Energy in Transition

Nuclear Fusion Pushes to Reach Commercial Power Plant Stage

June 27, 2024

Energy in Transition

Nuclear Fusion Pushes to Reach Commercial Power Plant Stage

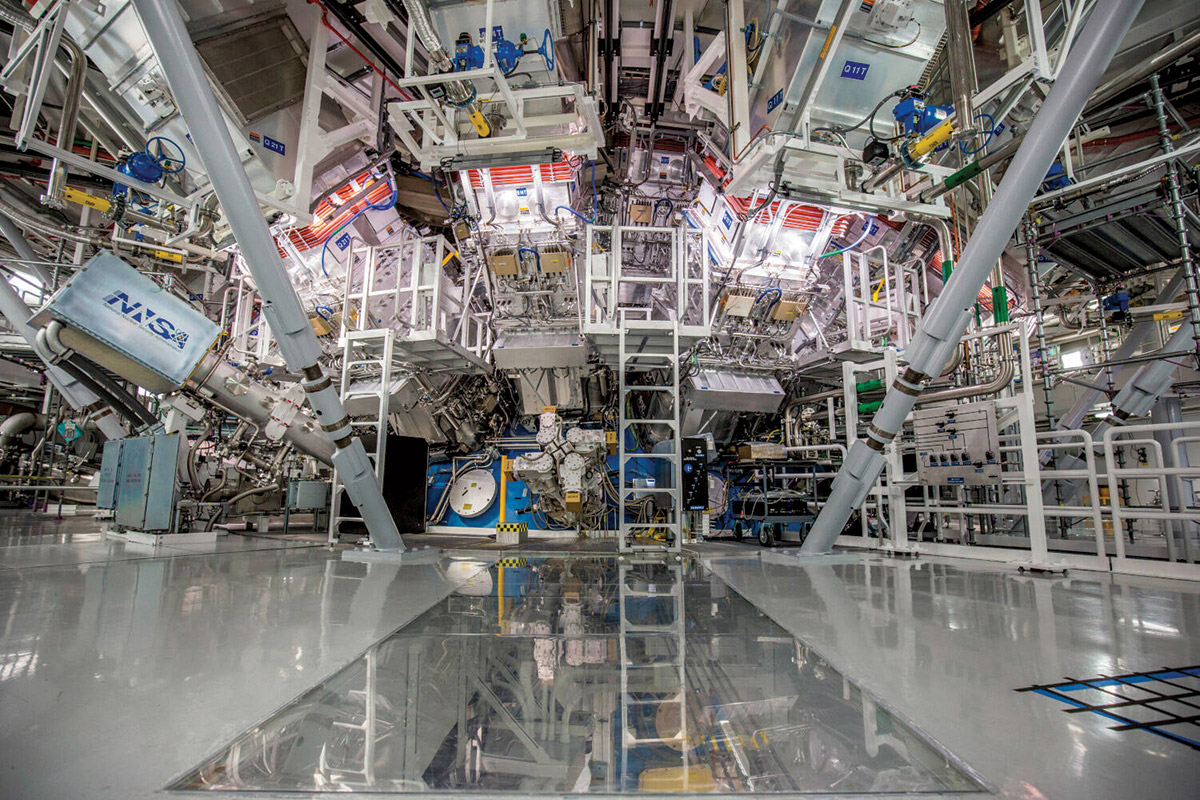

June 27, 2024Nuclear fusion power has long been researched in large lab facilities such as the US Energy Dept.'s National Ignition Facility (left), which did its first laser implosion of deuterium and tritium atoms in 2016 (center); and at the ITER complex in France (right), which is developing high-temperature magnets needed to generate massive energy from those colliding atoms.

Image Credits: US Energy Dept, LLNL-NiF, left; Don Jedlovec, US Energy Dept, LLNL-NIF, center; International Thermonuclear Experimental Reactor (ITER), right.

The quest to develop nuclear fusion—the process that energizes the sun and other stars—as an earth-based power source dates back more than a century when Albert Einstein and other scientists theorized how enormous amounts of energy could be produced when atoms fuse. That research was partly diverted for wartime weapons priorities but later targeted to develop fusion for commercial-scale energy—what sector proponents have called the “holy grail” for decades since.

Nuclear fusion is a power source that can generate nearly 4 million times more energy than fossil fuel combustion and four times more per kilogram of fuel than an existing fission nuclear power plant, has no carbon emissions nor major risk of nuclear waste or meltdown and offers a fuel supply more secure than current nuclear fission, says Jane Nakano, senior fellow in the Energy Security and Climate Change Program at think tank Center for Strategic and International Studies.

The global effort has poured billions of dollars into government-funded facilities and experiments over decades to test fusion energy ignition concepts. These include the $3.5-billion National Ignition Facility in California, built and operated by the U.S. Energy Dept., which includes nearly 200 of the world’s strongest lasers that converge on a hydrogen atom-filled target the size of a peppercorn; and the 445-acre International Thermonuclear Experimental Reactor test site (ITER) in France, still under construction, where researchers from 35 nations seek to develop high-temperature superconducting magnets needed to generate massive energy as colliding deuterium and tritium isotopes fuse into high energy neutrons and helium.

