Utility companies seeking to reduce CO2 emissions are increasingly relying on battery energy storage systems to meet peak-power demand as they retire their gas-fired plants. “Providing peaking capacity could be a significant U.S. market for energy storage,” according to a June report from the National Renewable Energy Laboratory. Rapidly falling battery costs make the transition attractive.

“In the next year or two, we’ll see an increasing number of locations where batteries are at the break-even point” of grid parity, says Paul Denholm, NREL principal analyst. “There’s still a tremendous market, on the order of tens of gigawatts of capacity that I think are suitable eventually for replacement by batteries.”

Battery energy storage systems (BESS) are often used to store excess solar and wind energy, and both BESS and renewable-energy generation have grown each year. In 2019, the cost of lithium-ion batteries has plunged while growth of BESS facilities has soared.

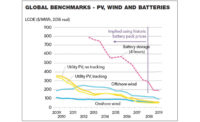

In March, BloombergNEF reported the benchmark levelized cost of electricity for Li-ion batteries has fallen 35% since the first half of 2018. And in Q1 2019, U.S. energy storage deployments totaled 148.8 MW, 232% greater than in Q1 2018, the Wood Mackenzie U.S. Energy Storage Monitor reported.

Perhaps more significantly, Q1 2019’s total topped Q4 2018 deployments by 6%, auguring a future of rapid growth. Q4 deployments typically are the highest of the year as developers rush to book completions before year’s end. Deployments in 2019 will total 647 MW, Wood Mackenzie estimates, but by 2024, U.S. energy storage deployments are forecast to reach over 4.5 GW annually.

AES Alamitos broke ground June 27 on a 100-MW/400-MWh battery-based storage system for AES Alamitos Energy Center in Long Beach, Calif., as part of a larger modernization and replacement project at the 2,025-MW gas-turbine AES Alamitos Generating Station. AES claims the new battery storage array will be more than twice the size of the largest such facility currently operating in the U.S. The Alamitos power plant was procured specifically to provide peaking power, company officials say, and its permit for 300-MW capacity allows for considerable growth.

Southern California Edison Co. has a 20-year power-purchase agreement with AES for the 100-MW capacity of the Alamitos Energy Storage project, which will be able to operate continuously for four hours, says Gus Flores, principal manager, origination, at SCE. It’s being built at the existing site of old gas plants. Many gas plants were built along the California coast using ocean water for cooling, but that is no longer allowed and they will be retired in the next five years.

“Energy storage is the most flexible resource we have,” said Colin Cushnie, vice president, power supply, at SCE. “SCE has calculated that California is going to need at least 10 GW, or 14 times as much energy storage as we have now in California to reach our 2050 greenhouse-gas reduction goals.” The contractor, who was not named, is fully mobilized and construction has begun. Grading and excavations are underway. Completion is scheduled for late 2020.

Several cost trends may make energy storage cheaper than peaking plants, says George Crabtree, director of the Joint Center for Energy Storage Research at Argonne National Laboratory. He recently concluded from plotting trends in three different sets of data that the levelized cost of storage will soon cross the levelized cost of peakers. That would make storage cheaper than peaker plants, confirming the findings of the NREL report. “It’s already true in certain areas of the country that the cost of storage is less than gas peaker plants, and some utilities have begun substituting them in,” he says. “California is a good example. PG&E has gotten approval for 300 MW of storage to replace three gas peaker plants.”

Duration is storage’s shortcoming, Crabtree says. Many peaker plants run for more than four hours, outlasting battery systems. The life of battery arrays can be extended, but at a cost more expensive today than the gas peaker plants, he says.