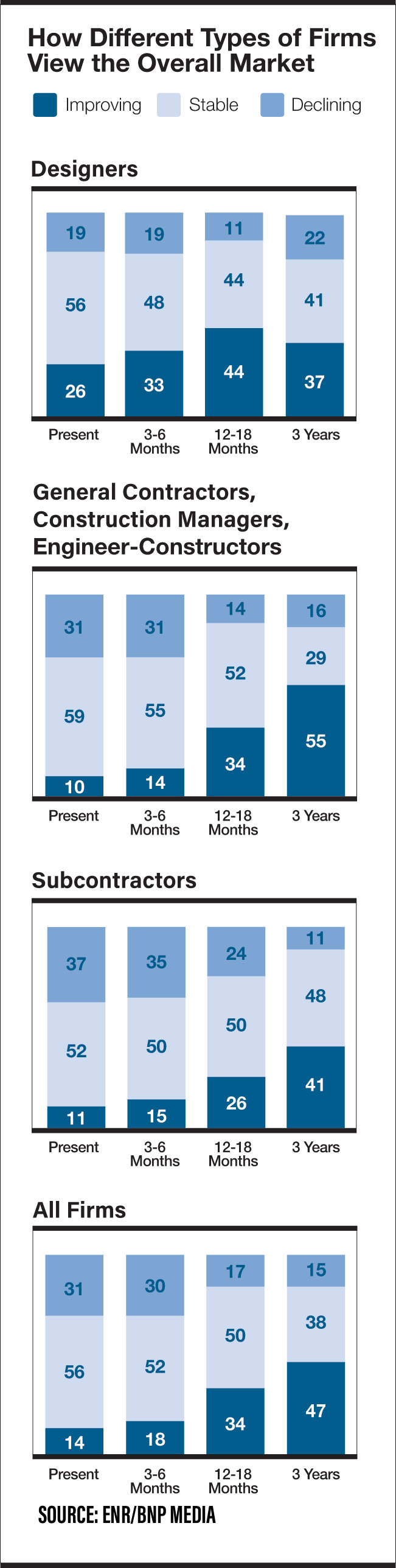

ENR’s Construction Industry Confidence Index rose this quarter to its highest rating since Q1 of 2022, up six points to a nearly stable 46 rating.

Confidence in the current construction market is virtually unchanged from last quarter, but executives report a more positive outlook in the short-to-medium term. Of our survey respondents, 70.2% see a stable or improving market three-to-six months from now, up from 59.8% last quarter. When considering 12 to 18 months from now, 83.1% see either a stable or improving market, compared to 66.6% last quarter.

The index measures executive sentiment about where the current market will be in the next three to six months and over a 12- to 18-month period, on a 0-100 scale. A rating above 50 shows a growing market. The measure is based on responses by U.S. executives of leading general contractors, subcontractors and design firms on ENR’s top lists to surveys sent between August 7 and September 18.

Confidence in the economy is also up, rising to 40 this quarter from 35 last quarter. As with the overall confidence index, respondents are more confident about the economy over the next 18 months, with 62.5% seeing a stable or improving economy in three-to-six months, up from 50.3% last quarter. The numbers for the 12-to-18 month window are 74.7% and 64%, respectively.

Related Link:

ENR 2023 3Q Cost Report PDF

(Subscription Reguired)

Looking regionally, confidence is strongest among those firms who list the Midwest as one of their primary regions. Overall confidence is at a stable 50 rating among those firms, and confidence in the economy comes in at 43. Most pessimistic are firms working in the Rocky Mountain states region. Overall confidence there is at a 44 rating, with economic confidence at 39.

Less Pessimism

Each quarter, the Princeton, N.J.-based Construction Financial Management Association (CFMA) polls CFOs from general and civil contractors and subcontractors on markets and business conditions. The resulting Confindex is based on four separate financial and market components, each rated on a scale of 1 to 200. A rating of 100 indicates a stable market; higher ratings indicate market growth.

All Confindex indices are down in comparison to their Q3 2022 readings, but a few have rebounded from last quarter. The overall Confindex fell 2% between Q2 and Q3 of 2023, to a rating of 99. The last time that index was below 100 was Q4 2020. Both the “financial conditions” and “current confidence” indices ratings are down, 3.9%, to 98 and 4.6%, to 104, respectively. However the “business conditions” index is up 1%, to 102, and the “year ahead outlook” index is up 2.2%, to 94.

CFMA respondents are not so much optimistic but rather “less pessimistic” about the near-term economic outlook, says Anirban Basu, CEO of economic consultant Sage Policy Group and the group's advisor and . “These respondents have been waiting for the downturn, and it hasn’t happened.”

The resilience of the economy has caused many economists to revise their assessments. In August, JP Morgan called off its recession forecast for 2023 and Bank of America has scrapped its recession forecast entirely.

Basu still sees a recession on the horizon before the end of 2023, however. He attributes the currently robust economy to the improvement in supply chains since late 2021.

“You get the supply coming online meeting with this frenzied unmet demand [coming out of the pandemic], that creates transactional volume. More transactional volume translates into economic growth.” As unmet demand is satisfied however, the transactional volume will go down, causing a contraction, the Sage CEO predicts.

Basu believes that the Federal Reserve’s previous interest rate increases have yet to make a meaningful impact on the economy. “Monetary policy operates with lengthy and variable lags,” he says. He points to rising home prices and the positive performance of the stock market as evidence. “Those are some of the most interest rate-sensitive aspects of the economy,” yet rate hikes have had little effect.

Looking at Markets

Confidence in the commercial offices market continues to tumble, down to a 19 rating on ENR’s survey this quarter. That is its lowest value since Q4 of 2020.

“A year and a half ago, we were seeing badge swipes in major downtown areas, at least go up from 25% to 40%. [But] I almost feel like those swipes have gotten asymptotic at this point,” says Neil Shah, CFMA president & CEO. Landlords are realizing that tenants aren’t coming back.

“We have that debt maturity wall, where $1.5 trillion of commercial real estate has to be refinanced between now and 2025,” adds Basu. Much of that will not be refinanced, which will lead to bankruptcy for some building owners.

Multi-unit residential also fell in Q3, down to a 47 rating—only the third time the market has dropped below 50 in the past decade.

Confidence in some markets remains strong, notably transportation (a 73 rating), industrial process (69), water supply (68) and power (68).