Industry Economist: Recovery Has Started, But Tough Times Still Ahead

Economic recovery is under way, but there's still a long way to go, according to Anirban Basu, chief economist at Associated Builders and Contractors. He presented his analysis during an Aug. 12 webinar for the association.

Basu pointed to May and June jobs reports—with gains of 2.7 million and 4.8 million jobs respectively—as the start of a recovery period, but he remained cautious during the webinar titled “Six Months In, What is the Trajectory of Construction’s Recovery from COVID-19?” July’s jobs dropped to 1.8 million added, largely because of a resurgence of the virus in the South, where re-opening plans are being put on hold or even reversed.

“I’m not saying another recession is coming,” said Basu. “But if this pandemic was still not lingering, [the economy] would be much, much better.”

In June, the Congressional Budget Office forecast the U.S. economy will shrink 6% this year, followed by 4% growth in 2021. Global organizations have similar projections: World Bank projects a 6% drop in GDP in 2020, and a rebound of 4.5% in 2021, while the International Monetary Fund (IMF) predicts an 8% decline in 2020 followed by a 4.5% increase next year.

The Organisation for Economic Co-operation and Development predicts a 7.3% drop in 2020, with a rebound of 4.1% in 2021, barring a second wave. Should the next wave occur, its forecast changes to an 8.5% decline in 2020, with only a 1.9% rebound in 2021.

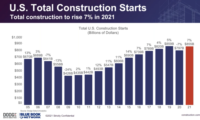

The overall economy, including construction, is expected to improve in 2021, but “there are no guarantees,” said Basu. He notes that non-residential construction may be in for a rough 2021, as trends in that market often trail the overall economic trends by 12-18 months. This year “was awful for the broader economy [and] 2021 will be awful for non-residential construction, but by 2022 we’re starting to see some recovery.”

Contractors are reporting fewer jobs being bid, and fiercer competition for those that are out there, says Basu.

ABC’s construction backlog indicator fell to 7.8 months in July, a full month lower than the 8.8 months reported in July of 2019. Respondents to the association’s confidence index say they expect a decline in sales and profit margins over the next six months. While the index indicates that staff numbers will stay flat, this follows a loss of more than 300,000 construction jobs throughout the past few months.

“Recovery has begun, but these times remain treacherous,” concluded Basu. “I don’t think we’ve earned a v-shaped recovery yet.”

.png?height=200&t=1690404049&width=200)