Contractors are feeling optimistic about 2022 thanks to anticipated infrastructure projects and expected increased private-sector investment for healthcare and warehouses, even as workforce and supply chain issues remain as likely challenges for the industry, say survey results released by the Associated General Contractors of America and construction technology company Sage on Jan. 12.

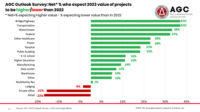

The construction outlook survey of more than 1,000 AGC members showed that contractors are expecting dollar value of projects across most building segments will increase this year, with the most optimism around bridge and highway construction, plus other transportation projects. That was a big turnaround from the AGC survey a year earlier, when the majority of respondents predicted drops in nearly all categories. The only market segments where more respondents expect a drop this year are retail and office space projects. Stephen Sandherr, CEO of AGC, says contractors are planning to invest in their own growth.

“After enduring a difficult 2021, contractors have high expectations for 2022,” he says. “They foresee growing demand for a wide range of construction market segments. They plan to add to their headcount and to invest in new technologies.”

More than half of surveyed firms’ business volume matches or exceeds where they were a year ago. Then, only a third of contractors surveyed said business met levels from another year prior. The number of respondents who had projects postponed in 2021 was also down compared to a year earlier. Forty-six percent said they’d had projects postponed but rescheduled and 32% said they’d had projects not yet rescheduled, compared to 59% with projects postponed and rescheduled in 2020 and 54% with projects that had not been rescheduled as of that year’s survey. In 2021, 35% of surveyed contractors said they hadn’t had any projects postponed or canceled.

Chris Stanton, vice president for pre-construction at Kansas City, Mo.-based McCownGordon, says the current environment has complicated the construction industry, necessitating that professionals follow economists and global happenings to understand what’s going on and how it will affect their firms.

“It’s more than just construction,” he says. “Construction seems like the easy part right now. It’s everything, procuring, understanding what’s going on with COVID, what’s going on with vaccinations, client requests, making sure we’re complying with those and government requirements.”

Rising costs were the most common reason for projects to be postponed or canceled in 2021, and material costs were the most commonly identified biggest concern for 2022, followed by supply chain disruptions, the pandemic’s continuing impact and worker shortages, the survey results show.

Only 10% of respondents said they hadn’t encountered any significant supply chain problems. To deal with supply chain issues, more than six-in-10 said they had turned to alternative suppliers and accelerated purchases after winning contracts. Nearly half had also specified alternative materials. However, there are signs some of the supply chain issues may be improving, says Charlie Wilson, president of North Carolina-based CT Wilson Construction.

“On the roof insulation I ordered last week, the first thing I got was, we’re going to get it in the fall of this year. And now it’s been moved up to June,” he says. “So I think there’s been a little bit of an overreaction of people not wanting to over-promise. But when you actually sign the purchase order and start doing submittals, things are starting to improve as far as lead times.”

The majority of respondents said they expected to increase their headcount this year, with nearly half expecting to increase their staffing by up to 10%, and more than a quarter expecting greater staffing increases. However, 86% of respondents said they’re having a hard time filling craft positions, and most said they expect it will continue to be hard – or even become more difficult – to hire this year.

While AGC encourages vaccination against COVID-19, Sandherr says the Biden administration’s coronavirus vaccine mandates for federal contractors and for companies with 100 or more employees will likely add to hiring challenges, especially for larger firms. More than 60% of construction workers are employed by companies with under 100 employees, he says.

“Given how many firms are currently looking to hire, this means that many vaccine-hesitant workers will be able to switch jobs instead of taking a shot they have already resisted for a year,” Sandherr says.

Sandherr adds that he hopes officials will help the industry by boosting workforce development, avoiding adding “imposing new and needless regulatory burdens” and appropriating funding from the Infrastructure Investment and Jobs Act.