City Scoop: Sacramento

Sacramento Construction Continues Its Kingly Reign

Major health care projects in the Sacramento area like the $589-million UC Davis Health 48X Complex are likely to continue.

Rendering courtesySmithGroup

City Grill

Nils Blomquist

Sacramento Business Unit Leader

DPR Construction

Like the Sacramento Kings, the Sacramento construction market is experiencing a substantial period of growth and has a bright future ahead.

California’s capital has seen dramatic population growth over the past decade, driven by new opportunities and relative affordability compared with other California cities.

According to the U.S. Census Bureau, the six counties surrounding Sacramento County saw a 16% growth in population between 2010 to 2022. The state’s population rose just 5% over that same span.

This population increase accelerated through the COVID pandemic, briefly earning Sacramento the title of California’s fastest-growing city. Today, residential construction in the downtown core and outlying areas has been and will continue to be strong in the near term.

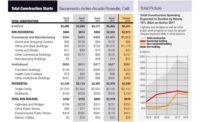

According to Dodge Data & Analytics, construction starts in the Sacramento, Arden-Arcade, Roseville region last year reached $7.2 billion, rebounding from a step back in 2021. Starts are slated to continue on an upswing and reach $8.2 billion in 2024.

In response to this growth, city leadership and developers are responding with new support facilities, infrastructure and amenities. Specifically, a large volume of health care construction is required to support the larger population.

Construction starts for health care facilities almost tripled between 2021 and 2022, reaching $353 million, according to Dodge Data & Analytics. They are expected to make a similar surge over the next two years to reach $637 million.

Health care systems are also renovating existing facilities to address the seismic mandates required by OSHPD to be completed by 2030. As a result, a combination of large acute care hospital projects, new outpatient facilities and various renovation projects are underway and in the health care pipeline.

In fact, two major health care projects in the Sacramento area were included in ENR’s California’s 2022 Top Starts. The No. 1 project was the $3.75-billion UC Davis Medical Center California Tower. DPR’s $589-million UC Davis Health 48X Complex was No. 8 on the regional Top Starts list.

The large State of California Office Building program accounts for most of the office work in the Sacramento area. Outside of this building program, commercial office demand must catch up. Like many other metropolitan areas, commercial and retail businesses of all sizes are still grappling with new patterns of office use, and the continued evolution of office spaces and how people work in them will affect the downtown core.

Commercial and manufacturing starts in the Sacramento area are projected to have muted growth in the next two years, according to Dodge Data & Analytics. While 2022 starts showed healthy growth over the year prior to reach $726 million, they are far behind the peak of $1.35 billion in 2020. And Dodge’s projections don’t show the sector’s starts surpassing that high water mark in the near term.

Compounding this, interest rate hikes months ago are starting to negatively impact capital investments in industrial, multifamily and office sectors.

Sacramento and its surrounding areas are still seeing growth. There are a variety of life sciences projects in the works both on the private and the public side, with the $1-billion Aggie Square public/private research facility currently under construction on the UC Davis campus. Higher education projects are slowly returning after a few years of COVID-related impacts. UC Davis continues to invest in its campus; Sierra College is planning for growth with its new student housing facility; and CSU Sacramento is planning a new satellite campus.

But buildings aren’t the whole story, according to Dodge. After recovering from a dip in 2021, total non-building starts in the Sacramento area topped $1.4 billion in 2021. Investment in highways, environmental public works and electric utilities are expected to continue on the rise with the influx of both state and federal funding. Dodge Data & Analytics projects Sacramento-area starts in the sector to grow by half to reach $2.17 billion in 2024.

Much like the Kings’ recent success in basketball, the excitement around the current construction market is positive, but it will take the entire industry to turn future potential into reality.