During the week of the U.S. Dept. of Energy’s first-ever Carbon Negative Shot summit on July 20, daily temperatures in Arizona rose to well over three digits consecutively, weather in northeastern states sizzled above previous record highs, the U.K. had its hottest day on record (104.5°F), and a wildfire, sparked in central California, scorched acres of land and spurred evacuations near Yosemite National Park.

Described as a call to action for innovation in carbon dioxide removal, policymakers, energy officials and advisers at the virtual summit did not sugarcoat the climate change realities currently gripping nations. Reaching net zero is no longer enough, they warned. Only sucking CO2 directly from the air to be safely stored underground can move carbon emissions in the right direction.

Calling attention to a growing number of extreme weather events making headlines, Energy Secretary Jennifer Granholm told Carbon Negative Shot summit attendees that the urgency for carbon removal solutions is “only growing.” She added: “We just feel in our bones that carbon dioxide removal is finally having its moment,” noting that DOE’s goal over the next decade is to help reduce the price of decarbonizing industries.

The $1.2-trillion Infrastructure Investment and Jobs Act (IIJA) allocates more than $12 billion toward the development of carbon capture and sequestration (CCS) technologies—the “largest example of government support of carbon management technology that the world has ever seen,” the agency claims.

Related Link:

Efficient 'Tree' Pulls Carbon From Thin Air

By Scott Blair

Because CCS mitigates carbon emissions at point of source during industrial and energy-producing processes such as oil recovery and coal-fired power generation, climate activists have criticized federal investment in the technology as simply a way to prolong the world’s reliance on fossil fuels—only benefitting the worst carbon-emitting culprits.

IIJA’s CCS subsidies are not “an excuse to slow down the transition to clean energy,” said Granholm, but a chance for climate policy and carbon removal pricing to meet in the middle, “because we can’t live without industries such as steel, cement, chemicals, aviation and agriculture.”

DOE estimates one gigaton of CO2 is equivalent to the annual driving emissions from some 250 million vehicles. The agency's goal is to drive down the cost of durable, scalable CO2 removal and storage to less than $100 per net metric ton equivalent by 2032.

In 2016, the $1-billion Petra Nova Carbon Capture Project in Thompson, Texas, became the first U.S. industrial-scale coal-fired power station with CCUS technology, capturing 5,000 metric tons of CO per day for enhanced oil recovery. The plant stopped the technology in 2020 due to low oil prices caused by the COVID-19 pandemic.

Photo courtesy of NRG ENERGY

Capturing at the Right Cost

Proving the feasibility of CCS technology to work at commercial scale will require a big lift from AEC firms to engineer, procure and construct pilot and demonstration projects, says Jason Kraynek, president of production and fuels business line-energy solutions for Fluor Corp.

Current government incentives are “being challenged by market headwinds and hyper-escalation for equipment, material and labor—the key inputs for a CCUS project, especially the CO2 capture island,” says Kraynek, explaining that scaling up CCS adoption must include new recruitment and training programs to ensure an adequate pipeline of skilled labor.

“The problems have all been on maintaining the economic model, not the technical model.”

Susan D. Hovorka, Senior Research scientist, The University of Texas at Austin

Government support is a “critical component in advancing these CCS projects,” adds Kraynek. “We continue to engage all stakeholders—from the DOE and owners to other contractors and suppliers—to ensure these challenges are adequately understood and mitigated.”

CCS feasibility has two elements: technical feasibility and financial feasibility, explains Susan D. Hovorka, senior research scientist at the Gulf Coast Carbon Center (GCCC) in the Jackson School of Geosciences at the University of Texas at Austin.

“The problems have all been on maintaining the economic model, not the technical model,” says Hovorka, who helped GCCC monitor the carbon capture, utilization and storage (CCUS) technology at Petra Nova—the first commercial-scale coal-fired plant in the U.S. featuring the technology. A consortium of Kiewit subsidiary TIC - The Industrial Co., and Mitsubishi Heavy Industries America engineered, procured and constructed the $1-billion project. According to Kiewit, the project totaled over 1.7 million working hours.

Switching on in 2016 at the W.A. Parish Generating Station in Thompson, Texas, a post-combustion system captured CO2 from a 240-MW slipstream of flue gas to be compressed and transported for enhanced oil recovery. According to Petra Nova owner NRG Energy, the CCS-retrofitted boiler captured 92.4% of emissions in its three years in operation. In 2020, the technology was switched off just as the COVID-19 pandemic took hold and caused low oil prices.

However, there is some debate about whether the project can be called a true CCS success, explains Hovorka. The project was delivered on time, on budget and captured the expected amount of CO2 to make for a technical success, but the incentive to use CCS was lost.

“They are waiting for a financial incentive that works for them,” she says. “They can supply lower cost electricity to the Houston markets by not capturing carbon and that’s the core of the issue.”

