Power Plant Construction

Companies Look Abroad and to Small Nuclear Reactors as U.S. Work Slows

The new projects are in India, China and Russia

The NuScale power module incorporates steam generation and heat exchange into a single unit.

PHOTO COURTESY OF NUSCALE

NuScale shows off a full-scale mock-up of the upper module of its small nuclear reactor.

PHOTO COURTESY OF NUSCALE

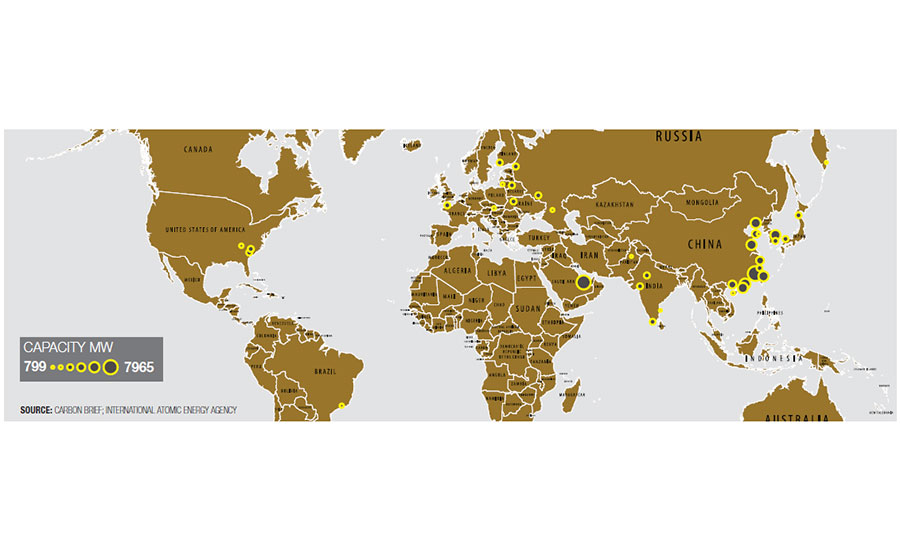

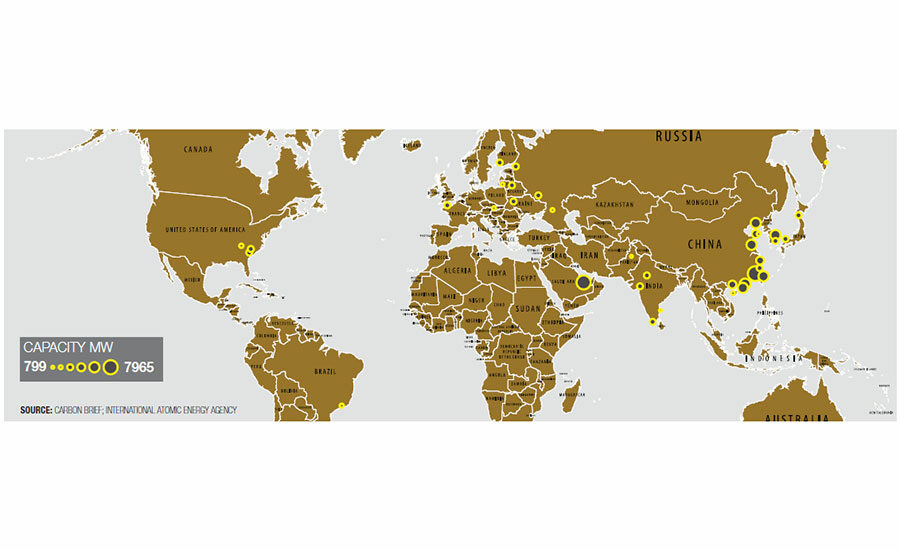

The majority of new nuclear plants are being built in Asia, specifically China. This map shows the concentraiton of new nuclear plants in different countries.

