First Shortlist Selected in $7B Hydrogen Hub Funding Competition

US Energy Dept. pares down list of teams, which include construction sector firms, it thinks are best able to win a chunk of $7 billion in federal funds to propel development of regional hydrogen production networks in the U.S.

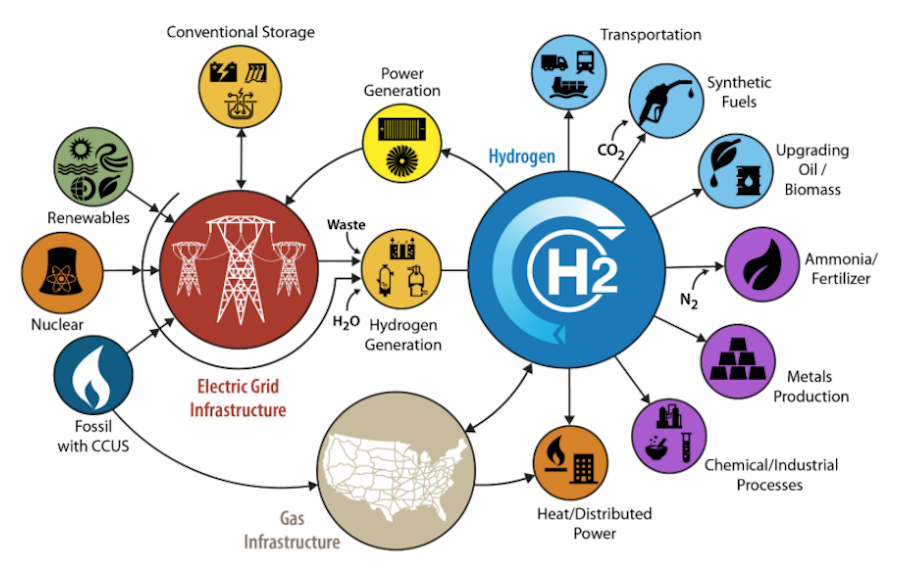

Image: US Energy Dept

The U.S. Dept. of Energy selected 33 public-private teams—out of 79 total contenders—to move forward as the strongest candidates in the competition for up to $7 billion in federal funding to support development of large regional clean energy hydrogen hubs.

Funded through the 2021 infrastructure law, the hubs are a network of clean hydrogen producers and the infrastructure that connects them. They are part of a larger $8-billion program established by the law to back efforts to shave costs of producing hydrogen with renewable power electrolysis.

The 79 applicants said project investments included $150 billion of their own funds, but they had also requested $60 billion from DOE. The chosen projects are seeking $33 billion in federal funds.

The agency would not release names of the 33 teams it “encouraged” in Dec. 27 letters to submit a formal funding application by an April 7 deadline, or the 46 that were “discouraged” from continuing—although teams picked to proceed in the competition could release details publicly. The most common reason for discouragement was that a development concept focused on only one element of the hub, according to DOE.

Proposed concepts “that would depend on technologies unready for commercial scale demonstrations and projects whose elements were not readily suited to help catalyze a national clean hydrogen network,” were also discouraged, the agency said. Discouraged applicants are not barred from formal applications, however, added DOE.

DOE said its encourage or discourage notifications to applicants were meant to caution them from spending resources to develop a full application of a concept unlikely to meet hydrogen hub program goals.

DOE divided the full program funding into four phases of competition that will result in “go/no-go” decisions, it said. The first phase includes planning and analysis to ensure the proposal is technologically and financially viable. Phase 2 will finalize engineering design, labor agreements and more.

The 2022 Inflation Reduction Act, enacted in August, also provides tax credits for new hydrogen production capacity investment, which are “generous enough to spur announcements for at least an initial round of multibillion-dollar projects,” says Housley Carr, an energy sector analyst at consultant RBN Energy.

“I would expect a lot of front-end engineering work [in 2023] and a lot of contracts to companies that do that kind of thing,” noted Brian Murphy, hydrogen analyst at S&P Global Commodities Insights.

About 240 MW of U.S. electrolysis capacity is either under construction or permitted to come online in 2023, says S&P Global, with 136 MW of added capacity announced or in an early planning stage. This is equivalent to about 7% of global electrolyzer production capacity set to be added in 2023, compared to 16% in Europe. The analytics firm projects larger U.S. capacity gain in the following year.

DOE expects to select six to ten hubs to receive between $400 million and $1.25 billion later this year.

Contender Details Slowly Emerge

According to information made public by some competing teams, proposals that cleared the first hurdle include one by Louisiana, Arkansas and Oklahoma called HALO that includes partners Shell, TC Energy, Williams, Halliburton, GE, Plug Power, Total Energies, Oak Ridge National Lab and a number of others.

