City Scoop

Aviation, Tech Projects Help Dallas Weather Workforce Challenges

With multibillion-dollar projects in the pipeline, such as Texas Instruments’ $30-billion investment nearby, firms in Dallas are staying busy despite labor shortages

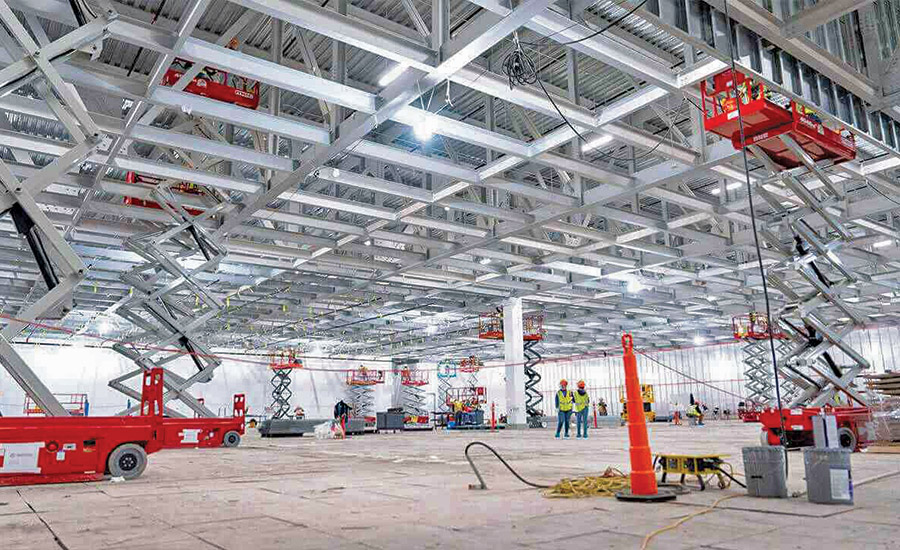

Texas Instruments’ total investment in Sherman, Texas, north of Dallas, could reach $30 billion as it constructs four plants for fabrication of 300mm silicon wafers used in electronics.

Photo courtesy Texas Instruments

City Grill

Chris Wall

Vice President, Division Manager

Brasfield & Gorrie

Construction in Dallas-Fort Worth is busy, so much so that long lead times for materials are becoming the norm, Wall says. But those long lead times are becoming a secondary concern to available staff and project financing.

“The last few years have been volatile in certain market sectors, with many variables being thrown at us,” he says. “But Dallas-Fort Worth being diversified, the market has been favorable for construction.”

Some markets have softened and others have exploded to fill in the gaps, he says, with data centers, manufacturing, industrial, civil/infrastructure and health care leading the way in the metropolitan area of more than 6.5 million people. He notes the challenge of finding enough skilled labor in all areas, but says the need is greatest in the mechanical, electrical and plumbing trades.

While Wall says finding workers in construction “has always been a factor,” he notes that “available capacity and abundance of megaprojects are requiring companies to use different approaches—such as joint ventures—to share the load and ensure that resources are available to successfully complete a project.”

The megaprojects in the Dallas area that are finishing up, under construction or in design development stages include the nearly $9-billion capital improvement project at Dallas-Fort Worth International Airport (DFW), the $3.7-billion Dallas Convention Center expansion and the $5-billion University of Texas Southwestern/Children’s Pediatric Hospital.

At the airport, work on the massive capital improvement plan dubbed DFW Forward began in August 2024 and will add new facilities and amenities, transform existing terminals, grow the number of gates and improve roadway and airfield infrastructure. According to the airport, it’s the largest capital investment since its 1974 opening and includes a $3-billion rebuild of Terminal C, DFW’s busiest terminal. The work involves removing more than 400 columns, installing new dynamic glass windows and raising the roof throughout. Expansions will add 115,000 sq ft and four gates to Terminal C and 140,000 sq ft and five gates to Terminal A.

In all, DFW Forward entails more than 180 projects, with highlights including the new 15-gate Terminal F and International Parkway Modernization.

At the Kay Bailey Hutchison Convention Center, the massive overhaul and expansion is moving ahead, with the city approving design contracts Jan. 8 for architect and engineering services. As ENR previously reported, a $25.1-million contract was awarded to Gensler for design of the renovation and construction of the Dallas Memorial Auditorium and a $22.3-million contract to KAI Design for The Black Academy of Arts and Letters.

Work is underway on other aspects of the plan, with the city awarding a construction manager at-risk contract for the main convention center to Trinity Alliance Ventures LLC, a joint venture team led by AECOM Hunt and Turner Construction Co. with 14 other firms.

The updated center will include 800,000 sq ft of exhibit hall space, 170,000 sq ft of ballrooms and 260,000 sq ft of meeting rooms, set to be in use in 2029 and funded by a 2% hotel tax approved by local voters in 2022.

“The last few years have been volatile in certain market sectors. But Dallas-Fort Worth being diversified, the market has been favorable for construction.”

—Chris Wall, Vice President, Division Manager, Brasfield & Gorrie

Dallas is also the country’s hottest data center market, Wall adds, with both construction and expansions of existing campuses. About 60 miles north, in Sherman, Texas Instruments’ new plant could generate up to $30 billion in spending that could send ripples across the industry.

According to the company, as many as four 300-mm semiconductor wafer fabrication plants will manufacture hundreds of millions of computer chips every day in 1.4 million sq ft of clean room space. Production could begin as early as this year on the site. The facility is being designed to meet LEED Gold v4 and will be powered by renewable electricity, according to the company.

Health care campus construction is one area of the market that has softened, Wall says, but expansion and renovations of existing campuses continue to move forward and grow, even as health care providers struggle like construction firms in the labor market. The election and change in administration are making an impact as well.

“We tend to see a slowdown just before a presidential election and industries getting back to business after the election cycle ends,” Wall says. “Given recent geopolitical developments, in 2025 we need to monitor the impacts of tariffs and how they could affect pricing and material availability.”

But, he adds, the new administration has also expressed its support for growth. Wall says challenges of the last few years have taught the industry to be better prepared to adapt to changes in the market.