SOURCE: CARBON BRIEF; INTERNATIONAL ATOMIC ENERGY AGENCY

China National Nuclear Corp. is testing its AP1000 Sanmen plant, which should be on line in 2018.

PHOTO IMAGINECHINA VIA AP IMAGES

Don’t tell Bill Gates, Fluor Corp. or China that nuclear power is on the wane. And certainly don’t mention the trend to the companies that are developing more than 90 advanced nuclear technologies or the 15 countries building 60 reactors.

While economic, construction, engineering and regulatory factors make it unlikely that—for years, if ever again—another large nuclear plant will be built in the U.S., several companies are spending millions of dollars to develop different nuclear technologies and small modular designs that may prove to be cheaper, easier to build and more flexible in their capacity.

And the factors that make big nuclear difficult in the U.S., like cheap domestic natural gas, aren’t hampering new builds in China, Korea, India and elsewhere.

“Internationally, in 2016, slightly under 10 GW of new generation was brought on line, the newest generation since the 1980s,” says Matt Lee, director of nuclear operating-plant projects for Black & Veatch. “New nuclear is not dead. It is actually growing.”

Indeed—as the U.S. is looking away from big new nuclear plants—India, China, Russia and other countries are turning to new nuclear to provide power to their growing populations and to reduce carbon emissions under the Paris Climate Accord.

In addition to the 60 reactors being built, 100 more are on order or planned, and more than 300 are proposed, according to the World Nuclear Association.

The strongest market for new nuclear power is in Asia, specifically China, where 20 new reactors are under construction. In fact, China is on track to bring four AP1000 reactors on line next year. The Westinghouse-designed AP1000 was used to build the now-canceled V.C. Summer reactors in South Carolina, as well as the two Vogtle reactors in Georgia that now are scheduled to come on line starting in 2021.

Related Article: Witness to the Origins of a Huge Nuclear Construction Flop

Compared to China’s nuclear industry, U.S. players face a more rigorous regulatory authority at the federal level. “I think it costs less in China because of [Nuclear Regulatory Commission] scrutiny,” says Aneesh Prabhu, senior director of U.S. energy infrastructure for S&P Global Ratings. In the U.S., “labor costs are more [and] material costs are more because you want to gold-plate the plant” to achieve NRC approval, he observes.

Further, other countries have a greater commitment to nuclear power than does the U.S., says Rex D. Geveden, president and CEO of BWX Technologies. BWXT and Bechtel earlier this year halted development of a small modular reactor called mPower because they determined there was little demand for the reactor.

“If you look at what’s going on in China, India and the Middle East, those nations are committed to energy independence. They are committed to energy security.”

– Rex D. Geveden, president and CEO of BWX Technologies

“If you look at what’s going on in China, India and the Middle East, those nations are committed to energy independence. They are committed to energy security,” says Geveden. “When there’s a national commitment to it, you can make it happen.”

While Geveden doesn’t see that commitment yet on these shores, the push toward new nuclear in other countries is a business opportunity for U.S. companies, including BWX, which is working in Canada as well as the U.S.

Black & Veatch sees opportunities as an owner’s engineer in the United Kingdom, Argentina and South Africa—“That’s our primary focus outside the U.S.,” says Lee.

But transferring U.S. nuclear technology and knowledge can prove to be difficult. Before U.S. companies can enter into a nuclear deal with another country, Congress must approve the “123” agreement with that country. The agreement, under the Atomic Energy Act, sets the terms for sharing U.S. peaceful nuclear energy technology, equipment and materials.

The U.S. has such agreements in place with countries including Japan, Australia and South Africa, but not with Iran or India. Further, the Energy Dept. oversees exports and imports of nuclear materials under another law. “U.S. companies have limitations,” Lee said.

The nonproliferation agreements make it costly and difficult—if not impossible—to work with other countries. The Nuclear Energy Institute (NEI), among others, says the restrictive regulations must change or the U.S. risks being shut out of oversight of nuclear programs in developing countries.