Researchers at the U.S. Energy Dept.’s National Ignition Facility in California used nearly 200 lasers to achieve fusion energy gain for the first time in late 2022 after decades of tests, and has repeated it four more times—propelling startups to develop utility-scale power projects that can replicate it.

Photo courtesy Lawrence Livermore National Laboratory

Recent fusion breakthroughs at these test sites and others—plus accelerating climate change— have elevated the power source as a priority and spurred more action to create technological, political, regulatory and financial incentives to develop projects to mitigate impacts sooner.

“We are edging ever closer to a fusion-powered reality, and at the same time, significant scientific and engineering challenges exist,” then-U.S. Climate Envoy John Kerry told the COP28 climate conference last December in Dubai, releasing the first U.S. plan to commercialize fusion power globally. “Fusion emerged from the shadows at COP28,” Christofer Mowry, current chair of U.S.-based advocacy group Fusion Industry Association, recently told publication Recharge. He also is CEO of fusion startup developer Type One Energy and a former advisor at clean energy investor Breakthrough Energy Ventures, which backs several fusion firms.

Image credits: U.S. Government Accountability Office report, left; U.S. Fusion Industry Association, 2023, right

Fusion Energy 'Ignition'

The Energy Dept. announced a department-wide initiative in 2022 to accelerate commercial fusion energy, and earmarked $46 million in combined development funding with required progress milestones for eight startup developers: Commonwealth Fusion Systems, Focused Energy Inc., Princeton Stellarators Inc., Realta Fusion Inc., Tokamak Energy Inc., Type One Energy Group, Xcimer Energy Inc. and Zap Energy Inc. "In five to 10 years, the initiative “will resolve scientific and technological challenges to create designs for a fusion pilot plant that will help bring [it] to technical and commercial viability,” the agency said, comparing it to a NASA program that propelled commercial space launch.

More buzz was created later that year when the department's National Ignition Facility lasers achieved “ignition”—generating more energy from a fusion reaction than the amount used to start it. Massachusetts Institute of Technology engineers in 2021 also successfully tested a novel high-temperature superconducting magnet with a world-record field strength and simplified fabrication, calling it a key step for practical fusion power. “It basically changed the cost per watt of a fusion reactor by a factor of almost 40 in one day,” said Dennis Whyte, former director of MIT’s Plasma Science and Fusion Center. “Now fusion has a chance of being economical.”

The successes have attracted major private investors willing to risk millions more and who have, in many cases, the technical skill to judge a developer’s potential. Tina Tosukhowong, investment director of fusion investor TDK Ventures, which has a stake in developer Type One Energy, is a PhD chemical engineer who leads the investment firm's cleantech and advanced-materials areas. “Scaling a first-of-a-kind fusion power plant is going to be hard, but we strongly believe [the firm] has what it takes” to succeed in the effort, she says.

The fusion energy sector attracted more than $6 billion in investment last year, says its trade group, $1.4 billion more than it reported previously. While the growth rate slowed, investment still rose 27% "in a period where fears of inflation, interest rate increases and even bank failures led technology investors to hold onto their money," the group says.

Developer Longview Fusion Systems is basing its fusion power process on lasers demonstrated in federal tests that achieved repeated energy gains since 2022, using a 10-m-dia. fusion "engine," top. Fluor is designing its first commercial plant, left. Firm CEO Ed Moses, right in photo, a former top U.S. Energy Dept. physicist, leads California Gov. Gavin Newsom, center, and another official, on earlier National Ignition Facility tour.

Images: top and bottom left, courtesy Longview Fusion Energy Systems; bottom right, courtesy U.S. Energy Dept. Lawrence Livermore National Lab

But other market experts and observers are more skeptical, claiming that wind and solar power along with energy storage, smart networks and more green hydrogen weaken the case for fusion. “Just because it would be nice if controlled fusion could work doesn’t mean it’s on the verge of doing so,” said Victor Gilinsky, a former U.S. Nuclear Regulatory Commission (NRC) member, in a February opinion in the Bulletin of the Atomic Scientists. “The hard truth is that scientists and engineers don’t even know yet whether controlled fusion can be achieved … at least anywhere outside the sun.” Harvard University environmental policy professor and former White House advisor John Holdren told Forbes there would not be “economically competitive fusion on the power grid before 2050.”

29

Number of Fusion Industry Association survey respondents, out of 38, who said fusion power gain, as well as funding, are their biggest hurdles through 2030.

The U.S. Government Accountability Office concluded in a 2023 analysis that “researchers do not fully understand the behavior of burning plasmas” in fusion reaction, which “presents several complex systems engineering problems yet to be solved,” such as how materials withstand fusion conditions for decades. It also cited “misaligned” research priorities and regulatory uncertainty.

