Engineering firm executives and others told a House small business subcommittee about the negative financial impact their firms have experienced because some federal agencies are recognizing Paycheck Protection Program loans as credits under the Federal Acquisition Regulation.

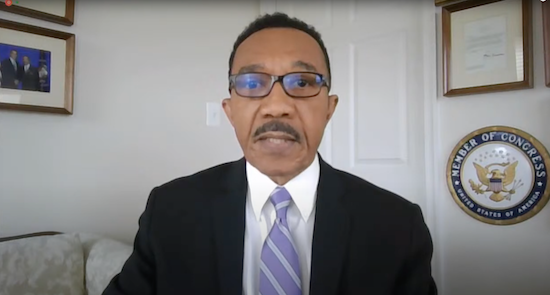

Rep. Kweisi Mfume (D-Md.), who chairs the Small Business Committee's subcommittee on contracting and infrastructure, noted at a March 23 hearing that although Congress created the program to help small businesses meet payroll costs and other expenses through forgivable loans, some federal contractors “may find themselves owing the government a credit if the PPP loan has been forgiven and it was used to pay for costs covered under a government contract.”

The government’s stated intent is to avoid duplication of payments, but Mfume said that “some small contractors argue that this is antithetical to the PPP program’s intent, which is to help struggling firms during a time of crisis.”

He added, “Contractors contend that if the government forces them to repay portions of the loan through credits, then the PPP loan wasn’t truly forgivable.”

Robin Greenleaf, CEO of Boston-based Architectural Engineers, testified that if a credit is applied by, for example, the Federal Highway Administration, it would significantly reduce the firm’s overhead rate, potentially for several years.

“Many of our clients lock in the indirect cost rate over the life of a multi-year contract,” she said.

“On my $594,000 PPP loan, on which we just received forgiveness last week, I’m looking at a 32% drop in my overhead rate, resulting in a loss of at least $129,000 per year.”

Greenleaf also was testifying on behalf of the American Council of Engineering Companies, of which she is the current chair-elect. “For firms that do predominantly [Dept. of Transportation] work, it’s easy to see how the losses will far exceed the value of the loan,” she said.

Greenleaf argued that applying the credits clause to firms working under cost-reimbursable contracts, but not under fixed-price contracts, is not equitable.

“While my rates are reduced, other businesses working on the same infrastructure projects have been able to retain the full benefit of the PPP,” she added.

Carlos A. Penin, president of CAP Engineering, Coral Gables, Fla., echoed Greenleaf’s concerns. He told the subcommittee that his firm faced a 25% reduction in its overhead rate and, because of multi-year contracts, might lose more money in the long-term than the original loan value.

“The interpretation of the FAR clause would reverse the benefits received from the PPP and could have a negative impact for our company and any company that pursues federal or state contracting for years to come,” he said.

The potential harm would be a disincentive for pursuing government contracts, he added.

Greenleaf suggested that the impacts would be particularly acute for small, minority- and women-owned firms, which perform a higher percentage of government contracting work.

Asked by Rep. Marie Newman (D-Ill.) if addressing these concerns would require Congress to intervene, Penin said clarification of the FAR interpretation would be the “easiest way to handle it.”

The debate over the application of the FAR credit clause on PPP loans comes as the Biden administration and Congress have begun discussing a major infrastructure bill.

“At a time when the industry is very eager to work with you and your colleagues to deliver a robust infrastructure-based economic recovery agenda, your prospects for these opportunities are dimmer because of this credit holding us back,” Greenleaf told the subcommittee.

Greg Bingham, a partner at consulting firm HKA and Susan Moser, a partner at accounting firm Cherry Bekaert, also testified.

Story changed on 3/25/2021 to provide Mr. Bingham's correct surname.