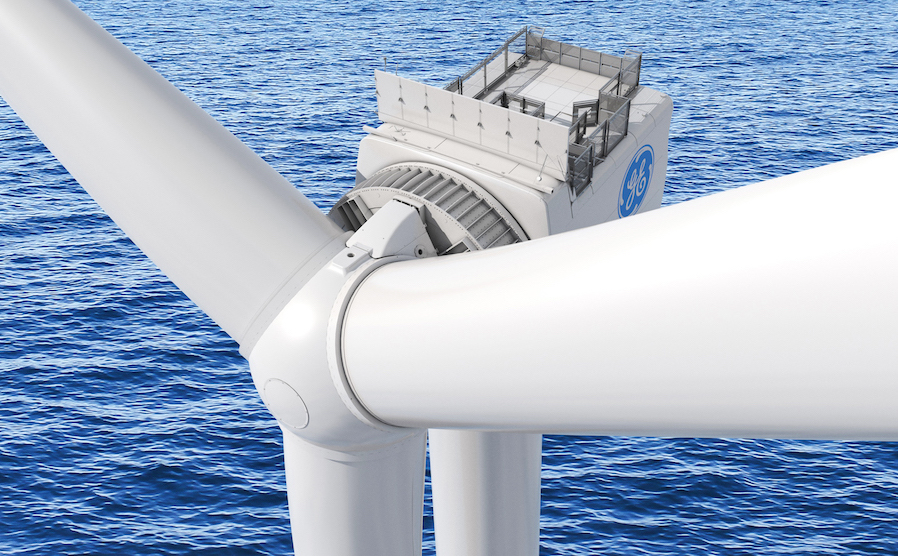

Two offshore wind turbine manufacturing giants, U.S.-based General Electric Co. and Europe-based Siemens Gamesa, reached a settlement March 31 to end their long-running patent infringement dispute over the former's design of the Haliade-X 12 MW to 14 MW offshore wind turbine, which involved a court-ordered ban on its sale in the fast-expanding U.S. market.

The companies said they reached an “amicable settlement,” but details are confidential. In a statement, the firms said they have “granted each other and their respective subsidiaries worldwide cross licenses under the asserted patent families, for the life of those patent families.”

A spokesman for GE said it would not comment further, in response to an ENR query on whether or how the pact now affects the federal court-imposed ban on Haliade turbine sales beyond the exemptions it granted—for the 800-MW Vineyard Wind project under construction in Massachusetts and the soon-to-start 1.1-GW Ocean Wind I project in New Jersey.

GE already had announced a redesign last October of the Haliade-X rotor it said did not infringe on the Siemens-Gamesa patent. The German-Spanish firm filed the U.S. patent infringement claim in 2020.

Philip Tatoro, founder and CEO of sector market consultant IntelStor, told ENR that the settlement means Siemens Gamesa will get some royalties, “but it will allow GE to go back to selling the Haliade-X 12MW without having to make the design changes.”

A federal jury in Massachusetts found GE guilty last June of patent infringement and set a royalty payment of $30,000 per MW for use of the turbine.

Federal Judge William Young in September permanently barred the company from installing the large turbines in U.S. waters. He set a limit of 62 turbines in the Massachusetts project and royalty payment to Siemens at $30,000 per MW as well as payments for the New Jersey project at $60,000 per MW.

A British court ruled in November that GE’s Haliade-X turbine does not infringe on Siemen Gamesa’s patent. It said the Siemens Gamesa patent is invalid and that “neither the fully assembled Haliade-X nor its hub fall within the scope” of the patent claim. GE also has contracts to supply the turbine model to several offshore wind farms in the country.

“The patent enforcement strategy as a means to protect market share is hopefully dead as a business strategy,” Totaro told ENR. "Excluding competition from the market has never been a good thing for the industry,” he added.

“The settlement allows everyone to get back to business, and while GE is likely to owe some royalties for the Haliade-X 12 MW platform, it can at least proceed with firming sales worth billions instead of worrying about chasing tens or hundreds of millions in IP royalties anymore,” Totaro said.

The settlement follows difficult bottom-line results for both manufacturers in recent months. Siemens Gamesa reported a fiscal 2022 operating loss of €581 million euros on sales of €9.8 billion euros, the firm's second consecutive annual operating loss, said Barron's. Sales fell 4% year over year.

Siemens Gamesa became part of Siemens Energy at the end of 2022.

GE reported a $2.2 billion loss in its wind business in 2022, larger than the $795 million loss reported in 2021, according to Barron's. GE still expects losses for its wind business in 2023 but its shares edged up 0.9% in March 31 trading.

GE, McDermott Gain Big North Sea Hub Contracts

Meanwhile, GE announced it won five contracts for high-voltage, direct-current infrastructure from TenneT, a transmission system provider for Germany and the Netherlands, to connect offshore wind farms in the North Sea to their power grids—including two in a consortium with McDermott International, for $4.3 billion, and three from a partnership with Singapore-based Sembcorp Marine, for $6.5 billion.

Each project can carry 2 GW of power. It will convert alternating current from wind turbines to HVDC and transmit it to onshore converter stations to be reconverted to AC as part of TenneT's North Sea capacity expansion.

Each has a 525-kV voltage level, which the companies said is the first-of-its-kind for offshore wind.

“This is one of the most important infrastructure projects of the century; the green transformation of the energy system is key for the decarbonization of industry,” said Tim Meyerjürgens, COO of TenneT. “With our market partners, we secure decisive acceleration of the offshore grid development.”

The GE/McDermott projects are 162 km off the coast of Germany and will connect to its transmission system. The GE/Sembcorp Marine projects, 62 km and 95 km off the Netherlands coast, will link to its power grid.

The projects include offshore converter platforms and onshore converter stations for the two-way conversion between alternating and direct current. Converter stations will have double the capacity compared to previous monopole grid connection systems, GE said.

GE Grid Solutions is responsible for the engineering, procurement, construction, installation and commissioning of converter stations for all the projects, the company said. McDermott will design, fabricate, install and commission offshore converter substation platforms for the German grid connection systems. Sembcorp Marine will design, build, install and commission offshore platforms for Netherlands converter systems.

Projects are expected to be completed between 2029 and 2031.

GE’s five contracts are among 11 awarded to HVDC suppliers as TenneT seeks to connect 40 GW of offshore wind generation to the two countries’ grids. Under a 2022 agreement, Germany, the Netherlands, Denmark and Belgium agreed to jointly install at least 65 GW of offshore wind by 2030 to accelerate Europe’s energy security.

Hitachi Energy and London-based energy services provider Petrofac were awarded contracts totaling an estimated $14.2 billion for six projects, five linking to the Netherlands and one to Germany.

The projects include technology and engineering expertise from Hitachi, with Petrofac handling EPC and installation tasks for offshore platforms and onshore converter stations. Hitachi said it is the largest framework deal in its history.