Economics

Architecture Billings Fall Steeply in September, Reach New Post-Pandemic Low

Historic low demand in the housing market cited as biggest factor

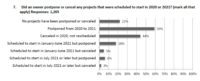

The September 2023 Architecture Billings Index reflected a continuing trend of declines in billings and the lowest ABI score since 2020. Infographic courtesy of the American Institute of Architects

Business conditions at architecture firms declined sharply in September, according to the AIA/Deltek Architecture Billings Index. The ABI score of 44.8 for September is the lowest score reported since December 2020 during the height of the pandemic. Any score below 50 indicates decreasing business conditions at architecture firms and the September score indicates a significant increase in firms reporting declining billings, according to the institute, a trade association for architecture and design firms.

“The September ABI score reflects a marked downturn in business conditions at architecture firms, with the sharpest decline observed since the peak of the pandemic," said Kermit Baker, AIA's chief economist. "While more firms are reporting a decrease in billings, the report also shows the hesitance among clients to commit to new projects with a slump in newly signed design contracts. As a result, backlogs at architecture firms fell to 6.5 months on average in the third quarter, their lowest level since the fourth quarter of 2021.”

Firms with an institutional specialization are the only architectural specialization that remained flat while all other sectors reported declining billings. Firms with a multifamily residential specialization saw more decline, a continuation of month-over-month trend of declines that began in August 2022.

The ABI is a forward-looking economic indicator of construction activity, providing an approximately nine-to-12-month glimpse into the future of nonresidential construction spending activity, according to the AIA. The score is derived from a monthly survey of member architecture firms that measures changes in their billings from the previous month.

The project inquiries index remained above 50 in September, but AIA said it's difficult to tell if clients will ultimately sign on for design services for those projects even if they are inquiring about them.

September Highlights

- Regional averages: Northeast (46.4); South (46.2); Midwest (49.3); West (44.3)

- Sector index breakdown: commercial/industrial (45.0); institutional (50.1); mixed practice (firms that do not have at least half of their billings in any one other category) (46.2); multifamily residential (43.5)

- Project inquiries index: 53.7

- Design contracts index: 46.2