“There is a lot of collaboration happening among the industry Itself in trying to find the best solutions.”

Melissa Jones, General Manager, Bechtel

The multibillion-dollar Kemper power plant project in Kemper County, Miss., was considered another financial feasibility failure for CCS. After initial plans to operate on a coal gasification system, and capture more than half of the CO2 produced in the process, the coal component was scrapped because the economics no longer made sense for the operating companies.

Globally, governments are finding that subsidizing CCS technology deployment is the missing link in building adoption rates to scale, explains Ruth Ivory-Moore, policy and advocacy manager for the Americas at the Global CCS Institute.

“CCS costs are decreasing as the breadth of deployment increases, and additional policy and financial incentives are made available,” says Ivory-Moore. The institute counts more than 140 CCS facilities in development globally, 30 in the U.S. Another 13 are in operation across the country, according to World Resources Institute. Costs are projected to further decrease as the tech scales up, Ivory-Moore says.

Last year, there were 19 direct air capture plants operating worldwide, according to the International Energy Agency, the largest being Climeworks’ Orca facility in Iceland.

Building Momentum

Also decreasing the price tag attached to CCS are evolving business models—such as turning industrial islands into CCS hubs to share CO2 transportation and geologic storage infrastructure.

In 2021, ExxonMobil announced plans for a $100-billion “innovation zone” for CCS along the Houston Ship Channel in Texas. Since then, a growing list of companies have also signed on to support the project, including Shell, Chevron, Marathon Petroleum, Phillips 66, Dow, INEOS, Linde, LyondellBasell, NRG Energy and Calpine.

“There is a lot of collaboration happening among the industry itself in trying to find the best solutions,” says Melissa Jones, Bechtel general manager for decarbonization, emission reduction and energy efficiency solutions.

With subsidies for development and initial deployment of CCS technology, DOE aims to jumpstart widespread interest in across various heavy industrial and energy sectors. But retrofitting a facility with the technology is not as easy as flipping a switch. Instead, it requires a concerted approach that heavily leans on the abilities of AEC firms to choose the best fit for owner assets, explains Jones.

“We always think about that every industrial asset is different,” says Jones. “They all need their own bespoke solutions.”

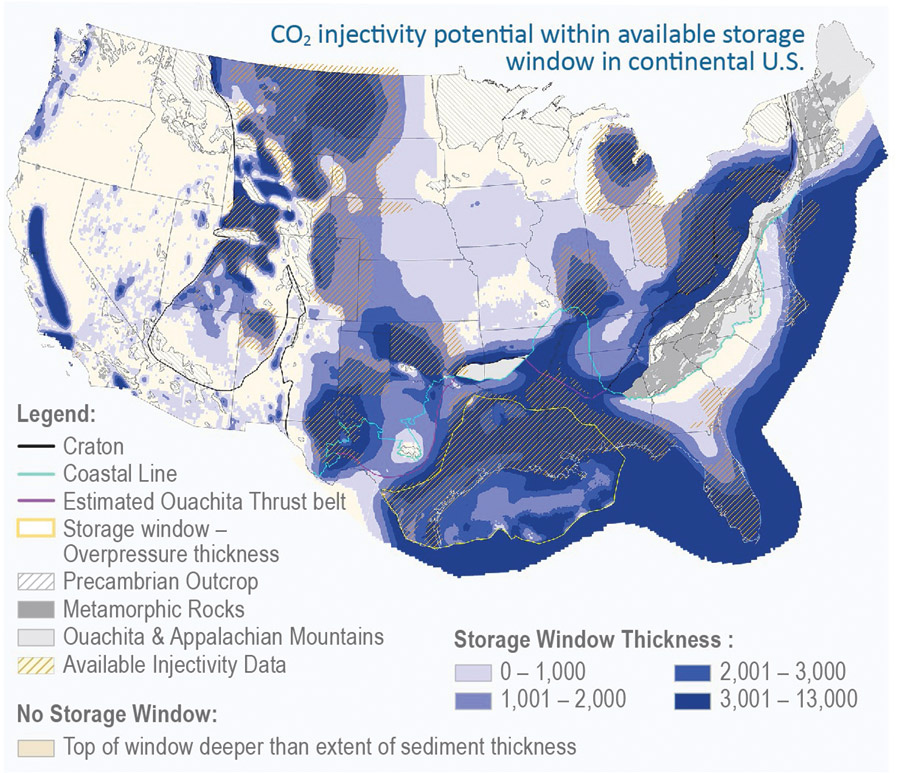

A map that shows the presence and capacity of saline aquifers where captured CO can be stored safely underground.

