Clean Energy Construction

Offshore Wind Projects Move Forward in Northeast, California

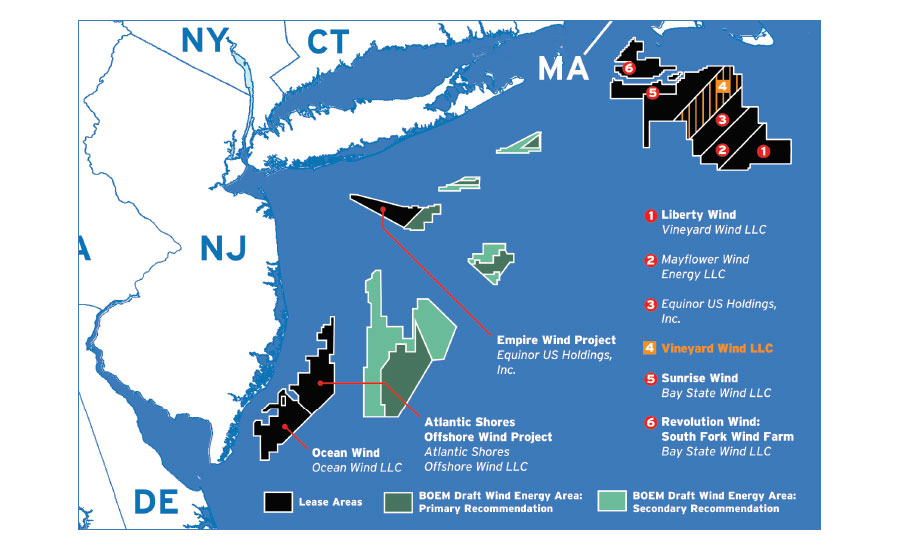

Two developers submitted bids for Massachusetts’ third offshore wind energy solicitation, to build up to 1,600 MW of capacity, but two large players abstained—leading members of the state legislature to question state bidding rules.

The Mayflower Wind consortium, a joint venture of energy giants Shell New Energies US, EDP Renewable and Engie, submitted multiple bids, with the largest for 1,200 MW, while the Vineyard Wind joint venture of Copenhagen Infrastructure Partners and Avangrid Renewables submitted proposals to build an 800-MW project and one at 1,200 MW under the project name Commonwealth Wind.

The latter team already has begun building the 800-MW Vineyard Wind 1 offshore farm, which faced permit setbacks in the Trump Administration but now is set to be the first utility-scale facility to be completed in the U.S, set for the end of 2023. It reached financial close this month on $2.3 billion of senior debt funding and has begun onshore related construction, with offshore work to start next year.

The Mayflower Wind team won the state's second offshore wind solicitation in 2019 to build an 804-MW project of the same name south of Martha's Vineyard that now is under environmental review.

But notable non-bidders for the latest Massachusetts solicitation were major global developers Orsted and Equinor, both of which have development rights off the state’s coast.

Two leaders in the Massachusetts House of Representatives said Sept. 21 that they will introduce legislation to eliminate price caps included in the solicitations, and instead focus on economic development, grid modernization and port infrastructure to encourage more companies to bid.

State House Speaker Ronald Mariano tapped Rep. Jeff Roy, chairman of the utilities and energy committee, to “restore Massachusetts” as the leader in the offshore wind competitive market.

“We want to open up the process so that we could encourage companies to come in and bid. We’re going to go up to 5,600 megawatts very quickly. So let’s put policies in place that encourage people to want to be a part of the Massachusetts offshore wind,” press reports quoted Roy as saying while on a tour with legislators of the 30-MW Block Island offshore wind farm off Rhode Island, the first U.S. operating facility.

Mayflower Wind officials said each consortium bid had accompanying economic development packages and that it would invest up to $81 million to build the offshore wind supply chain and to develop specialized workforce education and training. It also pledged to make significant investments in local ports and infrastructure.

Mayflower would establish an operations and maintenance port in Fall River, Mass., at the Borden & Remington Ironworks complex. Architect Stull and Lee would plan the redevelopment. That planned port and the National Offshore Wind Institute in New Bedford "will be twin anchors for a vibrant and growing offshore wind industry on the South Coast,” Mayflower CEO Michael Brown said.

The Boston & New England Maritimes Trades Council, AFL-CIO, supports the Mayflower Wind project, the company said.

Vineyard Wind submitted its two bids for an area just south of the company’s current Vineyard Wind 1 project and its Park City Wind project planned to support Connecticut's clean energy goal. Currently, Vineyard Wind has 1,604 MW of offshore wind under development for the two states.

The consortium gave few details of its new proposal as to power price and turbine number but said it will adhere to the 1 x 1 nautical mile spacing between turbines, which was endorsed by the US Coast Guard as preferred for safety and navigation.

Noting a restructuring of their joint venture, Avangrid and Copenhagen said Sept. 21 the firms will continue to jointly own Vineyard Wind 1. But Avangrid will take full ownership of the lease area that includes the 804-MW Park City Wind project and Commonwealth Wind proposal. Copenhagen will take full ownership of an easternmost Massachusetts offshore wind lease area, which has the highest wind speed of any area in the Northeast and is “very competitive for solicitations from New York and Massachusetts,” Christian Skakkebaek, a senior company partner, said in a statement.

The restructuring financial transaction is expected to close in six months.

In other offshore wind news, California Gov. Gavin Newsom on Sept. 23 signed a $15-billion climate bill that. among other things, requires the state Energy Commission to evaluate and quantify the maximum feasible capacity of offshore wind by June 1, 2022. The agency also must establish offshore wind planning goals for 2030 and 2045 needed to achieve the state’s renewable energy goals. An agency report issued earlier this year says California needs at least 10 GW of offshore wind to achieve its energy goals.

The state and U.S. Interior Dept. reached agreement in May to enable two areas of the Pacific Ocean northwest of Morro Bay and Humboldt County to be opened for offshore wind development that could accommodate up to 4.6 GW of capacity. Development had long been blocked by the US military.

Interior Secretary Debra Haaland also said Sept. 23 that she expects the agency will soon announce additional offshore wind projects, including lease sales, off the New York coast.

New York City Mayor Bill Di Blasio on Sept. 23 released a $191-million, 15-year plan to support construction of offshore wind farms that outlines how the city will expand its manufacturing sector to build, stage and install wind turbines, he said.

.