Tammy Ma, who leads the Lawrence Livermore National Laboratory’s Inertial Fusion Energy initiative and was a team member in its 2022 ignition demonstrating energy gain, and four others that followed, says “the next facility we build is not immediately going to be a power plant. There are still other intermediate steps, other test facilities."

Ma says public-private partnerships "are a new way for us to really push innovation and leverage resources on both sides," stressing that "what's great about fusion is the energy it generates can potentially be very flexible."

As to skeptics, she counters: “Before the Wright brothers, did anyone think humans could fly? It takes imagination [and] determination.”

Robert Prieto, a nuclear engineer who formerly led design firm Parsons Brinckerhoff and was a Fluor Corp. top executive, says that with "great progress made in the last few years, designing a fusion power plant is in the realm of the possible." But he cautions about too much "optimism bias" in the sector.

With $2 billion in private investment, Commonwealth Fusion Systems is building a $500-million magnetic fusion power complex in Massachusetts that will include its prototype SPARC reactor as well as an advanced component manufacturing facility, bottom, right; Physicisr and firm CEO Bob Mumgaard, above, tours the firm site with Sen. Elizabeth Warren (D-Mass.), left. and Energy Secretary Jennifer Granholm

Photos courtesy Commonwealth Fusion Systems

Moving 'Past the Lab'

Millions in Biden administration funding to push fusion R&D and commercialization are earmarked in new federal infrastructure funding programs. DOE's 2024 appropriations bill included a record $790 million for research and it reached final agreement in June with the selected developers in its “milestone-based” funding program “to take fusion energy past the lab and toward the grid,” said Energy Secretary Jennifer Granholm.

Firms chosen are Commonwealth Fusion Systems, Focused Energy Inc., Princeton Stellarators Inc., Realta Fusion Inc., Tokamak Energy Inc., Type One Energy Group, Xcimer Energy Inc. and Zap Energy Inc. Funding covers the first 18 months of a five-year program to advance designs. The administration’s “bold decadal vision” for commercial fusion also includes $180 million in competitive grants for teams to “bridge the gap” between foundational science and practical application, the department says.

On June 20, Congress sent to President Biden the bipartisan ADVANCE Act, the first major clean energy legislation of the term. It cuts licensing costs and updates rules for advanced nuclear reactor technologies and empowers more global export of U.S. fusion approaches, particularly as China aggressively expands its own investment. The bill codifies a previous NRC decision to regulate fusion facilities in a less-stringent “byproduct” category used for those in nuclear medicine and research. The law, which also requires NRC to update Congress in June 2025 on commercial fusion technology licensing, follows similar legislation enacted last year in the U.K. The two now have a partnership agreement to collaborate on fusion R&D.

Andrew Holland, CEO of the fusion trade group, wants the U.S. government to invest $100 million a year into energy development, plus a one-time $3-billion infusion. “It’s important for the government to be there when the risk is high because it crowds in more investments,” he says, noting the multi-billion-dollar cost of building a first of its kind power plant. Nearly 90% of firms in the group’s latest market survey expect to see fusion power on the grid in the 2030s, or even before, he says, asking: “You can build one plant, but can you build 1,000?”

Startup Helion Energy is blending aspects of magnetic and inertial fusion in prototype work for its first power plant, which it says is set to operate in 2028. The firm touts a signed power supply contract with Microsoft and a $375-million investment from OpenAI CEO Sam Altman.

Photo courtesy Helion Energy

Intellectual Property

The issue of government access to startup firms’ patents, trade secrets and other intellectual property has been a controversial part of Energy Dept. funding deal talks with developers, executives told ENR on background. They considered government demand for such information in certain circumstances too onerous since it is core to a firm’s market valuation and investor support.

One battery technology firm the agency supported financially declared bankruptcy in 2021 and was bought by a Chinese firm that took its intellectual property to China, said a Congressional Research Service report. Terms of Milestone funding program contracts were not disclosed, but developer unease remains, one executive told ENR. Rules also mandate a ban on non-U.S. based investors in participating companies.

The patent issue becomes more pronounced as more private investors, particularly big tech firms, back fusion startups to secure a directed power source as more and larger data centers and added artificial intelligence use escalate energy demand.

Even now, fusion power supply deals with major players such as Microsoft, Google and ChatGPT-maker OpenAI have propelled developers to expedite timelines for prototypes and even full-size plants. Paul Wilson, University of Wisconsin-Madison nuclear engineering department chair, says he is not confident firms will meet such deadlines but expects breakthroughs in the 2030s with full commercialization in the 2040s. Scientific hurdles remain, but “engineering challenges are the long pole in the tent,” he says.

"The engineering challenge of building complex systems that can harvest the energy and convert it to electricity without being destroyed by radiation poses a series of tall engineering and materials-science hurdles," says a report in the Institute of Electrical and Electronics Engineers IEEE Spectrum.

