Coronavirus and Construction

AGC-Procore Data Shows Construction Increasing as State COVID-19 Orders Loosen

Construction returning to pre-COVID-19 levels in much of U.S., according to new survey

Construction activity has returned to pre-COVID-19 levels in 34 states, according to new data from Procore's cloud-based construction project management platform. The Associated General Contractors of America also has reported that the organization's most recent survey found that only 8% of construction companies were forced to furlough or lay off workers in June while 21% reported adding new hires, compared to one-in-four firms letting workers go between March and May.

“Many of the immediate economic impacts of the coronavirus have passed and, as a result, activity and hiring are up a bit,” said Ken Simonson, AGC’s chief economist. “But while the immediate crisis appears to have passed, we are just now beginning to appreciate some of the longer-term impacts of the pandemic on the industry.”

[For ENR’s latest coverage of the impacts of the COVID-19 pandemic, click here]

The AGC survey is based on responses from more than 630 construction companies collected between June 9 and June 17. Procore’s data is based on transactions logged via the company’s project-management software by tens of thousands of construction firms across the country—data that's been translated into OMB core-based statistical numbers broken down by state and metro area.

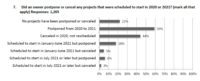

The AGC survey reported that 44% of contractors had one project halted or canceled between March and May. While the number of project suspensions has gone down as states open back up, 23% of contractors reported having at least one project canceled that was supposed to start in June.

One concern is the 15% of contractors that reported having projects canceled that were supposed to start in August or later because owners, many of them state or municipal authorities, no longer have the funding to move them forward. At least 14% of contractors reported delays due to government inaction such as permitting and inspection difficulties. Only 10% of AGC respondents reported delays from shortages of personal protective equipment, down from almost 40% in the March to May period.

"The pandemic has had a dramatic and dynamic impact on construction headcounts," Simonson said. "This month, only 8% reported furloughing or terminating employees while 21% report adding employees. This probably reflects the benefits of many states lifting their economic lockdown orders and the help provided by the Paycheck Protection Program loans, which over 80% of [construction companies surveyed] reported having received."

Only 12% of respondents thought they would need to terminate or furlough employees in the next four months, while 21% expect to hire employees over the same period.

"There is definitely some consistency in that states that had stay-at-home orders were definitely seeing a larger decrease in worker-hours," said Kris Lengieza, director of business development at Procore. "Even if construction was deemed essential, many of the projects that were still happening were happening in occupied buildings, including tenant improvements and office towers. Even if there was construction that was deemed essential, some owners may have chosen to pause those projects. We do expect to see some slowdowns no matter what in those states."

Construction activity has returned to pre-coronavirus levels in 34 states, according to Procore's tracking of worker-hours by week in eight major metropolitan markets: Chicago, San Francisco, Dallas, Houston, Miami, New York, Los Angeles and Seattle. The southern U.S., which had more relaxed standards for keeping projects open during the pandemic, logged more consistent construction hours than other regions. New York City, which only recently re-opened, was returning to pre-COVID-19 levels. By May 31, 34 states were equal to or above their pre-COVID-19 employment levels.

"Areas such as Los Angeles and Dallas were not as affected as other metropolitan areas of the country," Lengieza said. Dallas stayed above its pre-COVID-19 worker-hour high during the entire pandemic. All of Procore's data is available at Procore.com/COVID-Insights.

The AGC survey also reported that 59% of respondents are counting on Congress and the Trump administration to enact liability reform to protect firms from litigation as they attempt to comply with coronavirus safety protocols. At least 34% want Congress to boost infrastructure spending to offset a decline in private-sector demand.

“Without additional help from D.C., the few gains this industry has made during the past few weeks will likely be fleeting,” Simonson said. “That is why the AGC will continue to push Congress and the Trump administration to enact the kind of long-term economic recovery measures this industry needs to truly rebound from the coronavirus.”

Simonson also said that the paycheck protection benefits may hurt contractors as they try to rehire workers, since many people are collecting the more generous unemployment benefits included in the law.