Construction officials were optimistic this spring, when a Senate committee approved an energy-efficiency bill with features deemed favorable to the industry. However, the measure may not make it to the Senate floor for a full vote by the end of the calendar year, observers say.

For one thing, time is limited. The Senate is scheduled to be in session for only about a dozen days before the end of December. "I think it will fall into next year," says Steven Nadel, executive director of the American Council for an Energy-Efficient Economy (ACEEE).

The Senate Energy and Natural Resources Committee cleared the bill on May 8, and Majority Leader Harry Reid (D-Nev.) brought it to the floor in mid-September. But the measure was bogged down by non-related amendments, such as a proposal from Sen. David Vitter (R-La.) to repeal the Affordable Care Act.

"What's happening now is, Senator Reid is basically waiting to see if there are assurances that there are 60 votes or more" to ensure the bill's passage, Nadel says. Reid also has other priorities, such as the farm bill and budget negotiations with the House, says Nicole Steele, Alliance to Save Energy director of policy and state regulations.

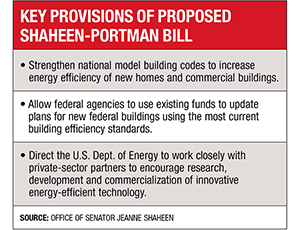

The energy bill, introduced by Sens. Jeanne Shaheen (D-N.H.) and Rob Portman (R-Ohio) in April, includes elements that construction groups like. One provision would strengthen national model building codes. Another would allow agencies to draw on existing funds to use the most current efficiency standards for new federal buildings. ACEEE estimates the current core bill, if enacted, would support 164,000 jobs and, by 2030, result in 80.2 million metric tons of avoided annual greenhouse-gas emissions.

If the Shaheen-Portman proposal does come up for a floor vote, industry officials say it has a good chance of passage. "It's a rare example of bipartisan legislation," says Andrew Goldberg, American Institute of Architects managing director of federal relations.

In the House, David McKinley (R-W.Va.) and Peter Welch (D-Vt.) have introduced legislation that is similar to Shaheen-Portman. The House proposal also would create a grant program to encourage private investment in efficiency upgrades for commercial buildings. That provision was in the original Senate bill but then stripped out.

House Energy and Commerce Committee Chairman Fred Upton (R-Mich.) has said he will schedule a committee vote on the McKinley-Welch bill if the Senate approves Shaheen-Portman.

Industry groups also are keeping an eye on the fate of the tax code's Section 179d, which specifies a deduction for energy-efficient commercial buildings. The tax break, which Goldberg says has been a plus for design firms, is set to expire at the end of the year. Goldberg adds, "It's essentially gone, unless Congress puts it back in."

Still, Congress could take action in 2014 to extend Section 179d and other expiring tax incentives, applying them retroactively, Goldberg notes. But Nadel says that issue probably won't be addressed until 2015, as part of a larger tax reform effort. If procedural hurdles can be overcome, Goldberg says, "there is bipartisan support for both the tax incentive and Shaheen-Portman, and, combined, I think it would be a boost for the [construction] industry."