With the economic slump battering tax receipts, state budgets remain in dire shape, and the pain may continue into fiscal year 2012, according to the National Governors Association and National Association of State Budget Officers. In that environment, it’s no surprise that states around the country are slicing spending. One sector in which construction firms are feeling the impact is transportation.

NGA and NASBO on Nov. 12 released preliminary findings from their next biannual Fiscal Survey of the States, due out Dec. 3. Scott D. Pattison, executive director of the budget officers’ group, says for fiscal 2009 and 2010, “We are seeing the worst numbers and indicators that we’ve ever seen in terms of state fiscal conditions.”

State cutbacks are widespread. In fiscal 2009, which ended on June 30 for most states, 42 states slashed operating budgets by a total of $31.2 billion, according to NGA and NASBO. That reduction is much deeper than in the last fiscal crunch, when cuts amounted to $14 billion in 2002 and $12 billion in 2003.

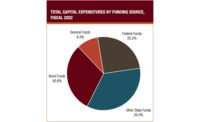

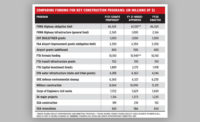

Pattison says preliminary reports show 21 states sliced their transportation funds in 2009, and 25 plan cuts in that sector in 2010. He says those cuts are in states’ own funds, but their overall highway spending is rising, thanks partly to federal American Recovery and Reinvement Act highway funds, which have topped $20 billion in obligations. Matt Jeanneret, spokesman for the American Road and Transportation Builders Association, notes that the cuts are uneven across the 50 states. But in 2009, he says, 37 states are expected to increase highway contract- award dollar volume.

States are in a tight squeeze partly because their 2009 tax receipts fell 7.4% below 2008’s level. Brian Deery, senior director of the Associated General Contractors’ highway and transportation division, says declines came in all state tax categories and in other income such as vehicle registration fees. “ Everything across the board is just down,” he says.

The revenue drop is one reason why state departments of transportation are trimming spending, industry officials say. Uncertainty over the shape and timing of a bill reauthorizing federal highway and transit programs also is prompting state DOTs to pause in moving some longerrange projects, says Jay Hansen, National Asphalt Pavement Association vice president for government affairs.

“They are really holding back,” says Pam Whitted, National Stone, Sand and Gravel Association vice president for government affairs. “And our guys aren’t seeing business.”

Raymond C. Scheppach, NGA’s executive director, says states feel the biggest impact from an economic downturn two years after a recession ends. When a rebound does begin, he adds, states still will have to address large, “unmet needs.” NGA and NASBO say those needs include pension-fund contributions and deferred infrastructure spending.

Scheppach says ARRA has helped states’ budgets, particularly the bill’s $87 billion for Medicaid and $48 billion in fiscal stabilization aid. “Without those, the cuts would have been a lot more draconian,” he says.