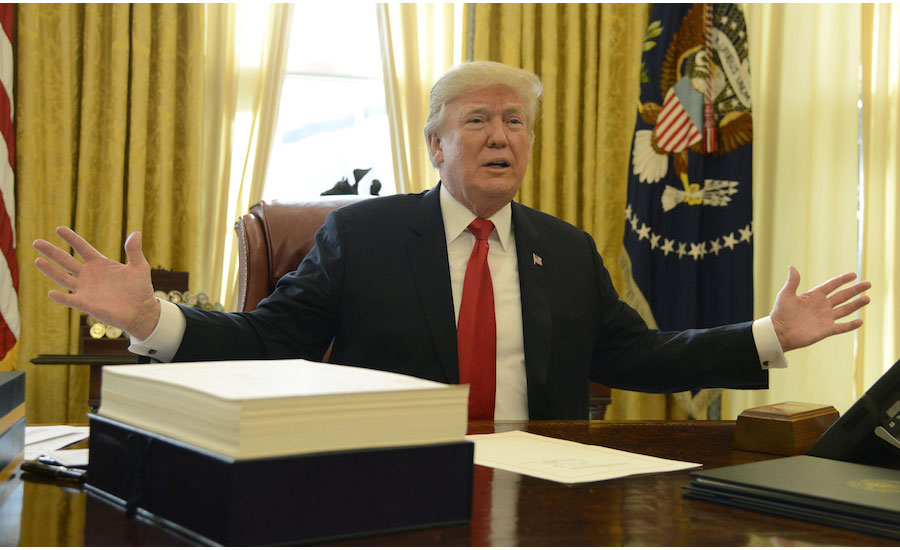

In addition to tax cuts for big corporations and pass-through entities, infrastructure was another winner in the tax reform bill that President Trump signed on Dec. 22.

But the legislation didn't start out so happily.

The House version of the tax measure would have eliminated what some think could have been 25% of the tax-exempt bond market by taxing interest on private activity bonds, used for private projects with a public benefit, including water, airports and affordable housing projects.

Such bonds have been used to finance a broad array of projects on which designers and contractors are put to work. Even high-speed rail, schools, waste, and power-related construction used tax-favored private activity bonds, if they qualified.

The House also had proposed dropping the tax-favored treatment of such bonds for professional sports stadiums, but that, too, was kept in the final version of the measure.

In keeping these exemptions, "congressional Republicans avoided crippling President Donald Trump's infrastructure initiative before it begins," wrote a team of tax specialists from the law firm Ballard Spahr on National Law Review's website.

The exemption still applies only to qualified uses.

Successful Final Tax Reform for Businesses

Contractors are generally pleased with the final, business-friendly version of the tax bill signed by the president. Among the key measures are a deduction on the reportable income for pass-through entities and repeal of the alternative minimum tax, which had set a floor under the tax obligation of businesses, trusts and other entities that use numerous deductions.

"Out of most of the priorities identified and negotiated in the conference committee, most came out favorably from our perspective," noted Matthew Turkstra, the Associated General Contractors' director of congressional relations on tax, fiscal affairs and accounting.

But the House's proposed elimination of private activity bonds as a special class was especially worrying.

The House estimated that the proposed cut of the private-activity-bond exemption, as provided under Section 103 of the federal tax code, would generate $40 billion in revenue over 10 years.

An owner of a private activity bond is able to exclude the interest for their gross income, thus lowering their overall tax burden.

When the House sought to cut the exemption, some foresaw disaster for affordable housing finance.

Without the private activity bond's exemption, the measure "will cost all of us far more because it impairs a critical component of interdependent federal and state policies and programs that leverage private investment to support, among other things, the development and financing of affordable rental housing and the needs of those served by Section 501(c)(3) organizations," according an article in the Buffalo Law Journal by Jean Everett, a consultant with Barclay Damon.

Stage Set for Infrastructure

But once the exemption for private activity bonds was saved, the picture was clarified for not just affordable housing but for all infrastructure, even as the Trump administration prepares to roll out its infrastructure plan.

Numerous infrastructure bills from both parties are already in Congress, and the president's legislative guidance on his own infrastructure plan will be submitted in January.

Michael Likosky, head of infrastructure for consultant 32 Advisors, is sanguine about what lies ahead.

"Regardless of what we think of the tax bill, on either side of the aisle infrastructure is at its core bipartisan," Likofsky recently wrote on the Huffington Post website. "Don't let the pages of The Wall Street Journal and New York Times be your full picture here—the Trump plan's values on infrastructure" are the same as those held by the Democrats.