Brandon Dekker

San Diego and Irvine Office Leader & Principal

CannonDesign

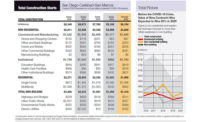

After taking a big step back in the wake of the pandemic, the sunny disposition of the San Diego AEC industry seems to be returning. According to Dodge Data & Analytics, total construction starts in the region are expected to rise 13% to $10.4 billion in 2025. The upswing is encouraging, but starts will still be down almost a quarter from 2021.

With a population of 3.3 million in the greater San Diego County metro area, the region is growing at a faster pace than the state overall. The upward trend isn’t surprising, particularly when San Diego’s strategic plan released in 2022 is factored in. It prioritizes investments in public transportation, sustainable development and responsible growth, says Dekker.

“While private sector spending on building projects has decreased, public sector spending is on the rise,” he says. “Alternative delivery methods like progressive design-build are being considered for more public projects.”

Perhaps the most robust area for growth will be non-building starts, with almost $2.7 billion slated for 2025—a 60% increase over 2023. Environmental public works leads the way with $1.26 billion in project starts predicted for 2025.

Dekker says public agencies are feeling a financial pinch, but they have recently been offered a lifeline.

The passage of SB 706 should accelerate this by allowing cities, counties and special districts in California to use the progressive design-build process for up to 15 public works projects exceeding $5 million each, he notes.

That matters more as budget constraints have pushed agencies to scale back capital programs and look toward the private sector to help bridge the gap between the demand for public buildings and the capital needed to build them.

“This method has already proven successful for public agencies across California, fostering increased collaboration, ensuring cost and schedule adherence and ultimately delivering superior project outcomes,” Dekker says.

On the private side, CannonDesign, like many California firms, is closely watching the health care sector for opportunities.

“The overall health care industry in San Diego remains robust, with billions of dollars of health care projects in the pipeline across the county involving major health systems,” he says.

One recent project for CannonDesign is the VA San Diego Spinal Cord Injury Center and Community Living Center, which is being built on the VA San Diego Medical Center campus. The 197,000-sq-ft, four-story building will offer cutting-edge services to veterans grappling with spinal cord injuries.

When it opens in 2025, this comprehensive facility will provide a spectrum of services including diagnosis, treatment and rehabilitation. Archer Western Federal Joint Venture is the builder. Engineering was done by Saiful Bouquet Inc. (structural) and IMEG Corp. (MEP and civil).

“The overall health care industry in San Diego remains robust, with billions of dollars of health care projects in the pipeline.”

—Brandon Dekker, CannonDesign

The health care sector is also expected to accelerate with the recent passage of Proposition 1, which will provide $6.4 billion to bolster mental health resources, particularly for individuals with mental health/substance use disorders. The effort is more than just an opportunity for new work, “it’s a chance to rethink the basics of the region’s health care resources,” says Dekker.

“Simply adding more beds across San Diego County will not fully tackle the complexities of the mental health crisis, so we have to think bigger and create solutions that provide lifelines for those in need,” he says. “It’s a moment of profound importance for the AEC industry, prompting us to reimagine our built environment as a powerful catalyst for holistic well-being and societal change.”

Although life sciences had also been a bright spot for San Diego, that brilliance has dimmed a bit due to rising interest rates.

“While many developers had initially pursued speculative projects, a significant number have been put on hold due to the high cost of borrowing,” Dekker says, and “an excess of available lab space in the market has also contributed to this deceleration.”

San Diego has not been immune to the industrywide issues of rising materials costs and scarcity of skilled workers. “It has been a real challenge to say the least,” Dekker says. “When you couple the high cost of construction with the high cost of capital, many, specifically in the science and technology space, have decided to hit pause until the market stabilizes.”