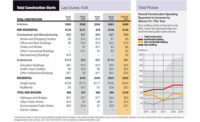

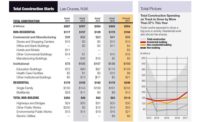

ENR's Southwest City Scoop: Las Cruces, NM

Before the COVID-19 crisis, value of new contracts was expected to plunge 55%

A dramatic decline in the non-building sector had been expected to more than offset a sharp gain in non-residential.

City Grill

Kelly Roepke-Orth

Kelly Roepke-Orth

CEO

AGC New Mexico

A special legislative session was held June 18 to address New Mexico’s economic issues. Depressed oil prices, coupled with the economic downturn from COVID-19, are likely to result in a $2-billion shortfall out of a $7.6-billion budget for the state, says Roepke-Orth. Cities and counties rely heavily on gross receipt taxes (GRT) for their revenues.

“The Las Cruces Sun News recently reported that Las Cruces got 76% of its 2019-2020 revenue from GRT. Another 12% came from property taxes,” she says.

New Mexico is in “limited reopen” status from the pandemic, and all businesses must operate in accordance with COVID-Safe Practices for their industry, Roepke-Orth says.

COVID-19’s impact could be seen in New Mexico’s April employment numbers. The state’s unemployment rate reached a seasonally adjusted 11.3% in April, tying it for 16th best in the country for employment, along with Colorado and Montana, according to a May 22 report from the Bureau of Labor Statistics. Construction employment in New Mexico was up by 200 jobs, or 0.4%, year over year.