A team led by Colorado, New Mexico, Utah and Wyoming known as the Western Interstate Hydrogen Hub has participants that include engineeering firm Atkins, which was identified by Wyoming officials as the prime contractor. Also teamed up in its development plan are Xcel Energy, Avangrid, Dominion Energy Utah, Los Alamos National Laboratory, DOE's National Renewable Energy Lab (NREL), Sandia National Laboratories among others, including academic partners. The project needs $1 billion to $1.25 billion from DOE, the team said.

Houston and the University of Texas are teamed up to develop the proposed HyVelocity Hub, with partners Chevron, ENGIE, ExxonMobil, Fortescue Future Industries, Phillips66, Sempra Infrastructure, Shell, Siemens the Port of Houston and others.

Industry firms McDermott, Quantas and Orsted are named among its team members.

DOE said at least two hubs must be located in regions with the greatest natural gas resources. A second Texas proposal selected to move forward, Trans Permian H2Hub headed by MMEX Resources, includes Siemens Energy and a number of cities in the state's energy-producing Permian region, the team said in an announcement. The private-led hub already includes two hydrogen production projects, one that uses natural gas and one that uses renewable energy.

The Pacific Northwest Hydrogen Hub also received the nod from DOE for a plan that includes hydrogen production, storage and a 590-mile pipeline system to store, collect and distribute hydrogen across Oregon and Washington, it said.

One former participant in that plan—Lake Oswego, Ore.-based solar energy company Obsidian Renewables—withdrew from the team last year and submitted another regional plan on its own that won DOE approval. Its proposed project needs $700 million from DOE and has $10 billion from private sources, the developer said.

California’s Alliance for Reliable Clean Hydrogen Energy System also earned DOE's blessing to submit a full application. Its proposal has two interconnected objectives—establish a renewable hydrogen hub in the state and create an economically sustainable, and expanding, renewable hydrogen market there and beyond its border, the alliance said in a statement. Partners include industry firms AECOM and Wood, as well as utility PGE, Toyota Corp., Plug Power, Hyundai, Michelin, BOSCH, Bloom Energy, Avantus and others.

The Midwest Alliance for Clean Hydrogen, a multistate coalition of 55 carbon free energy producers and developers and hydrogen technology providers, utilities, manufacturers and national labs and universities also confirmed its DOE go-ahead. The project needs $4 billion from the agency and other sources of funding, its developers had said earlier.

The Pennsylvania-backed team, called Decarbonization Network of Appalachia, will proceed as well, according to media confirmation. With Shell and Equinor as leads, the public-private partnership envisions a so-called "blue hydrogen" hub producing the substance from natural gas with carbon capture and sequestration, but no other details were shared.

Also moving forward is a northeast U.S. proposal by New York, Connecticut, New Jersey, Massachusetts, Rhode Island and Maine. With the New York State Energy Research and Development Authority as the lead partner, the team includes more than 60 partners such as utilities ConEdison, Eversource and National Grid, as well as Nucor Steel, Plug Power, Avangrid, EPD Renewables, Equinor, GE, Invenergy and Pratt & Whitney.

The Hawaii Pacific Hydrogen Hub, which includes 21 partners that seek to develop existing and proposed hydrogen production to be deployed across the state and Indo-Pacific region, can proceed

But an Alaska state-led effort, also with private partners that sought funds for a blue hydrogen hub that would redevelop a closed ammonia plant near Kenai and build an LNG project and 800-mile gas pipeline from the North Slope was discouraged and it will not apply further, state-owned Alaska Gasline Development Corp, said Dec. 30.

The company did not disclose reasons for DOE's stance, but said work continues on its planned hydrogen facilities.

Proposals That Are Still TBD

Other proposal developers that have not disclosed being asked to take the next application step include a coalition of major utilities in the Southeast—the Tennessee Valley Authority, Duke Energy, Dominion, Southern Co. and others that are teamed up with Battelle and a variety of industries across the region.

West Virginia also may still be in the running, leading a regional hub with Ohio, Kentucky and Pennsylvania that is teamed with Battelle, Babcox & Wilcox, Dominion, TC Energy, Marathon Oil and Longridge Energy Partners. The latter firm built a gas-fired power plant in Ohio that will eventually transition to 100% hydrogen fuel. Its GE turbine currently can burn up to 15% hydrogen and began using a blend of hydrogen and natural gas in April 2022.

Governors of North Dakota, Minnesota, Montana, and Wisconsin submitted a proposal that includes Bakken Energy, which would redevelop the Basin Electric Power Cooperatives Great Plains synfuels plant built in 1984.

The status of Florida Power and Light's submitted proposal is unclear, although in mid-December it said it broke ground on a $65-million green hydrogen hub that will use power from 200,000 solar panels to separate hydrogen from water.