Nuclear Fusion Developers Make Strides

Longview Fusion Energy Systems was launched days after the 2022 Energy Dept. laser test by two ignition facility construction and operations veterans—physicist and fusion leader Edward Moses, who is CEO, and COO Valerie Roberts, a former facility project manager and Jacobs executive.

Lasers were invented in the 1960s, but not declassified until the 1970s, says Roberts, adding that inertial confinement fusion is something "people still don’t have an understanding of."

To replicate the laser approach on a more efficient scale, Longview hired Fluor Corp. in April to design and build a commercial power plant, with the energy gain tests serving as its fusion physics demonstrator. “It’s an engineering detail project to turn it into an operating plant,” says Moses, who cites Fluor EPC and power plant integration expertise. Longview’s plant “will use today’s far more efficient and powerful lasers, with added manufacturing and optimization through AI,” Roberts says. "Our initial plant design is highly modularized and based on currently available materials. "Everything we do is plug and play, including the lasers that are truck mountable."

The firm’s plants are set to each deliver from 1 GW to 1.6 GW of energy at full capacity. Fluor will finish designs by late 2027 for a first 440-MW plant that will operate five years later, Moses says. “The focus is on the lasers, modular in nature so components can be switched out, but there are technical hurdles,” says Fred Hughes, Fluor vice president and Longview project director.

$6.2 billion

Private/public investment reported by 43 fusion developers in a 2023 industry survey. About $5.3 billion was from private investors, $271.6 million from public sources.

Barriers are factored into design to contain radioactive tritium, which is “tricky and will find every nook and cranny,” he adds. Related to fusion plant grid connection, there are no real obstacles, Hughes says. “The output from the fusion process is steam or heat, the same as from a gas or coal plant,” he notes, although “conversion of heat from the fusion engine blanket to a cooling system may be different than for conventional power plants.”

Roberts says Longview has worked on plant siting for two years, with “interest from several states” but no location timeframe yet set. The firm could repower a coal-fired power plant "to restore jobs and use existing infrastructure," she adds. "There's a lot of forward thinking things you can do with new technology like this so we have a pretty robust program for the next five years."

"This is probably the hardest thing I've done in my entire 35 year career," Roberts notes. "But I'm working on something that makes a difference, it's going to leave an incredible legacy."

