The convergence of virtual reality, prefabrication, manufacturing, building information modeling and construction came into better focus for Autodesk product users in mid November at the software vendor’s annual conference in Las Vegas.

CEO Andrew Anagnost told the 11,000 attendees the company’s strategy is to concentrate on its construction products—including the BIM 360 cloud sharing platform and its design and modeling tool, Revit—and focus less on its media and entertainment lines, except for those products, such as the rendering and animation tools Maya and 3ds Max, that also serve design, construction, and on- and off-site construction manufacturing.

“Construction is not just an AEC opportunity for us,” Anagnost said, “it’s the fastest-growing manufacturing opportunity out there.” He predicts that in 10 years, construction workflows will be much closer to manufacturing efficiency.

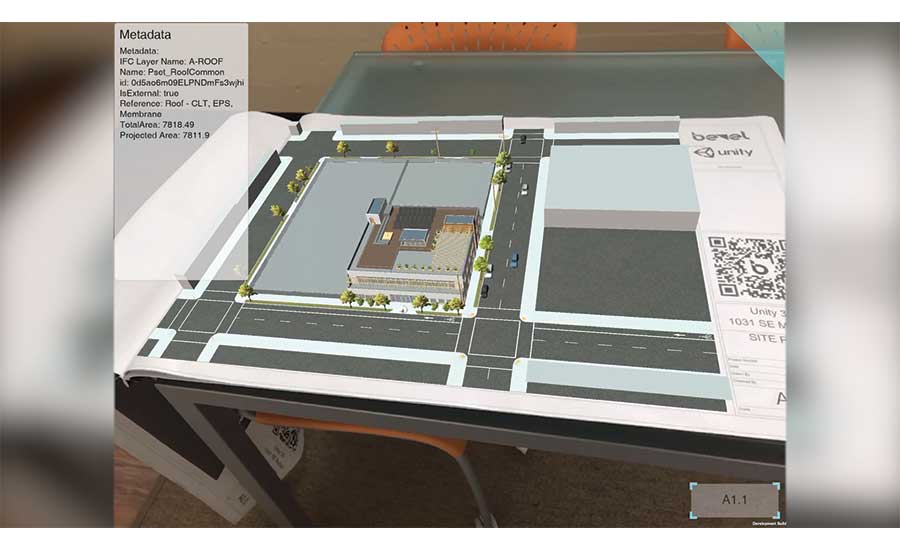

The company’s July acquisition of Assemble Systems, which helps designers use 3D model data for estimating, and a new partnership announced at the show with VR technology provider Unity to integrate Unity’s immersive visualization engine into Autodesk design products, were given as examples. “There are going to be multiple tools involved with prefabrication and delivery of manufactured building systems,” said CTO Scott Borduin. “We want the data flow to be more seamless and transparent.”

The partnership between Autodesk and Unity is non-exclusive for both, but for Unity, it’s a chance to streamline data transfer for customers who already use Autodesk products. “We will be simplifying the workflow between our products, making them faster and easier to use and eliminating much of the manual work that is being done today,” says Tim McDonough, general manager for the industrial division at Unity.

Anagnost said the Unity partnership will save Autodesk from spending a decade developing a VR platform as robust and well-adopted as Unity’s. “In a world where Microsoft, Apple and Google are building X/R capabilities into their workflows, I’d rather spend $100 million on generative design than that,” Anagnost said. He added that with tools like Assemble, Autodesk is working with AEC users to digitize project data, pulling it out of 3D models in some cases and delivering it in a form that they, as well as subcontractors and owners, can use. Borduin noted that Autodesk is working to improve its application program interfaces to make data-supported workflows more productive.

Construction had top billing at the event, with demonstrations and case studies such as the automation of curtainwall design and the panelization of construction. Structural engineer LERA+ showed how it uses Autodesk’s computational tools to create design iterations. Paric’s vice president of technology and innovation, Andy Leak, showed examples of how all Paric subcontractors use a 3D model as the “single source of truth” for project data. Autodesk hosted presentations from general contractors such as Mott McDonald and Paric to show what they have done with computational design, 4D scheduling and quantity take-off.

Anagnost noted that contractors with strong digital workflows will have the advantage of much better “bid fidelity,” than low-tech competition. “We want to help projects teams have what they need,” added Jim Lynch, vice president of the Autodesk building products group. “I really do believe in this convergence and that it’s coming. We … support those moving in the direction of automation and manufacturing in construction.”

By Jeff Yoders and Aileen Cho