Ten Minutes With Holly Drumheller Butler

How To Prepare For A Paycheck Protection Program Loan Audit

A compliance attorney describes what you should know and do

Holly Drumheller Butler of law firm Miles & Stockbridge in her office. Photo: Courtesy of Miles & Stockbridge

Holly Drumheller Butler, a principal in the Baltimore and Washington, D.C. offices of law firm Miles & Stockbridge, who advises companies on government and internal investigations and corporate compliance, recently spoke with ENR Correspondent Scott Van Voorhis about the new federal Paycheck Protection Program and its complicated requirements for borrowers to cover COVID-19 shortfalls. She describes how to prepare for potential government reviews and investigations of firms' loan use.

ENR: Are you fielding lots of calls from clients with PPP loans who are concerned they may be audited down the line?

HDB: We are getting lots of calls. Virtually all of our clients are concerned not just about potential reviews from the Small Business Administration, but also investigations by the U.S. Department of Justice, as well as general anxiety over being potentially caught up in media scrutiny.

What specifically are contractors and other clients worried about?

The PPP rolled out in early April with little to no guidance. Since then, SBA has issued a number of shifting guidelines, which have caused a great deal of concern.

Okay, let's walk through a few of those. Can you start at the beginning with the issue of need and availability of other financing?

Specifically, SBA’s frequently asked questions (FAQ 31) issued on April 23 included a warning that borrowers carefully consider the “need” certification and suggested that those with alternative sources of liquidity could not make that certification for their PPP loans in good faith. Despite express language in the CARES Act suspending the “credit elsewhere” requirement for SBA loans, which generally requires that lenders certify to SBA that a traditional borrower under the 7(a) program cannot obtain comparable credit “elsewhere,” this guidance seemed to suggest that some alternative test and self-certification were required for certain borrowers.

I follow you. What came next?

SBA then gave PPP borrowers a safe harbor, with the opportunity to reassess their need and return loan proceeds, but that deadline has since passed.

But that wasn't the end of the guidance, was it?

No. On May 13, SBA created another safe harbor provision under FAQ 46, which deemed all borrowers of loans under $2 million as having made their “need” certification in good faith. For a loan at or in excess of $2 million, the agency stated that if—in reviewing that loan—it concludes that the “need” certification was made without an adequate basis, SBA would seek repayment of a PPP loan and inform the lender that such loan was not eligible for forgiveness.

And the result?

This ambiguous and shifting guidance generated a lot of anxiety even for the most needy PPP loan borrower.

How much protection do these safe harbor provisions provide?

With regard to the need certification, the safe harbor provisions provide significant protections in connection with any future SBA review. However, I have been cautioning clients that these provisions do not provide immunity across the board.

Can you give an example or two, please?

The Justice Dept. is not prohibited from taking either civil or criminal action against a PPP loan borrower even if SBA has not made a referral. As PPP applications set forth, a borrower may face potential criminal and civil exposure for making false statements under a variety of federal statutes. There have already been a number of cases where the department has filed charges for fraud in connection with a PPP loan.

What happened?

So far, the cases fall under two categories. One involves false payroll records. These cases are not instances of minor discrepancies, such as where a business said it had 25 employees and it actually had 22. Rather, in these cases, the accused allegedly indicated it had dozens, 200, or even 400 employees, when in fact it had zero.

There are also cases involving diversion of loan proceeds. As one example, the Justice Dept. brought charges last month against a radio and TV personality in Georgia who used $1.5 million in PPP loan proceeds to buy jewelry and other personal items, rather than finance his trucking company.

What can contractors with PPP loans do to ensure they don’t face issues down the line with government auditors?

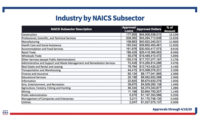

In the first round, construction companies had the largest share of PPP loans, with almost $45 billion. Recognizing that time will pass and memories will fade before any potential SBA review or government investigation, we are definitely advising borrowers to look forward and protect themselves proactively with documentation that details the basis for their good faith certifications—including the nature of the uncertainty created by the ongoing pandemic, the corresponding need, and the lack of other meaningful sources of liquidity. Contractors and other companies should maintain supporting documentation submitted for the loan, including all materials submitted to the PPP lender with a loan application.

What types of things should contractors document?

A firm should document the employees on payroll during the covered period established in the PPP loan legislation. This was needed for the initial application and will be required again to receive forgiveness on the back end. The firm also should document facts in support of the “need” certification. For construction companies, this may include work in the pipeline and details of upcoming projects; pre- and post-COVID-19 bid activity; any increases in costs as result of new, virus safety requirements that are being imposed; and any cost-cutting measures, such as a cutback on new purchases. A firm also detail uncertainty in its supply chains, and if involved in government contracting, document any budget cuts by state and federal governments.

Once the loan is approved, should contractors track their expenditures?

Contractors should closely track the expenditure of PPP loan proceeds, broken down by categories authorized under the federal loan program. In addition, companies should consider the optics of their business decisions, such as non-essential expenditures and travel, and prepare for potential media inquiries regarding receipt and use of loan proceeds.

Who should be in charge of gathering documentation in support of the decision to obtain a PPP loan?

A company will want backup documentation and chances are, also will want managers who are aware of the firm's different areas, such as various divisions or units, to begin pooling information from their chiefs. These various company officials should then consult and review the information gathered with legal counsel and the executive who signed the certification, such as the CEO or CFO.

What other steps should companies take?

To protect against potential whistleblower claims, companies should monitor their hotlines for complaints about their PPP loan. If a firm doesn't have a hotline, it needs to monitor whatever reporting mechanisms are available for employees to convey concerns, such as through a manager or the company’s legal counsel. If anyone registers a complaint related to the receipt and use of PPP loan proceeds, those types of complaints should be investigated.