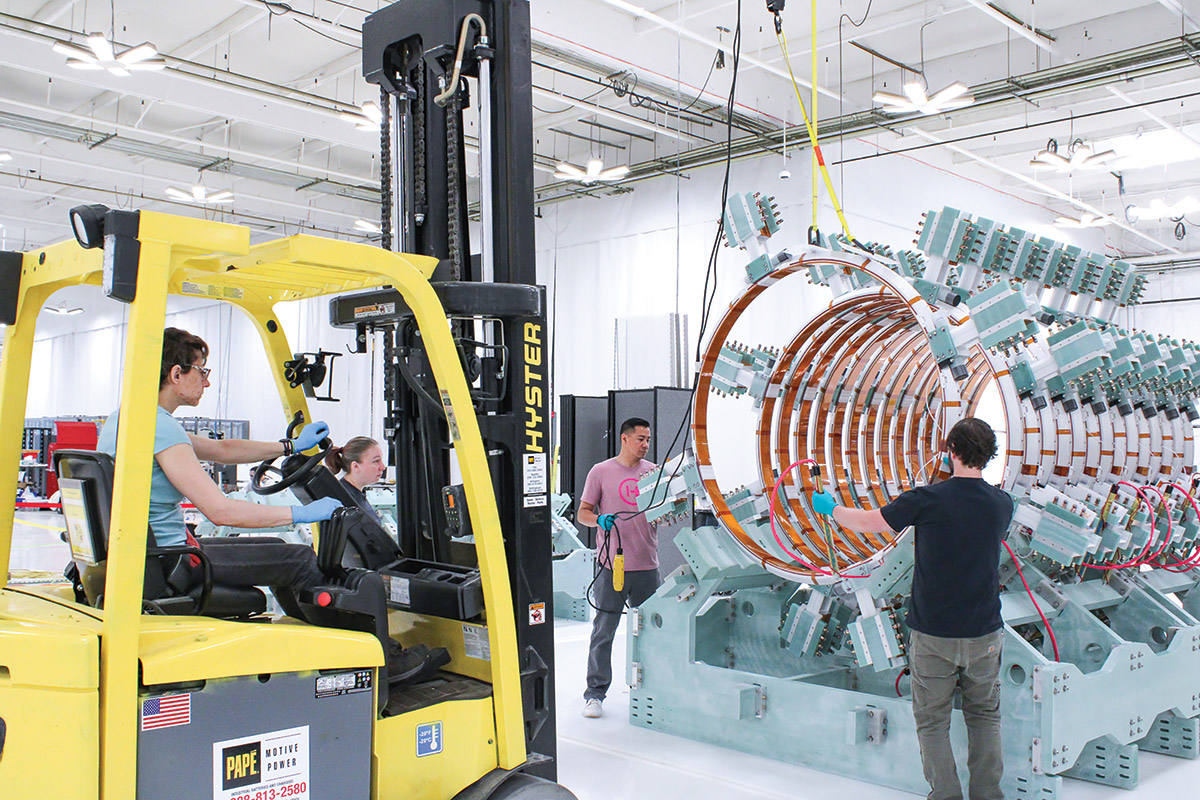

Commonwealth Fusion Systems, which spun off from MIT plasma center research in 2018 and is backed by more than $2 billion in private investment, is building its estimated $500-million fusion test complex at a former military site in Massachusetts to include a doughnut-shaped tokamak that will heat hydrogen atoms to about 180 million° F. Resulting plasma is squeezed by a powerful magnetic field to fuse atoms and release energy.

The firm says its SPARC prototype, now under construction, will demonstrate new magnet technology that “allows for much higher magnetic fields that can produce more power in a smaller machine”—about 40 times smaller than the ITER fusion reactor. SPARC will demonstrate its fully integrated plant, ARC, which it says is set to deliver power to the grid in the early 2030s but with its location not yet determined.

Commonwealth Fusion notes “challenges in materials and heat exhaust from the tokamak” that are being addressed. One hurdle is global supply of 4-mm-wide high-temperature superconducting tape it uses, made of yttrium barium copper oxide on a steel substrate, of which the company says it needs 10,000 km to build its smaller magnet design. It envisions having enough supply when SPARC is ready, but the firm and other sector experts see a major global production boost needed for commercial power generation.

The complex, which also includes an on-site advanced magnet production facility and corporate headquarters, is nearly complete, says the firm, with all major industrial equipment on site or on order. The plan is to finish SPARC commissioning by the end of 2025 and generate “first plasma” in 2026, Commonwealth Fusion says.

Engineer HDR and BOND Construction have been the primary design firm and contractor for all building phases, with Thornton Tomasetti and VHB as structural and civil engineers, respectively. The team “proposed several regions to safely narrow the facility’s massive concrete walls and roof,” says Ken Filar, HDR principal. “Such a large volume of concrete was saved overall that it shortened the construction schedule by eight months.”

Commonwealth Fusion announced in early June it received $15 million in funding under the Energy Dept. Milestone program. Among its estimated 60 private investors are Italian energy giant ENI and Bill Gates-supported Breakthrough Energy Ventures. SPARC could produce up to 100 MW of fusion power but its development "will run through most (it not all)" of Commonwealth funding raised to date, says MIT Technology Review.

Using a stellarator fusion technology design, image right, Type One Energy is developing an estimated $300-million prototype facility at the now decommissioned Bull Run coal-fired plant, left, in a pact with the Tennessee Valley Authority. It is set to finish plant design in 2028, with engineer AtkinsRealis selected to develop the design concept.

Photo, top, courtesy TVA; right, courtesy Type One Energy

'Small and Efficient'

