Following a slow first quarter and a seasonally adjusted 15% drop in April, construction starts are on the rise. In May, starts experienced a 10% seasonally adjusted monthly boost, according to Dodge Data & Analytics. The increase brought the yearly construction starts to just 2% below May 2018, an improvement over the 9% drop during the first five months of 2019.

Robert A. Murray, Dodge chief economist and vice president, says the partial government shutdown at the start of the year slowed some public works, “but details on federal appropriations for fiscal 2019 were finalized in February, including a 2% hike for the federal-aid highway program, which has enabled highway and bridge construction starts to show improvement as the current year has progressed.”

Murray adds that with interest rates remaining low and funding still secure from state and local bond measures passed in the last few years, the volume of construction starts is moderately lower than in 2018, “but the gap is expected to become less pronounced as the current year proceeds.”

Noteworthy projects that broke ground so far this year include the $4.3- billion Calcasieu Pass LNG export terminal in Louisiana, the $1.6-billion Toyota Mazda auto manufacturing plant in Alabama and the $1.3-billion Kansas City International Airport terminal.

|

Related Link |

Mixed Price Picture

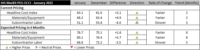

Related to materials costs, consultant IHS Markit predicts an 11.6% overall drop in softwood lumber prices in 2019—down significantly from the 5.5% decrease predicted in the first quarter. The ENR 20-city average also showed a falloff, with prices in June decreasing 3.1% for the year.

Deni Koenhemsi, senior economist at IHS Markit, attributes the drop to a prolonged stretch of lower than expected demand from the U.S. housing market. However, due in part to supply uncertainty caused by recent mill closures in British Columbia, she predicts an increase in lumber prices in the third quarter. But she anticipates the spike will subside due to increasing supply in the southern U.S. and eastern Canada, as well as lower spending on housing construction in 2019 compared to last year.

After reporting a 2.2% price increase for structural steel in the first quarter, IHS Markit raised projections slightly to 2.7% this quarter. The small boost is sharply less than last year’s double-digit increases caused by newly implemented steel tariffs that are now lifted.

“Prices in the United States are now moving well below the 25% tariff premium, a surprising development,” says John Anton, associate director of pricing and purchasing at IHS Markit. “Prices are weaker in all regions, as the steel market continues to crumble.”

Anton adds that while prices have remained relatively steady in Asia and Europe, “they are already near or at production cost.” However, he contends that “the risk is rising that prices will actually fall below cost, raising the possibility of mill distress.”

The ENR 20-city average price for steel experienced a similarly small yearly increase in June, at 2.9%, but “prices will be down through the third quarter of 2019,” and the fourth quarter “is in doubt,” Anton predicts.

Labor shortfalls continue their pricing impacts, according to ConstructConnect Chief Economist Alex Carrick. He notes that while compensation is rising, the overall increases remain low—at roughly 3% to 4% both hourly and weekly. ENR’s 20-city average for labor in June showed a 2% yearly increase for skilled labor, and a 1.8% boost for common labor.

The latest Construction Labor Research Council report on union labor trends shows the compensation package is highest in its Southwest Pacific region, which includes Arizona, California, Hawaii and Nevada, at $66.61 per hour. The lowest, at $39.67 per hour, is the Southeast region, including Alabama, Florida, Georgia, Kentucky, Mississippi, the Carolinas, Tennessee and Virginia. The average hourly U.S. package is $55.17.

Separated out by craft, CLRC’s report said hourly compensation for union plumbers is the highest at $70.44, with boilermakers at $65.92 and pipefitters at $65.56.