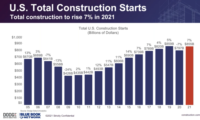

Dodge Economist: Residential Continues to Lead Construction Recovery

A year into the COVID-19 pandemic, the economy is performing at 22% below pre-pandemic level, said Richard Branch, chief economist at Dodge Data & Analytics, during the "Dodge Construction Outlook 2021 - First Quarter Update" webinar on March 4. However, with a new stimulus bill expected to pass in the next few weeks, Dodge predicts 4.8% GDP growth in the second quarter of 2021.

“The U.S. will be well on its way to widespread adoption of the vaccine and herd immunity by the mid-point of this year,” Branch said. “The vaccine in conjunction with the stimulus leads to progressively accelerating economic growth as we go through the year.”

Branch predicted that the economy will be back to pre-pandemic level around mid-2021, but cautions that not every sector will recover at the same time.

“Construction is certainly one of those industries that will take time [to recover],” he said. “Aside from COVID, one of the biggest speed bumps [for construction in 2021] is rapidly rising material costs.” Dodge reports that construction costs are up 5.4% from a year ago, with lumber and plastic prices driving the increase.

While some sectors struggle, single-family construction continues to be a bright spot. “Millennial homeownership made significant improvement during the pandemic. We think it will continue to accelerate,” said Branch, noting, however, that “the supply side has significant constraints.” High material and land costs, in addition to the ongoing labor shortage, will cap growth in single-family housing starts at 5%, after a 14% increase in 2020.

Commercial construction, which includes stores, office, warehouses, hotels and parking garages, will see a 6% increase in overall starts in 2021, after falling 23% in 2020. “If not for warehouse, that decline in 2020 would have been much deeper, and the expected gross in 2021 would be much, much shallower,” said Branch. While the warehouse sector will continue to expand, retail and hotel starts won’t see much growth this year.

In the institutional building sector, Dodge expects transportation and healthcare sectors to see growth in 2021, at 11% and 9%, respectively. Education is expected to drop 2%, which Branch attributed partially to continued remote learning. Due to increased federal funding for infrastructure, non-building starts are predicted to rise 5%, according to Dodge.

Overall, Branch expects a 4% increase in construction starts in 2021, largely due to the strength of the residential market, with non-building and commercial starts on track for a slower recovery.