AGC, Procore Provide Insights About Loss of 975,000 Construction Jobs, Northeast Hardest Hit

AGC Online User Data Shows Shifts Created by Loss of Projects

Construction lost 975,000 jobs between March and April or 13% of the industry's total jobs, according to an online survey of 817 members of the Associated General Contractors of America. The survey information was supplemented from data on realtime transactions, including construction hours worked, compiled by Procore.

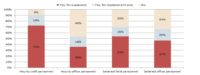

While the number of projects stopped due to stay-at-home orders declined from AGC's previous survey—to 30% from 35% two weeks ago—the number of contractors who reported having a project shut down by a client wary of continuing in the current environment was 36% in the most recent survey, conducted May 4-7. The survey showed the job losses were particularly severe in the Northeast, where 53% of respondents terminated or furloughed employees. Only 29% reported layoffs in the South, 38% in the Midwest and 45% in the West. Sixty-seven percent of the contractors reported having at least one project canceled or delayed.

"It is always good to have multiple sources of data to validate our findings. Fortunately AGC's partner and construction software provider Procore, has found a way to capture in almost real-time the real impacts to the construction industry," says Ken Simonson, AGC chief economist.

Procore's data is based on thousands of transactions captured in Procore's platform over the same time period as the AGC survey from companies that allow their data to be complied for research purposes. The data is updated regularly on Procore's COVID-19 response site. One metric Procore captures is construction worker hours, measured either by general contractor or construction manager's staff or specialty subcontractors working for them. Kris Lengieza, Procore's senior director of business development, says after measuring a baseline of 14 million construction worker hours the week of March 1, the platform saw those hours decline to 11.5 million hours the week of April 5, the third week of stay-at-home orders announced by the states. However, since that week, worker hours rose to 12 million the week of April 12 and have been hovering between 12.4 million and 12.2 million since.

"There has been a significant leveling off of this decline since about the week of April 12," Lengieza says. "Which puts us at a place where our current overall workforce stands at about 13% below our pre-COVID benchmark, highlighting some of the resilience we've seen in these projects."

Lengieza also says events such as California shutting down all construction, then opening some projects back up is reflected in the worker-hours data by state. The South has seen more work come back online as restrictions have been allowed to expire, and some states such as Illinois and Wisconsin, which never shut down construction, have stayed fairly consistent.

"The decrease in hours between March and the middle of April is a similar decline to what we've seen from the government [Bureau of Labor Statistics] data," Simonson says.

He says 61% of respondents said Congress should enact a safe harbor set of protocols to provide construction companies that are enacting new safety practices with protection from tort or employment liability for failing to protect from a COVID-19 infection. He says without a safe harbor provision, it's difficult to see when a construction recovery may occur.

43% of survey respondents said they would like a larger federal investment in infrastructure.