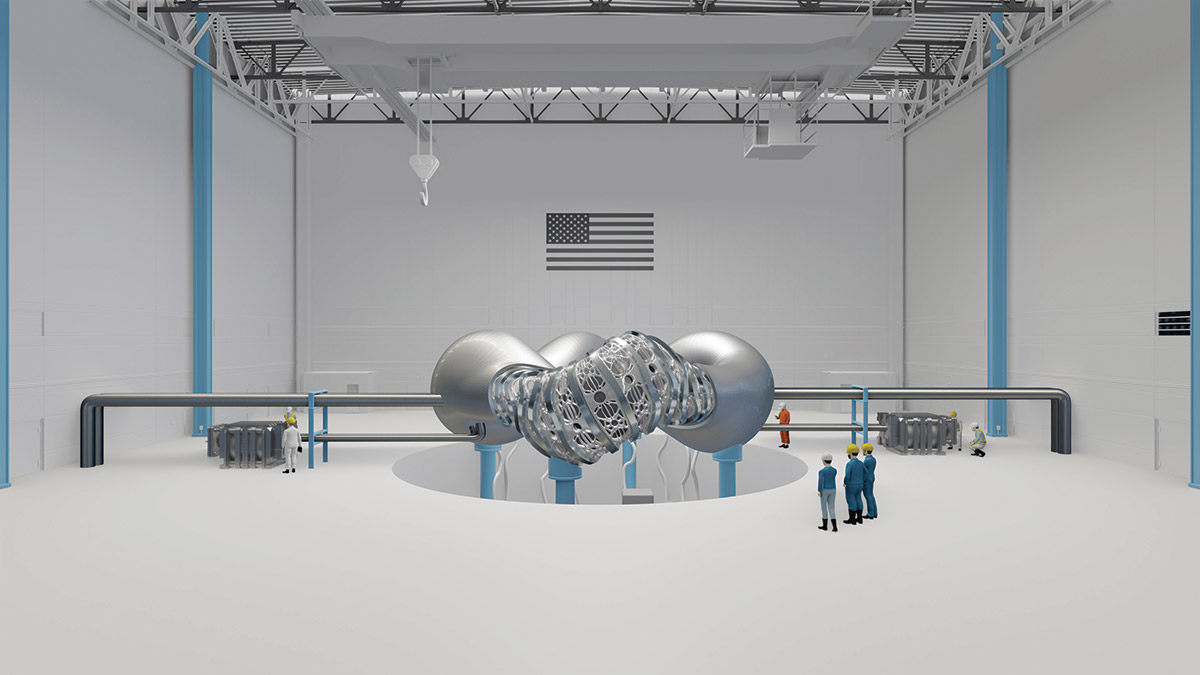

Developer Helion, based in Washington state, is testing technology to directly extract power from the fusion reaction rather than heating water for steam to produce it—an approach with an eventual cost of 1¢ per kWh, company CEO David Kirtley said on a podcast. Helion says its technology combines aspects of magnetic and inertial confinement with a pulsed, non-ignition fusion system that helps overcome physics challenges to build an energy-efficient system. Power output is adjusted by changing the pulse rate, it says.

Use of deuterium and helium-3 as fuel allows charged particles to be recaptured as electricity. “This helps keep our system small and efficient, to build faster and at a lower cost,” says the firm, which is now working with Princeton University’s Plasma Physics Lab on engineering development. Helion also inked a precedent-setting deal with Microsoft to supply power to its Redmond, Wash., campus and data centers, expecting to have a 50-MW plant completed by 2028 and producing power after a one-year ramp-up.

Microsoft and OpenAI also seek to build a 5-GW AI data center set to open in 2028, according to media reports. In another novel link, Nucor Steel and Helion said they will develop a 500-MW fusion plant at a U.S. mill by 2030 that will power smelters and bypass the grid. The firms now are working on how to dial power up and down as needed. “We believe in the technology Helion is building,” Nucor President and CEO Leon Topalian said. It invested $35 million to develop the plant.

Helion began developing Polaris, its seventh prototype, earlier this year, which Kirtley said will have stronger magnets and will pulse 100 times faster than its previous one. “If successful, Polaris will be the first fusion machine to demonstrate electricity production,” Helion says. It is on schedule to operate fully by year end, according to the firm.

'Ready for Primetime’

Two firms that won Energy Dept. funds are using stellarator technology, which the agency terms an alternative to the tokamak in the race to reach net positive energy. Developed in the 1950s by the Princeton University lab, it uses twisting magnetic fields to confine plasma in a torus instead of the tokamak’s electric currents inside the plasma. The approach was not considered on par with the tokamak until 2018 when supercomputers advanced it, according to the agency.

“We think [it] is ready for primetime,” says Matt Miles, senior vice president of Type One Energy, one of the two firms. Magnetic field shape and strength are critical, says Thomas Pederson, the firm’s chief technology officer. “It looks like a rippled donut,” he adds, noting that the developer must perfect the ripples to produce a strong magnetic field to contain plasma. “We’re continuously producing plasma. It is 10 tiny explosions a second and will burn like a fire,” Pederson says.

The continuous burn is an advantage over tokomaks, allowing more design flexibility and simplified plasma control, the Energy Dept. says. But “benefits come at the cost of increased complexity, especially for the magnetic field coils,” it adds.

