Winning the War for Talent

|

| Scott Duncan |

For successions to be effective, companies must prepare leaders years in advance. The problem is that most E&C firms have not planned or are unaware of the work that goes into an effective transition.

The older model of “throwing” people into situations and hoping they steer their own leadership development doesn’t work. Companies that take this approach in the absence of a professional process for talent development will be at a significant disadvantage. The problem is particularly acute in a market like the current one, where a major war for talent is underway.

For most owners, no simple solution exists for ownership transfer and leadership succession. Like a game of chess, it involves many moving parts—for example, equity transfer, shifting risk to the next generation from the principal owner, growing the business while funding the transition—and demands highly focused concentration to navigate. Even the best plans must be continually reevaluated and adjusted.

Progressive leaders recognize the complexity of the challenge. It’s not simply a financial or tax problem, an organizational or family problem, or a bonding or banking problem. It’s a combination of these. Each entity is different, and all the puzzle pieces must fit. Further, finding the right combination for success varies greatly, depending upon the nuances, traits and goals of an organization’s current and future owners.

Creating a Continuity Mind-Set

Effective leaders who understand continuity often must make hard, unpopular choices. The winning formula for an effective succession demands courage, humility and a long-term focus. A proactive approach will help to ensure that the right people are ready at the right time to enter leadership roles and become future owners. The key is to have the best talent in the most strategic positions—and the bench strength to fill crucial roles when the time comes.

In today’s business landscape, companies must raise the bar when identifying, assessing and developing leaders. These steps need to happen early in the careers of potential leaders. The strategy requires that senior leaders adjust their own positions in a way that opens up new roles for younger candidates.

Many firms have met this challenge head-on, while others continue to defer the issue to later years. But for those who wait, the complexity of ownership transfer and leadership succession will only increase with time.

How to Plan for a Succession

- Get started early. Ownership transfer can take up to a decade or more, which is often substantially longer than most owners anticipate.

- Understand your options. It’s important to understand the available options. Does an ESOP fit your business profile? Is a third-party sale feasible? How long will an internal transfer take?

- Focus on talent. Ownership transfer options are entirely dependent on the talent within an organization. A proactive approach to recruiting and retaining talent improves a company’s odds of a successful transition.

- Keep it simple. While there are myriad ways to transfer ownership, the simplest plans are often the most successful. The ability to explain the transfer process clearly and succinctly to new owners is critical and often overlooked.

- Don’t lose track of the obvious. Every transition plan depends on the future profits of the business. Maintaining a focus on the continued profitability of the business is integral to any ownership transfer.

Jake Appelman is a principal with FMI and part of the firm’s Center for Strategic Leadership. Contact: jappelman@fminet.com

Scott Duncan is a managing director with FMI Capital Advisors Inc. Contact: sduncan@fminet.com