Coronavirus and Construction

New 'Paycheck Protection' Loan Guidelines Worry Contractors

New Trump administration guidelines that tighten eligibility, retroactively, for the much-in-demand Paycheck Protection Program loans have sparked significant worries among member companies of a major construction contractor group. A leading engineering organization also has concerns about the PPP changes.

Associated General Contractors of America Chief Executive Officer Stephen E. Sandherr told Treasury Secretary Steven Mnuchin in an April 29 letter that new Treasury and Small Business Administration guidance, issued April 28, has caused "severe and urgent" concerns among AGC members. He urged Mnuchin to issue revised guidelines quickly.

PPP, created by the Coronavirus Aid, Relief and Economic Security, or CARES, Act, was designed to buffer small businesses and non-profit organizations from some of the financial impact of the coronavirus pandemic.

AGC members' worry is whether they meet the new guidelines—with the changes coming more than three weeks after the loan program was formally launched.

Sandherr said in his letter, “If the latest guidance disqualifies AGC borrowers for program loans, they will have to pay the loans back and exhaust their cash and lines of credit, and the pandemic’s ultimate impact on their operations will be that much more severe.”

Treasury has set a May 7 deadline for companies to repay the money if necessary. Sandherr also asked Mnuchin to extend that deadline.

AGC isn't the only industry group concerned about the new PPP guidelines, which are contained in a Frequently Asked Questions document.

Jeff Urbanchuk, a spokesman for the American Council of Engineering Companies, said via email that the provisions Treasury added in the FAQ are "causing concern and confusion among firms about the loan program." Urbanchuk said, "They need to release full guidance to create certainty among industry."

When SBA began taking PPP applications April 3, the requests poured in. The CARES Act's $349-billion allocation for the program was gone by April 16, just 13 days after the program's launch.

Big companies and PPP

Meanwhile, reports surfaced that large companies such as the Shake Shack restaurant chain applied for and received PPP loans.

The program was aimed at smaller companies, and the CARES Act set a workforce threshold of 500. But the statute allowed companies with multiple offices that each were below the 500-worker level to submit multiple applications.

The reports sparked criticism that many small mom-and-pop entities weren't getting PPP dollars. Shake Shack and some other PPP borrowers said they would return the money from the PPP loans.

In addition, the overwhelming demand for PPP loans led Congress to provide more money for the program. Lawmakers passed a measure that included a $310-billion infusion for the program.

Round two of PPP is off to a fast start. It opened on April 27 and by 5 p.m. on April 29, SBA reported, it had approved nearly $90 billion in new PPP loans.

Also on April 28, Treasury and the SBA issued a statement saying they now plan to review all approved PPP loans valued at more than $2 million and “other loans as appropriate.”

Moreover, SBA on the same day revised its guidance for potential PPP borrowers. Among other things, the agency said loan applicants must certify that “current economic uncertainty” made their loan application “necessary to support the ongoing operations.”

The guidance also said loan applicants must take into account “their current business activity and their ability to access other sources of liquidity.”

Contractors' 'loud concern' about guidelines

AGC's Sandherr cited those two sections of the guidance in his letter to Mnuchin. Sandherr said AGC members’ “loud concern is that the latest guidance on the program is increasing their uncertainty and threatens to undo much of the good work that the [PPP] has already done.”

Sandherr said, “While AGC borrowers want and intend to ensure that they are in full compliance with this guidance, they find themselves at a complete loss to determine whether they are.”

He added, “Just how does the federal government want or intend them to assess ‘their ability to access other sources of liquidity’?"

Some of the PPP criticism has centered on companies that are publicly held and thus could raise funds by selling stock. But Sandherr noted that “very few if any” AGC member firms are in that category.

He added, however, that “many of them do have lines of credit that they have long used to help them manage their cash flow and their economic uncertainty extends well beyond the next few weeks.”

AGC spokesman Brian Turmail told ENR via email that “we have a ton of members asking questions and [who are] definitely very concerned.” He said he hasn’t heard of any AGC members that yet have returned PPP funds, however.

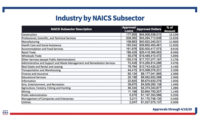

Construction PPP Totals

Construction companies received more round-one PPP dollars than any industry, with $44.9 billion.

Many AGC member companies were among the successful loan applicants in that first round. An AGC survey of its members, conducted April 20-23, showed that 44% of the 849 firms responding to the survey said they had received funds from PPP loans.

An additional 15% had PPP loan applications approved but hadn’t yet received the funds. Another 8% were waiting for a decision on their loan applications and 7% had applied but were informed that funds had been exhausted.