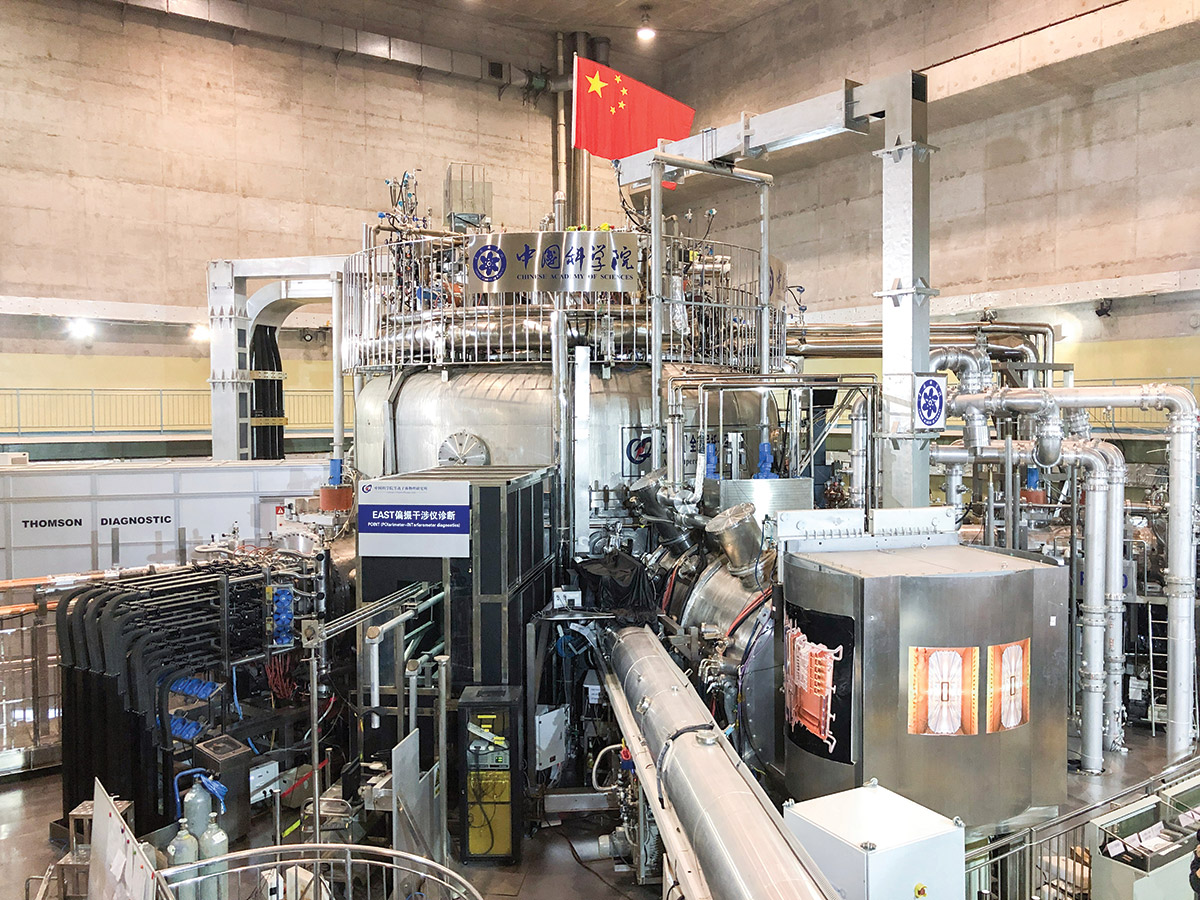

Some 35 nations, including China, are working on the $25-billion ITER fusion project in France, above, left, being built since 2007 but now delayed in operation, say media reports. A successor to China’s EAST fusion project, above, right, had a key breakthrough in June.

Photo. left, courtesy ITER; right, Feature China Via AP Images

Type One is pursuing design of both a small prototype and full-size project. It has an agreement with the Tennessee Valley Authority (TVA) to build the prototype at the decommissioned Bull Run coal-fired power plant site in Tennessee. Revamp of the 889-MW facility, opened in 1967 and closed last year, needs a federal environmental review before new work can begin. Prototype design and construction will cost $300 million, Type One says. Construction begins in 2025, with startup in 2028.

Engineer AtkinsRéalis was selected to further develop the design, with its U.S. and U.K. teams working on scope to include full plant requirements, pre-conceptual facility designs and a preliminary site layout to "de-risk" Type One fusion plant delivery and cost. "This program of work is the first step in a strategic partnership" with the developer in its technology commercialization push, said Jason Dreisbach, director of advanced energy technologies at AtkinsRéalis, which has years of global design experience in fusion and other nuclear power development.

Joe Hoagland, TVA vice president for innovation and research, notes fusion’s big benefits. “It is carbon free and could provide low-cost energy with simplified maintenance,” he says. The Bull Run plant site is near water with a large crane and grid access. TVA is providing support by leaving in place part of the plant turbine building as the rest of it is demolished.

Hoagland credits Type One’s work on fusion, pointing to its “startup company mentality.” The firm “looks at the science from the labs and says, ‘how can I make something that works that I can sell,’” he says, noting TVA’s potential to assist the firm to create “a new type of power plant.”

Developer TAE Technologies, which has gained $1.3 billion in private investment, announced in June an agreement with oil giant Occidental’s low-carbon unit to explore commercial potential to use fusion technology to supply “emissions-free power and heat” for direct air carbon capture (DAC) processes the energy firm is developing. Type One CEO Mowry describes DAC “as the most energy-intensive thing you can think about.”

Diana Grandas, fusion energy research analyst at the Electric Power Research Institute, says the nonprofit and other groups aim to support longer-term engineering needs, particularly in the supply chain, noting that startup firms with private funding “are able to take more risks and iterate through designs a lot more rapidly.”

