Construction Workforce

Construction Employment Picture Brightens in June

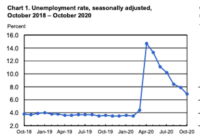

Industry adds 158,000 jobs, unemployment rate declines

Construction laborers placing concrete at a commercial development project in New Jersey in June. Photo: Richard Korman for ENR

Construction employment has continued to rebound, adding 158,000 jobs in June and registering an improved unemployment rate for that month, the Bureau of Labor Statistics reported.

But the industry’s June jobless rate still stood at 10.1%, more than double the year-earlier mark, and the latest numbers do not reflect the late June COVID-19 surges in Sunbelt states. And the Associated General Contractors of America noted that construction's total workforce in June still was down by 330,000 jobs, or 4.4%, year over year.

The BLS report, released on July 2, shows that compared with May levels, construction gained jobs in nearly all sectors, led by specialty trade contractors’ increase of 135,400.

Buildings construction posted a gain of 32,200.

But heavy and civil engineering construction, which includes infrastructure work, lost 9,700 jobs in June. Ken Simonson, AGC's chief economist, said in a statement, "Unfortunately, those infrastructure-related jobs are likely to keep declining as state and local governments postpone or cancel projects in order to cover the huge budget deficits they are facing in he fiscal year that began for many agencies on July 1."

Citing the heavy-civil construction numbers, AGC urged Congress to produce legislation to provide strong increases in infrastructure funding.

Architectural and engineering services, a separate BLS industry category, recorded an increase of 12,400 jobs.

Construction’s 10.1% June unemployment rate improved from May’s 12.7% but was significantly higher than the year-earlier rate of 4%. The BLS rates aren’t adjusted for seasonal variations.

Overall, the economy added 4.8 million jobs in June and the national unemployment rate improved to 11.1% from May’s 13.3%.

But there’s a caveat attached to the June employment numbers and rates. The results are based on data collected in mid-June, which don’t include the impacts of surges in coronavirus cases in late June in some Sunbelt and other states.

Anirban Basu, Associated Builders and Contractors chief economist, said the employment figures and other indicators are positive signals. But Basu added in a statement that even if the economy keeps improving this year, "construction is less likely to experience a smooth recovery."

He points to important construction sectors that have been hit hard in the recession, such as offices, retail and hotels, and state and local governments' "increasingly fragile" financial conditions, which endanger their capital spending.

Story updated with comments from Associated General Contractors of America and Associated Builders and Contractors economists.