Map courtesy of Gulf Coast Carbon Center

*Click the image for greater detail

A contracting behemoth, Bechtel is known for leading massive projects in infrastructure and energy, as well as manufacturing and technology sectors. When it comes to CCS, Jones says “there has certainly been a real push to look at the innovations, study the technology and understand what’s available.”

There are some enablers getting these projects to full scale, she explains. “One is having the new technology, but also you need partnership and collaboration—not only within the industry but also within the community, with regulators and with those who are developing the legislation.”

On July 13, DOE announced plans to fund six carbon capture and sequestration demonstration projects through its $2.6-billion Capture Demonstration Projects Program, with $100 million allocated for its Carbon Dioxide Transport/Front-End Engineering Design Program. Together, the two complementary programs will help map out technical costs related to developing CCS at commercial scale and plot a path for the infrastructure systems needed to move captured CO2 to safe storage.

Residents and landowners gather outside the Iowa state capitol building in Des Moines to protest three proposed CO2 pipeline projects.

Image courtesy of Food & Water Watch

Twelve commercial-scale CCS projects in the front-end engineering and design, permitting and environmental review phase will receive $160 million from DOE. Then, $2.1 billion will be allocated to six CCS projects for advanced procurement, construction and operation.

According to the IIJA law, those six projects must include two “new or existing” CCS projects each in natural gas electric, coal-fired electric-generating and non-electric-generating industrial facilities. Projects must demonstrate a minimum of at least 95% carbon-capture efficiency with verification of secure geologic carbon storage.

“For some projects it might be straightforward to add on a carbon capture unit. For others, it's a longer and a larger project,” says Jones about how AEC firms will play a role in helping owners crunch the costs. “The impacts of a particular technology on the initial cost to construction of a project versus the operating cost is something that you really want to understand before you go to full scale.”

“It is an unsually complex task, with hundreds and hundreds of variables, and we are looking for the optimum.”

Richard Spires, Director, Wood PLC

As outlined in DOE’s National Getting to Neutral Report, storing carbon in saline aquifers miles underground is the most well-established and tested method of safe CO2 storage.

Aquifers are made of porous sedimentary rock. Located above these rocks is an impenetrable cap rock that prevents CO2 from escaping. Additional storage techniques are also being tested to store CO2 in basalt and coal seams.

Without direct air capture of CO2, a recent report by the UN Intergovernmental Panel on Climate Change paints a grim picture. According to the report, “annual average GHG emissions from 2010 to 2019 were higher than in any previous decade.”

At the Carbon Negative Shot summit, Sen. Sheldon Whitehouse (D-R.I.) shared that he wants to put a price on captured carbon in a new bill that would make the U.S. government one of its biggest buyers.

“Which is another way to send a price signal into this market that will encourage development and innovation,” he said. “At the end of the day, if you don’t have a carbon price, and it is free to pollute, you handicap yourself in terms of a proper market signal that will give the revenue necessary for innovation to really flourish.”

Climeworks’ Orca is the world’s largest direct air capture and carbon storage plant. Located in Iceland, the facility can capture 4,000 metric tons of CO2 for storage.

Photo courtesy of Climeworks

Community Impact

Recent protests against three newly proposed CO2 pipelines in Iowa demonstrate that DOE will also need to convince the public that CCS is a viable solution that can’t wait. With a density of saline aquifers located in specific regions and virtually nonexistent in others, shown in map above, some regions will see an uptick in proposed pipelines.

In a letter to the U.S. Environmental Protection Agency Region 9 office in San Francisco, the Center for Biological Diversity urged it to reject carbon capture projects in central California, citing “threats to the environment and public health.” The letter was signed by more than 80 environmental justice and conservation groups.

“CCS projects pose dangers to communities wherever they’re located, plus they consistently fail to live up to climate promises,” says Victoria Bogdan Tejeda, staff attorney for the organization. “Right now we don’t see any level of CCS that is acceptable.”

However, the National Wildlife Federation has said that it supports CCS as an “important and necessary part of the climate solution, especially for industry.”

In 2020, one of the most damaging incidents affecting public acceptance of CCS took place in Satartia, Miss. A CO2 pipeline used for enhanced oil recovery by natural gas company Denbury Inc. ruptured and left 49 people hospitalized from inhaling concentrated emissions, reported journalist Dan Zegart of the Climate Investigations Center.

The incident has sparked a number of ongoing lawsuits against the company. “That is the heart and soul of the struggle right now. That is what all these companies are going to have to look forward to when they start trying to build pipelines,” says Zegart.

Contracting firms with experience in the space can play a role in making sure that clients and communities are fully informed of the risks and rewards tied to CCS projects in order to keep communities safe, explains Richard Spires, technology development director of Wood PLC’s energy assets and technology division.

“It is an unusually complex task, with hundreds and hundreds of variables, and we are looking for the optimum of as many of them as we can,” he says.