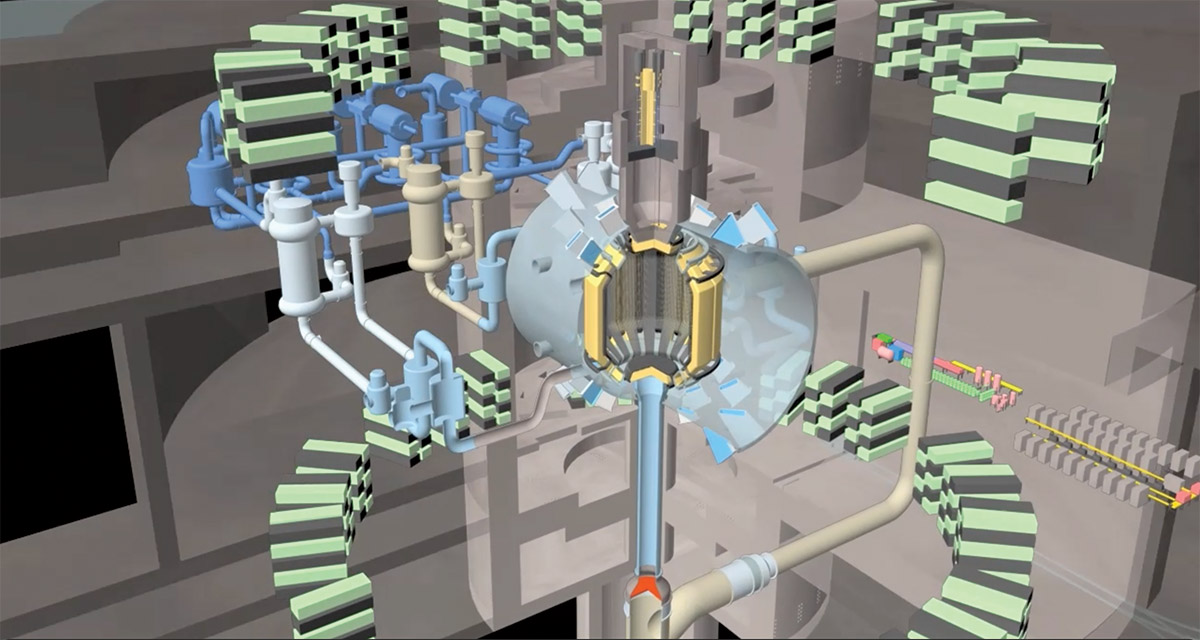

The long-running ITER project in France that uses magnetic fields in a tokamak device to achieve fusion reaction has spurred development of more efficient magnets and faster power delivery.

Photo courtesy AtkinsRéalis

Global Fusion Ecosystem

Meanwhile, work continues on ITER, even as media reports say its first plasma production, initially set to start next year, now is delayed five years. But engineer AtkinsRéalis, which provided both initial and detailed design and engineering for its main tokamak building and assembly hall, began work in May on a five-year, $50-million U.S. Energy Dept. contract to support further engineering there and at the Princeton lab. Structural diagnostics are vital “to confirm all the modeling and engineering that has gone into ITER design and construction,” says advanced energy technology director Dreisbach.

Tammy Ma, Lawrence Livermore National Laboratory Inertial Fusion Energy initiative leader, says public-private partnerships "are a new way for us to really push innovation and leverage resources on both sides."

Photo: LLNL

The U.K. in May announced $750 million in funding to attract investors willing to build a competing prototype and launched a competition for design and construction firms to form a public-private team led by UK Industrial Fusion Solutions Ltd., owned by the country’s Atomic Energy Authority. The government said it aimed to award contracts worth “hundreds of millions of pounds” by winter 2025.

China is also an ITER developer, but its own fast moving in-country fusion energy program is drawing more U.S. industry and government attention and concern. In a June report, Washington, D.C., think tank Information Technology and Innovation Foundation said the U.S. is 10-15 years behind China on fourth-generation nuclear energy deployment. The Chinese government aims to build by 2035 its first industrial prototype fusion reactor, dubbed an “artificial sun,” the analysis noted. “Nuclear fusion has become a national priority for China," it said, adding that China’s State Council made it clear in a recent meeting that “controlled nuclear fusion is the only direction for future energy.” China last December tapped its China National Nuclear Corp. to advance its fusion energy program.

Lagging U.S. nuclear engineering expertise since the 1970s and ’80s building boom remains a development challenge, with the decline in undergraduate degrees awarded in the last two years the largest in a decade, says a study by the Oak Ridge Institute for Science and Education, although doctoral-level degrees have risen. The Center for Energy Workforce Development in 2021 projected a need for 15,000 nuclear engineering employees by 2026.

“We are certainly training engineers to participate in the fusion energy industry,” says University of Wisconsin-Madison academic Wilson. Also noting similar fusion curricula development by other universities, he says his school's engineering program is set to add an undergraduate track and a master's degree program. With new focus on nuclear fusion, as well as other advanced nuclear sectors, he notes that if both "prove to be as successful as their proponents hope, we’ll definitely need to train a lot more nuclear engineers.”

Fusion developers and boosters acknowledge the intensifying global race among competing technologies, but with a worldwide “fusion ecosystem” projected by Bloomberg to total $40 trillion in company value, they see sector success lifting all boats.

Notes Longview Energy CEO Moses: “We want to be first, but we hope that more than one technology works. The market is infinite.”