“The U.S. position generally comes from the 1950s, when the U.S. was the only one supplying the technology,” says Marcus Nichol, a senior project manager at NEI. “Today, those same conditions don’t exist.”

Indeed, if a nonproliferation agreement has not been forged, a country seeking a U.S. company’s technology must look elsewhere, Nichol notes. “There is a fundamental change that needs to happen,” he says. If U.S. companies aren’t supplying the technology to build the plants, “we’re allowing China and Russia to dictate the standards.”

The red tape, however, isn’t keeping U.S. companies out of the international market. Earlier this year, Holtec and SNC-Lavalin agreed to develop and globally deploy small modular reactors, while GE Hitachi Nuclear Energy and Advanced Reactor Concepts, both based here, are working together to develop a reactor in Canada.

--------------------------------------------------------------------

The Future of Nuclear Energy: More Analysis

>Is Georgia's Project the Nuclear Revival's Last Gasp?

--------------------------------------------------------------------

One company, NuScale, sees a market for the small reactors both internationally and in the U.S. and, since 2000, has invested almost $700 million to design and build the new reactor, says John L. Hopkins, CEO of NuScale and a former Fluor Group president. Fluor became majority owner of NuScale in 2011.

NuScale has an agreement with the Utah Associated Municipal Power Systems to build a 600-MW nuclear plant at the Idaho National Laboratory, using 12 of its 50-MW small modular reactors (SMRs). Earlier this year, NuScale submitted its design to the NRC. The application was partly financed through the Energy Dept.’s licensing and cost-share program. Design certification is expected to take 40 months. So far, the process is going well and ahead of schedule, Hopkins says.

“I’m pretty bullish that we’re going to get through this,” Hopkins says. The company expects to be operational in Idaho by 2024 or 2025. He says the company is “paving the way” at NRC for a host of other technologies, such as TerraPower’s travelling wave reactor. A venture partly funded by Bill Gates, TerraPower hopes to have its first reactor operating in China by 2024.

NuScale and other modular developers tout the efficiencies of having a controlled factory in which to build modular reactors that can be shipped and installed in place on site. The streamlined process is tantamount to a large heavy-civil project. Ideally, the units would be mass-produced— similar to at Boeing, Hopkins says—and shipped in three pieces to the site. One hundred and twenty-six of the smaller units can fit inside the containment vessel at Vogtle, he notes.

The smaller, scalable nature of the units makes them more attractive than a 2,000-MW nuclear plant, says Prabhu of S&P. Hopkins says the 600-MW plant can be built on 32 acres for less than $3 billion, and owners can choose to build them in smaller, 50-MW increments.

NuScale, however, is not selling its technology as a replacement for traditional nuclear plants.

“Our focus is not to compete against large reactors or renewables,” Hopkins says. Instead, he thinks the reactors are best seen as a replacement for retiring coal plants. The SMRs could be installed on the same site as an aging coal plant and use the same transmission system. “Our sweet spot is between 300 to 600 MW,” Hopkins adds.

NuScale sees other applications for its reactors, such as supplying affordable power for refining and desalination plants. “In the end,” Hopkins says, “it’s all about commercial viability.”

Unlike larger reactors, which slowly start up and slowly shut down, the smaller reactors can be quickly ramped up and down, depending on what other electricity is being supplied to the grid. This feature makes them a more useful companion to wind and other renewable power. Currently, if older, larger nuclear plants are running when the wind is blowing, a nuclear plant often has to sell its power at the same price as wind, which can be below an operator’s cost, Prabhu says.

Nichol says successful placement of a small modular reactor will demonstrate that they can be built on budget and on schedule.

“We would expect, early on, somewhat slow development. No one wants to build the first. There are a number of utilities that would be happy to be the second,” he says. “Roughly, we might expect five to be operational between 2026 and 2030. As long as we can demonstrate ‘on time and on budget,’ we should see the numbers grow.”